Press - SMERGERS

Business World - Visionary Business Leaders Paving The Way For The Future

Feb 28, 2025

In a recent feature, Business World highlighted visionary business leaders and their insights on what is shaping the future of business. Discover Vishal Devanath’s perspective, CEO of SMERGERS, by visiting the link below.

Emerging Trends in M&A: The 4th National Conclave at Royal Orchid, Bangalore

Oct 18, 2024

The conclave, hosted by Tranformance, brought M&A thought leaders together in a single venue. This gathering offered an unrivaled chance to probe the current M&A landscape, create connections with foremost experts, and harvest valuable insights from keynote speakers. SMERGERS was delighted to sponsor this event for those in the M&A field.

The conclave, hosted by Tranformance, brought M&A thought leaders together in a single venue. This gathering offered an unrivaled chance to probe the current M&A landscape, create connections with foremost experts, and harvest valuable insights from keynote speakers. SMERGERS was delighted to sponsor this event for those in the M&A field.

M&A Conclave 2nd edition, organized by Transformace at Holiday Inn, New Delhi, had SMERGERS collaborating as Associate Partner.

Feb 16, 2024

The conference focuses on identifying entrepreneurs with visionary minds who are transforming the business landscape through mergers and acquisitions. It provides a unique opportunity to gain insights from experts on M&A processes, best practices, and challenges.

The conference focuses on identifying entrepreneurs with visionary minds who are transforming the business landscape through mergers and acquisitions. It provides a unique opportunity to gain insights from experts on M&A processes, best practices, and challenges.

SMERGERS partners with Transformace to host an exciting M&A Conclave at Radisson MIDC, Mumbai.

Oct 05, 2023

The M&A Conclave is a one-of-a-kind event that brings together experienced company executives, aspiring business owners, and savvy investors. Through thought-provoking discussions and in-depth presentations, the Conclave delves into the intricacies of M&A, providing valuable insights for all attendees.

The M&A Conclave is a one-of-a-kind event that brings together experienced company executives, aspiring business owners, and savvy investors. Through thought-provoking discussions and in-depth presentations, the Conclave delves into the intricacies of M&A, providing valuable insights for all attendees.

SMERGERS partners with IIT Kharagpur Entrepreneurship Cell's Flagship program GES 2023 as a major sponsor

Feb 02, 2023

Global Entrepreneurship Summit GES 2023 is IIT Kharagpur E-Cell’s annual flagship initiative. It is one of the biggest inter-collegiate corporate summits in India. It is a unique platform where industry doyens share their insights based on their experiences and entrepreneurial journey. GES is a confluence of aspiring entrepreneurs, venture capitalists, angel investors, new-age entrepreneurs, industry experts, academicians, and students. SMERGERS is proud to partner with IIT Kharagpur as a Major Sponsor for this event.

Global Entrepreneurship Summit GES 2023 is IIT Kharagpur E-Cell’s annual flagship initiative. It is one of the biggest inter-collegiate corporate summits in India. It is a unique platform where industry doyens share their insights based on their experiences and entrepreneurial journey. GES is a confluence of aspiring entrepreneurs, venture capitalists, angel investors, new-age entrepreneurs, industry experts, academicians, and students. SMERGERS is proud to partner with IIT Kharagpur as a Major Sponsor for this event.

New Indian Express - Vishal Devanath, CEO, SMERGERS article on Budget 2022 wishlist

Jan 21, 2022

Our vibrant MSMEs form the backbone of our economy contributing 30% of our GDP and 50% of our exports. They employ more than 12 crore people in the country and create new jobs every year. MSMEs undoubtedly play a huge role in generating prosperity for any nation. It is vital that this sector is nurtured and supported by the government, especially during these difficult times. While MSMEs have always had some burning issues in India, the year that went by was a roller-coaster ride that still offered a ray of hope. Union budget 2022 scheduled on February 1 could be the right time to build on this hope by ushering in the changes required to help MSMEs.

At SMERGERS, an investment banking platform, we work with thousands of small business owners and here's a list of common requests we hear from them.

Our vibrant MSMEs form the backbone of our economy contributing 30% of our GDP and 50% of our exports. They employ more than 12 crore people in the country and create new jobs every year. MSMEs undoubtedly play a huge role in generating prosperity for any nation. It is vital that this sector is nurtured and supported by the government, especially during these difficult times. While MSMEs have always had some burning issues in India, the year that went by was a roller-coaster ride that still offered a ray of hope. Union budget 2022 scheduled on February 1 could be the right time to build on this hope by ushering in the changes required to help MSMEs.

At SMERGERS, an investment banking platform, we work with thousands of small business owners and here's a list of common requests we hear from them.

