Business Investment Opportunities in Asia

Showing 1 - 15 of 7702 Business Investment Opportunities in Asia. Invest in a Business in Asia.

Asia

-

Investment Opportunities

Custom Application Development Company Investment Opportunity in Chennai, India

Pipes & Valves Company Investment Opportunity in Ahmedabad, India

Food Wholesale Company Investment Opportunity in Dubai, United Arab Emirates

Travel Portal Investment Opportunity in Chandannagar, India

Liquor Store Investment Opportunity in Mumbai, India

Supermarket Investment Opportunity in Kottayam, India

Waste Management Company Investment Opportunity in New Delhi, India

Agriculture Support Company Investment Opportunity in Surat, India

Newly Established Construction Material Processing Company Investment Opportunity in India

Bio Medical Devices Company Investment Opportunity in Mumbai, India

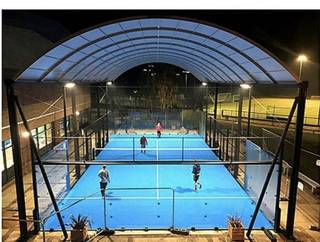

Newly Established Sports Facility Investment Opportunity in Panjim, India

Enterprise Software Company Investment Opportunity in Hyderabad, India

Stock Advisory Company Investment Opportunity in Mumbai, India

Call Center Investment Opportunity in Kolkata, India

Bottled Water Company Investment Opportunity in Tiruppur, India

Frequently

Asked

Questions

-

How many business investment opportunities in Asia are listed on SMERGERS?There are 7702 active and verified business investment opportunities in Asia listed on SMERGERS as of 17 May 2024.

-

What level of due diligence does SMERGERS conduct on the businesses/member?

SMERGERS scrutinizes all profiles and only features a select group of businesses, investors, advisors that meet a basic requirement. When required, certain members may have submitted some form of proof …read more

-

How active are the business profiles listed on SMERGERS?

We regularly filter out businesses which are inactive or have already closed a transaction. Typically, if the business is actively looking to sell/raise capital, the status is shown in green.

-

How can I be sure about privacy and confidentiality?

We understand the level of confidentiality required in strategic transactions and we strive to provide a safe and secure experience for our members. Please review our privacy policy. We …read more

-

How can I contact a business listed on SMERGERS?

You need to be logged in before you connect with a business. Click here to register and message the business If you are already logged in, please use the contact …read more

-

Should you buy an existing business or start a business from scratch?

Buying an existing business is generally an easier way to start a business with an immediate head start. It saves valuable time and administrative efforts, considering starting from scratch is …read more

-

How successful has SMERGERS been in helping its users successfully close a deal?

SMERGERS is a discovery and matchmaking platform with a global reach. It helps in connecting Businesses, Investors, Acquirers, Lenders, M&A Advisors and Boutique Investment Banks across locations, industries and transactions. …read more