SMERGERS invited as an external observer at Christ (Deemed to be University) Finance Club’s Gnantmak Vividhtha event

Jan 14, 2022

Vishal Devanath, Founder & CEO - SMERGERS was invited as a distinguished external observer at Christ’s (Deemed to be University) Gnantmak Vividhtha event to judge the participating teams and offer his valuable insights on various concepts of mergers and acquisitions and their value based metrics for strategic decision making.

Vishal Devanath, Founder & CEO - SMERGERS was invited as a distinguished external observer at Christ’s (Deemed to be University) Gnantmak Vividhtha event to judge the participating teams and offer his valuable insights on various concepts of mergers and acquisitions and their value based metrics for strategic decision making.

Hindu Business Line : Indian hospitality sector sees 17.5% hike in deployment of gross bank credit

Dec 03, 2021

The Indian travel and hospitality industries owes Indian banks ₹48,687 crore as of October 2021 as against ₹41,373.14 crore two years ago.

To explain the woes of the travel and hospitality industry, a quick search on SMERGERS showed that over 1,017 companies were listed in the travel, hotel, and restaurant industry segment. SMERGERS is a portal that facilitates sales or investments.

The Indian travel and hospitality industries owes Indian banks ₹48,687 crore as of October 2021 as against ₹41,373.14 crore two years ago.

To explain the woes of the travel and hospitality industry, a quick search on SMERGERS showed that over 1,017 companies were listed in the travel, hotel, and restaurant industry segment. SMERGERS is a portal that facilitates sales or investments.

Business Today: HDFC Bank, Mastercard, USAID offer $100 mn credit facility to MSMEs and women entrepreneurs. SMERGERS shares data on business listings.

Oct 21, 2021

While the government data on the number of MSMEs and women-led units impacted or shut due to the pandemic hasn’t been available so far, a large number of such enterprises had reportedly faced temporary closure of production units, job losses, and severe impact on working capital.

Financial Express Online had reported last month citing data from online investment banking platform SMERGERS, that out of the total 1.65 lakh businesses listed for sale on the platform, 52,000 came onboard from April 1, 2020, onwards, of which 7,000 are verified or approved listings. In fact, before Covid, the daily average of businesses listing for sale was 10 that increased to 20 before the second wave, and was about to cross 25 in September.

While the government data on the number of MSMEs and women-led units impacted or shut due to the pandemic hasn’t been available so far, a large number of such enterprises had reportedly faced temporary closure of production units, job losses, and severe impact on working capital.

Financial Express Online had reported last month citing data from online investment banking platform SMERGERS, that out of the total 1.65 lakh businesses listed for sale on the platform, 52,000 came onboard from April 1, 2020, onwards, of which 7,000 are verified or approved listings. In fact, before Covid, the daily average of businesses listing for sale was 10 that increased to 20 before the second wave, and was about to cross 25 in September.

Business Today: SMERGRS has 70,000 pre-screened businesses along with investors from over 170 countries.

Oct 10, 2021

According to government statistics, there are more than 5 million registered micro, small & medium enterprises (MSMEs) in the country with almost all states and union territories contributing to this huge number. These companies also need capital to grow but mostly have to be dependent on either banks or some opaque funding route. While loans from banks could be time consuming with a lot of paperwork and collateral, other avenues charge a high rate of interest and are much riskier in nature.

Vishal Devanath identified this lacuna and started his firm Smergers -- a play on the words SME and mergers -- in 2013, and today the platform boasts of more than 70,000 pre-screened businesses along with investors from over 170 countries. SMERGERS is a platform that brings together investors -- both individuals and corporates -- and SMEs that are in need of funding or even open to an outright sale.

According to government statistics, there are more than 5 million registered micro, small & medium enterprises (MSMEs) in the country with almost all states and union territories contributing to this huge number. These companies also need capital to grow but mostly have to be dependent on either banks or some opaque funding route. While loans from banks could be time consuming with a lot of paperwork and collateral, other avenues charge a high rate of interest and are much riskier in nature.

Vishal Devanath identified this lacuna and started his firm Smergers -- a play on the words SME and mergers -- in 2013, and today the platform boasts of more than 70,000 pre-screened businesses along with investors from over 170 countries. SMERGERS is a platform that brings together investors -- both individuals and corporates -- and SMEs that are in need of funding or even open to an outright sale.

Financial Express - Thousands of micro, small businesses are on sale right now

Sep 28, 2021

According to the data from SMERGERS on MSME buying and selling, of the total 1.65 lakh businesses listed for sale, 52,000 came onboard from April 1, 2020, onwards out of which 7,000 are verified or approved listings. In fact, before Covid, the daily average of businesses listing for sale was 10 that increased to 20 before the second wave, and is currently about to cross 25.

According to the data from SMERGERS on MSME buying and selling, of the total 1.65 lakh businesses listed for sale, 52,000 came onboard from April 1, 2020, onwards out of which 7,000 are verified or approved listings. In fact, before Covid, the daily average of businesses listing for sale was 10 that increased to 20 before the second wave, and is currently about to cross 25.

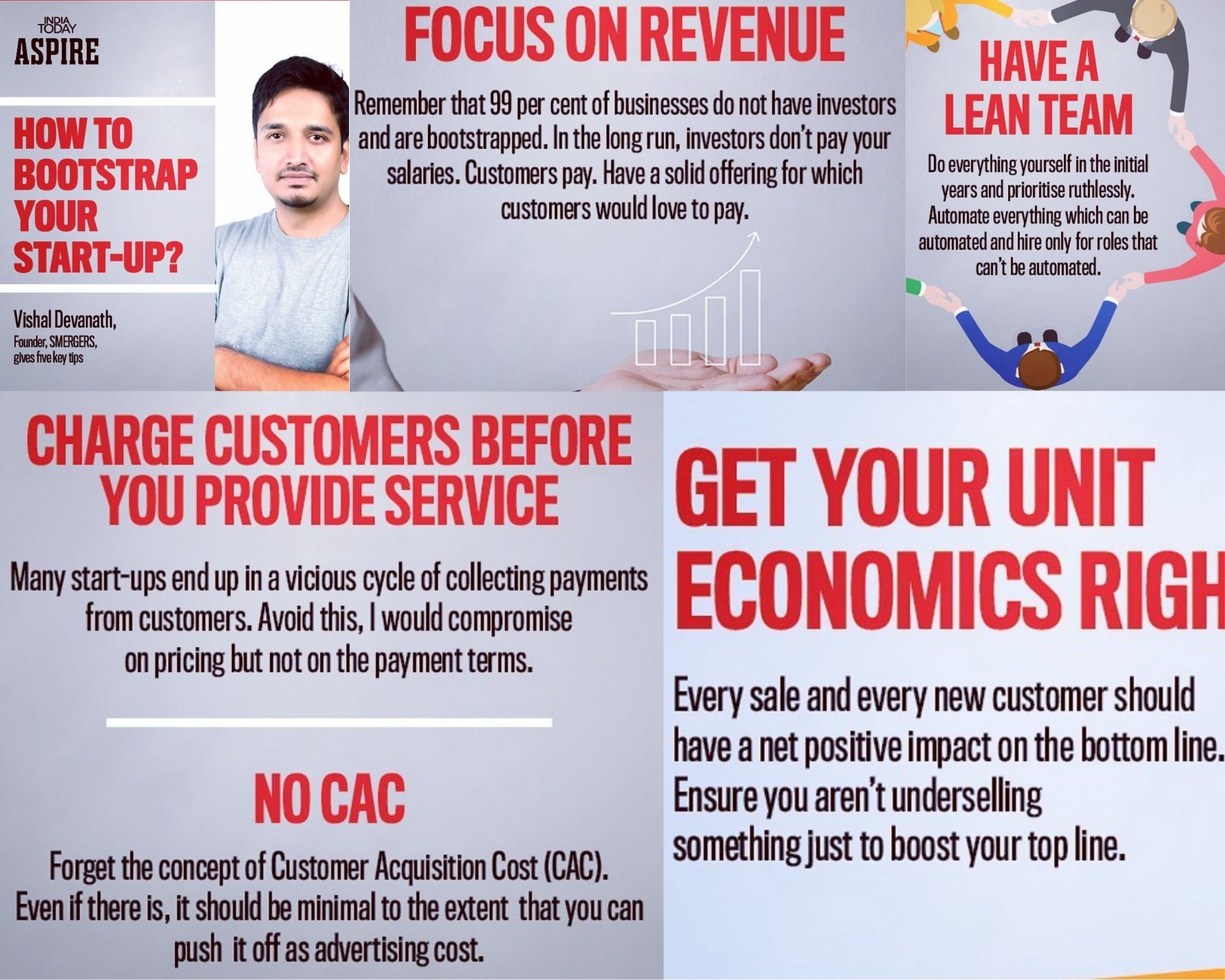

India Today Aspire - How to Bootstrap Your Start-Up? - Vishal Devanath, Founder, SMERGERS

Jul 27, 2021

Vishal Devanath, Founder, SMERGERS shares tips on how to bootstrap your startup. Read more on India Today's Instagram post.

Vishal Devanath, Founder, SMERGERS shares tips on how to bootstrap your startup. Read more on India Today's Instagram post.

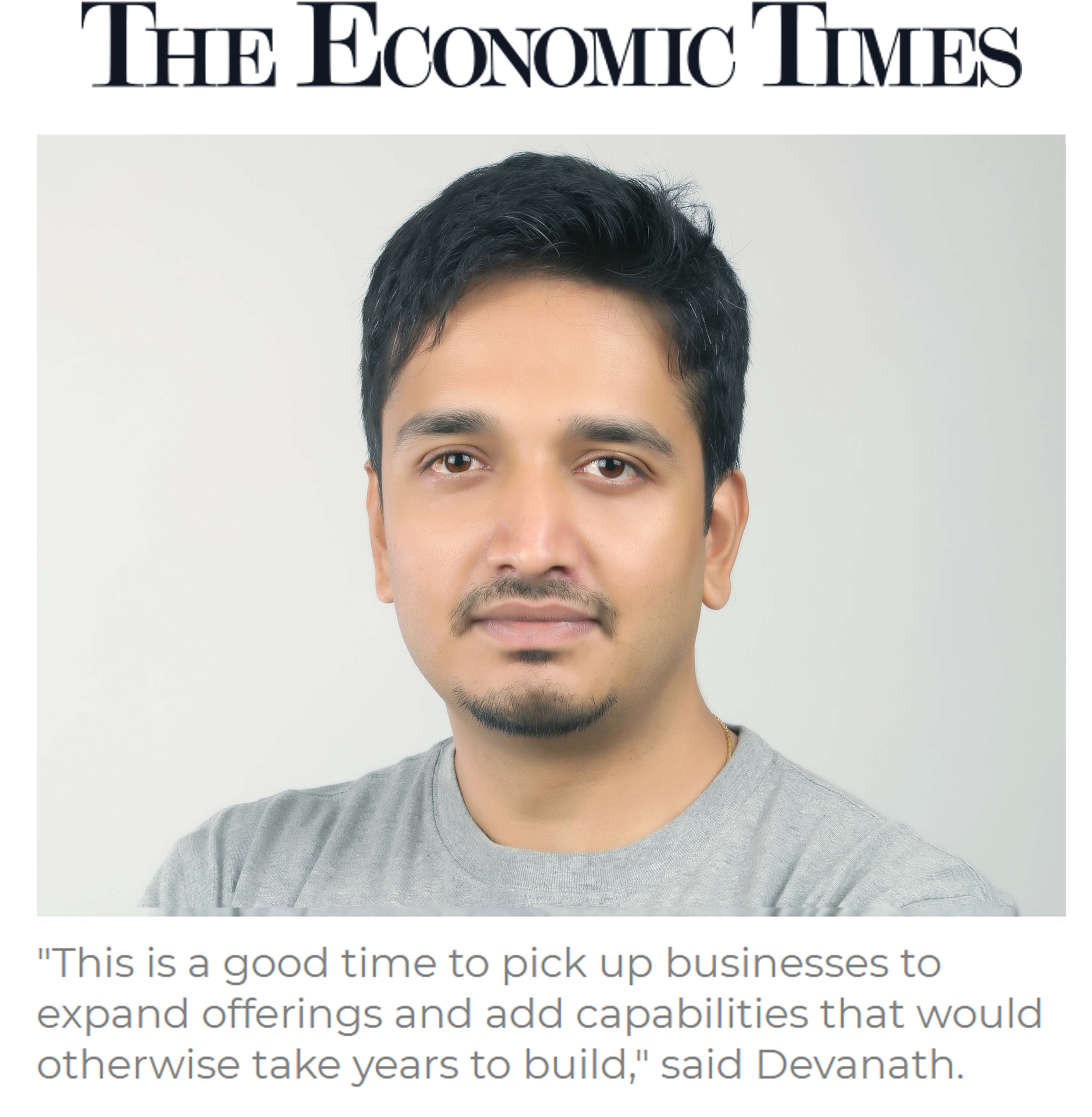

Economic Times - Buyer interest in SME space has gone up post-Covid: Vishal Devanath, founder, SMERGERS

Jul 16, 2021

Deal sizes in SME space are at least 25-30% down compared to pre-Covid times and this is a good time to pick up businesses to expand offerings and add capabilities that would otherwise take years to build, said Vishal Devanath, Founder of SMERGERS, an investment banking platform for SMEs. In a chat with ET’s Faizan Haidar, Devanath talks about the impact of Covid on SMEs, factors driving the SME deal market and what the government should do to incentivise small businesses.

Deal sizes in SME space are at least 25-30% down compared to pre-Covid times and this is a good time to pick up businesses to expand offerings and add capabilities that would otherwise take years to build, said Vishal Devanath, Founder of SMERGERS, an investment banking platform for SMEs. In a chat with ET’s Faizan Haidar, Devanath talks about the impact of Covid on SMEs, factors driving the SME deal market and what the government should do to incentivise small businesses.

Hindu Business Line - SMERGERS reports a 40 percent increase in business listings related to the luggage industry

Jun 30, 2021

Even smaller players are finding it difficult to sustain. SMERGERS, a merger and acquisition portal for SMEs, has seen a rise of 40 per cent listings by stressed companies in this segment.

“Our three existing retail shops were closed for three months due to the coronavirus lockdown. The shopping malls have recently reopened and our shops have also reopened. Our sales have reduced due to the pandemic,” said one of the companies listed on SMERGERS

Even smaller players are finding it difficult to sustain. SMERGERS, a merger and acquisition portal for SMEs, has seen a rise of 40 per cent listings by stressed companies in this segment.

“Our three existing retail shops were closed for three months due to the coronavirus lockdown. The shopping malls have recently reopened and our shops have also reopened. Our sales have reduced due to the pandemic,” said one of the companies listed on SMERGERS

Times of India - SMERGERS offers insights on favourable valuations attracting senior executives to invest in small businesses.

Jun 23, 2021

“We have seen a sharp increase in traffic and in the past couple of months the number of businesses signing up to sell out or bring in an investor has gone up from 10 a day to 20 a day. We also have a huge backlog of pending deals. Meanwhile the buyer traffic has also gone up sharply since April and we are approving 60-70 a day,” said Vishal Devanath, founder, SMERGERS.

“We have seen a sharp increase in traffic and in the past couple of months the number of businesses signing up to sell out or bring in an investor has gone up from 10 a day to 20 a day. We also have a huge backlog of pending deals. Meanwhile the buyer traffic has also gone up sharply since April and we are approving 60-70 a day,” said Vishal Devanath, founder, SMERGERS.

Millennium Post - SMERGERS shares information on MSMEs that are up for sale as a result of Covid-19

Jun 18, 2021

MSMEs in India are languishing in the doldrums with almost 4,900 of them up for sale, and double the number expected to follow in the wake of second and third waves, says online deal-making firm SMERGERS. According to a survey by Dun and Bradstreet, 82 per cent of 250 MSMEs that were surveyed, said that Covid-19 had hit them hard.

MSMEs in India are languishing in the doldrums with almost 4,900 of them up for sale, and double the number expected to follow in the wake of second and third waves, says online deal-making firm SMERGERS. According to a survey by Dun and Bradstreet, 82 per cent of 250 MSMEs that were surveyed, said that Covid-19 had hit them hard.

New Indian Express - SMERGERS view published - Small business carnage: 4,900 Covid-hit MSME firms up for sale, figures double up in second wave

Jun 18, 2021

Since April 2020, at least 4,900 owners have listed their businesses for sale with restaurants, fashion, gyms, cloud kitchen and event management companies dominating the space, according to data shared by online dealmaking firm SMERGERS.

Since April 2020, at least 4,900 owners have listed their businesses for sale with restaurants, fashion, gyms, cloud kitchen and event management companies dominating the space, according to data shared by online dealmaking firm SMERGERS.

Hindu Business Line - Closure of Hyatt Mumbai due to mounting debt and pandemic - SMERGERS shares stats on hotels for sale in the country

Jun 08, 2021

According to data from SMERGERS, globally it has 584 hotels for sale or investment on its portal. “As of June 8, of 584, 170 listed in the last one year. In India, it’s 281 of which 73 were listed in the last year,” Vishal Devanath, Founder of the company said. About 70 percent of ICRA’s hospitality portfolio applied for a moratorium, said ICRA in a recent report adding that some companies have also resorted to equity fundraising from investors and promoters.

According to data from SMERGERS, globally it has 584 hotels for sale or investment on its portal. “As of June 8, of 584, 170 listed in the last one year. In India, it’s 281 of which 73 were listed in the last year,” Vishal Devanath, Founder of the company said. About 70 percent of ICRA’s hospitality portfolio applied for a moratorium, said ICRA in a recent report adding that some companies have also resorted to equity fundraising from investors and promoters.

Financial Express - SMERGERS article on MSME schemes 2020: What was announced, what was utilised, and what is needed in 2021

Jun 06, 2021

6.3 crore Micro, Small, and Medium Enterprises (MSMEs) of India employs around 11 crore people. However, they were, unfortunately, one of the worst-hit by the first wave of the pandemic that affected their access to markets, credit, and financial security.

6.3 crore Micro, Small, and Medium Enterprises (MSMEs) of India employs around 11 crore people. However, they were, unfortunately, one of the worst-hit by the first wave of the pandemic that affected their access to markets, credit, and financial security.

Hindu Business Line - SMERGERS data covered - Up for sale: At least 1,200 Covid-hit small businesses looking for exit route

May 26, 2021

“While on average small businesses had reported a 30 per cent dip in revenue for FY21 compared to FY20, main street businesses like restaurants, salons, supermarkets, entertainment centres and even businesses that were primarily catering to ‘office crowds’ are much worse affected with 90-95 per cent drop in revenues.”

“While on average small businesses had reported a 30 per cent dip in revenue for FY21 compared to FY20, main street businesses like restaurants, salons, supermarkets, entertainment centres and even businesses that were primarily catering to ‘office crowds’ are much worse affected with 90-95 per cent drop in revenues.”

News 18 - SMERGERS article on alternative investments - FD, पेंशन स्कीम, म्यूचुअल फंड और शेयर बाजार की बजाय इन 6 जगहों पर लगाएं पैसा, होंगे मालामाल

May 18, 2021

"क्रैश एंड बर्न" यानी जल्दी के चक्कर में ठोकर खाना एक सच्चाई है, इसलिए सावधानी से चलना और ऐसे निवेश ढूंढना जरूरी है जो समय के साथ-साथ स्थिर रिटर्न देते हों

"क्रैश एंड बर्न" यानी जल्दी के चक्कर में ठोकर खाना एक सच्चाई है, इसलिए सावधानी से चलना और ऐसे निवेश ढूंढना जरूरी है जो समय के साथ-साथ स्थिर रिटर्न देते हों

Economic Times - SMERGERS coverage in article on small businesses which are struggling to stay afloat in the second wave

May 17, 2021

“Amongst all the SMEs listed on our platform, 25% have quoted Covid onslaught as the primary reason for sale and have reported a steep decline in revenues. This is more prevalent amongst restaurants, playschools, training institutes, construction material businesses, food processing units, where almost 50% of them quote Covid as the reason for sale,” said Vishal Devanath, founder, SMERGERS, a private marketplace for SME deals.

“Amongst all the SMEs listed on our platform, 25% have quoted Covid onslaught as the primary reason for sale and have reported a steep decline in revenues. This is more prevalent amongst restaurants, playschools, training institutes, construction material businesses, food processing units, where almost 50% of them quote Covid as the reason for sale,” said Vishal Devanath, founder, SMERGERS, a private marketplace for SME deals.

Financial Express - SMERGERS view - CLCSS: Small businesses supported in FY21 under technology upgradation scheme highest in five years

Apr 22, 2021

“With a severe labour shortage across the nation, small businesses have made automation and technology adoption their top priority. While it’s heartening to see the growth in CLCSS subsidies but for India to achieve 50 per cent GDP from MSMEs ahead, it is highly imperative that the CLCSS scheme is expanded further to benefit more small businesses,” Vishal Devnath, Founder of SME-focused online investment bank SMERGERS told Financial Express Online.

“With a severe labour shortage across the nation, small businesses have made automation and technology adoption their top priority. While it’s heartening to see the growth in CLCSS subsidies but for India to achieve 50 per cent GDP from MSMEs ahead, it is highly imperative that the CLCSS scheme is expanded further to benefit more small businesses,” Vishal Devnath, Founder of SME-focused online investment bank SMERGERS told Financial Express Online.

CNBC TV18 - Vishal Devanath, CEO, SMERGERS article on alternative investment ideas: How can you put your money to work?

Mar 27, 2021

With interest rates dropping and financial asset valuations hitting the roof, you may be wondering if there are any offbeat investments to protect yourself from the whims and fancies of the capital markets. Here are 5 unorthodox channels you could consider to make your money work for you - Vishal Devanath, Founder and CEO, SMERGERS.

With interest rates dropping and financial asset valuations hitting the roof, you may be wondering if there are any offbeat investments to protect yourself from the whims and fancies of the capital markets. Here are 5 unorthodox channels you could consider to make your money work for you - Vishal Devanath, Founder and CEO, SMERGERS.

Yahoo Finance - Leveraging online resources and marketplaces such as SMERGERS - Buying a Business: 6 Steps to Value and Buy a Small Business That’s for Sale

Jan 19, 2021

Buying a business often is arduous and requires long hours of research and contemplation and it is always better to have no-deal than a bad deal. Leveraging online resources and marketplaces such as SMERGERS which has thousands of small and mid-sized businesses, investors, acquirers, advisors, and franchisors advertising their deals can be invaluable to a buyer.

Buying a business often is arduous and requires long hours of research and contemplation and it is always better to have no-deal than a bad deal. Leveraging online resources and marketplaces such as SMERGERS which has thousands of small and mid-sized businesses, investors, acquirers, advisors, and franchisors advertising their deals can be invaluable to a buyer.

Dataquest - SMERGERS article on how to find the best businesses for sale this year?

Jan 12, 2021

Buying a running business would allow the buyer to focus on the expansion of the business through penetration of new markets, additional verticals, and new sources of revenue, thus, providing a more productive use of his efforts

Buying a running business would allow the buyer to focus on the expansion of the business through penetration of new markets, additional verticals, and new sources of revenue, thus, providing a more productive use of his efforts

Valuation Masterclass: Learn from Aswath Damodaran

Sep 25, 2020

Known worldwide as an authority on valuation, Aswath Damodaran, Professor of Finance, NYU Stern School of Business, delivers his first 4 day live online Masterclass on Business Valuations.

Known worldwide as an authority on valuation, Aswath Damodaran, Professor of Finance, NYU Stern School of Business, delivers his first 4 day live online Masterclass on Business Valuations.

SMERGERS interview discussing COVID-19's effect featured on Startup.info

Aug 03, 2020

SMERGERS' interview with Startup.info about the coronavirus effect, stress & anxiety, innovation by necessity, and the need for supporting small businesses.

SMERGERS' interview with Startup.info about the coronavirus effect, stress & anxiety, innovation by necessity, and the need for supporting small businesses.

SMERGERS invited as a key speaker at JITO Jain Business Network 360 Bangalore 2019

Dec 24, 2019

JITO & JBN (Jain Business Network) Bangalore organized a Mega National Networking Event Nahar JBN 360 on 14th and 15th of December, 2019 at Sheraton Grand, Bangalore. This event provided business stalwarts with a common platform to meet, connect and create new business opportunities.

Vishal Devanath, Founder & CEO – SMERGERS along with many other distinguished speakers were invited at the event. Vishal was asked to share his views on growth opportunities and challenges faced by Indian SMEs. Vishal also spoke on the role of women entrepreneurs in leadership roles.

JITO & JBN (Jain Business Network) Bangalore organized a Mega National Networking Event Nahar JBN 360 on 14th and 15th of December, 2019 at Sheraton Grand, Bangalore. This event provided business stalwarts with a common platform to meet, connect and create new business opportunities.

Vishal Devanath, Founder & CEO – SMERGERS along with many other distinguished speakers were invited at the event. Vishal was asked to share his views on growth opportunities and challenges faced by Indian SMEs. Vishal also spoke on the role of women entrepreneurs in leadership roles.

Valuation Training with Professor Aswath Damodaran in Singapore organized by I-Deals sponsored by SMERGERS

Nov 04, 2019

SMERGERS is a proud sponsor of the Valuation Workshop by Professor Aswath Damoradan to be held on 13th and 14th November at Sheraton Towers, Singapore. Aswath Damodaran, Professor of Finance at NYU's Stern School of Business, has been often referred to as Wall Street's "Dean of Valuation" and is widely respected as one of the foremost experts on corporate valuation.

SMERGERS is a proud sponsor of the Valuation Workshop by Professor Aswath Damoradan to be held on 13th and 14th November at Sheraton Towers, Singapore. Aswath Damodaran, Professor of Finance at NYU's Stern School of Business, has been often referred to as Wall Street's "Dean of Valuation" and is widely respected as one of the foremost experts on corporate valuation.

SMERGERS receives Economic Times Best BFSI Brand Award 2019

Oct 24, 2019

15th October, Dubai – SMERGERS was awarded as one of the Best BFSI Brands at the India-UAE Strategic Conclave presented by the Economic Times held at Hilton, Al Habtoor, Dubai 2019.

15th October, Dubai – SMERGERS was awarded as one of the Best BFSI Brands at the India-UAE Strategic Conclave presented by the Economic Times held at Hilton, Al Habtoor, Dubai 2019.

SMERGERS shortlisted as an innovative fintech startup at PICUP Fintech 2019 organized by FICCI

Mar 20, 2019

March 14th, Mumbai - SMERGERS was shortlisted as one of the most innovative fintech startups at PICUP Fintech conference organized by FICCI and Indian Banks' Association. The PICUP Fintech Awards 2019 aims to recognise and award the best innovations from Fintech companies in diverse areas.

March 14th, Mumbai - SMERGERS was shortlisted as one of the most innovative fintech startups at PICUP Fintech conference organized by FICCI and Indian Banks' Association. The PICUP Fintech Awards 2019 aims to recognise and award the best innovations from Fintech companies in diverse areas.

SMERGERS partners with I-Deals network for Business Valuation summit in Bengaluru

Mar 19, 2019

March 6th, Bangalore - SMERGERS partnered with I-Deals Network for Business Valuation Summit, 4th edition, organized at Taj Hotel, MG Road, Bengaluru. The event provided an overview of the global valuation industry, changing regulatory landscape and the need for adopting international standards in M&A valuations.

March 6th, Bangalore - SMERGERS partnered with I-Deals Network for Business Valuation Summit, 4th edition, organized at Taj Hotel, MG Road, Bengaluru. The event provided an overview of the global valuation industry, changing regulatory landscape and the need for adopting international standards in M&A valuations.

SMERGERS partners with YourStory and MSME Ministry for Brands of India Awards 2019

Mar 01, 2019

February 27th, New Delhi - SMERGERS partnered with YourStory and Ministry of MSMEs for Brands of India Awards 2019. The award ceremony was an attempt to recognize homegrown brands of our country. The event was presided over by Giriraj Singh, honorable minister for state for MSMEs. 41 home grown brands including Chai Point, Springfit Matresses, Cadd Center and IndiQube received awards during the ceremony.

February 27th, New Delhi - SMERGERS partnered with YourStory and Ministry of MSMEs for Brands of India Awards 2019. The award ceremony was an attempt to recognize homegrown brands of our country. The event was presided over by Giriraj Singh, honorable minister for state for MSMEs. 41 home grown brands including Chai Point, Springfit Matresses, Cadd Center and IndiQube received awards during the ceremony.

SMERGERS at VJIM's Silver Jubilee Lecture Series

Oct 17, 2017

August 29, 2017, Hyderabad - Vishal Devanath, Founder & CEO of SMERGERS was invited to VJIM Hyderabad's Silver Jubilee Lecture Series. Vishal spoke on Equity Financing and Valuations which was followed by an interactive Q&A session.

August 29, 2017, Hyderabad - Vishal Devanath, Founder & CEO of SMERGERS was invited to VJIM Hyderabad's Silver Jubilee Lecture Series. Vishal spoke on Equity Financing and Valuations which was followed by an interactive Q&A session.

SMERGERS at Digital Summit For Local Business 2017, Organized by AskLaila

Sep 15, 2017

February 11, 2017, Bangalore - Vishal Devanath, Founder & CEO of SMERGERS delivered an exclusive talk on Business Valuation at Business Event held for SME businesses at Grand Magrath Hotel, Bangalore on 11th Feb, 2017. The event was conducted by AskLaila, a local search company. The event included talks from other speakers such as Geetika from Jigsaw Academy, Deepak Kumar from Webnish, Rizwan Khan from Lion Packers & Movers, V U Ismail from Shuchi Ruchi Restaurant, etc.

February 11, 2017, Bangalore - Vishal Devanath, Founder & CEO of SMERGERS delivered an exclusive talk on Business Valuation at Business Event held for SME businesses at Grand Magrath Hotel, Bangalore on 11th Feb, 2017. The event was conducted by AskLaila, a local search company. The event included talks from other speakers such as Geetika from Jigsaw Academy, Deepak Kumar from Webnish, Rizwan Khan from Lion Packers & Movers, V U Ismail from Shuchi Ruchi Restaurant, etc.

SMERGERS awarded 20 Most Promising Banking Solution Companies in India 2016

Jan 19, 2017

SMERGERS has been recognized as 20 most promising Banking solutions in India 2016.

Online copy can be found here

SMERGERS has been recognized as 20 most promising Banking solutions in India 2016.

Online copy can be found here

SMERGERS Co-Founder Vishal Devanath’s Interview with Bharat Go Digital

Jan 19, 2017

Bharat Go Digital interivewed our CEO Vishal Devanath recently reagarding SMERGERS and the journey so far.

Online copy can be found here

Bharat Go Digital interivewed our CEO Vishal Devanath recently reagarding SMERGERS and the journey so far.

Online copy can be found here

Deal Street Asia - Nimit Finance buys 50% stake in Gujarat based Avity Agrotech via SMERGERS

Sep 01, 2016

Ahmedabad-based Nimit Finance Pvt Ltd , has picked up 50 per cent stake in Avity Agrotech Pvt Ltd, company's top executive told DealStreetAsia

Ahmedabad-based Nimit Finance Pvt Ltd , has picked up 50 per cent stake in Avity Agrotech Pvt Ltd, company's top executive told DealStreetAsia

SME Finance Forum - For the World's 460 Million SMEs, FinTech Firm SMERGERS to Become a One-stop Investment Bank

Feb 19, 2016

SMERGERS, India's leading online investment bank for Small and Medium Enterprises (SMEs), announces the expansion of its services to US, UK, Canada, Australia, and the UAE. SMEs are a resilient and vibrant sector for every nation in the world. They generate a large share of jobs for the common man; they form the backbone of a nation's economy. Yet financial institutions, including investment banks, have been turning a blind eye towards this segment.

Silicon India names SMERGERS as Brand of the Year 2015 in Investment Banking Platform Category

Jan 23, 2016

Alternative Financing Fintech Landscape on iamwire - SMERGERS' View

Dec 10, 2015

New age digital startups are disrupting the complete spectrum of the capital raising process for businesses. For any business to grow, there is an inherent need for capital.

New age digital startups are disrupting the complete spectrum of the capital raising process for businesses. For any business to grow, there is an inherent need for capital.

SMERGERS at Welingkar's Round Table Conference on Valuation

Sep 10, 2015

September 10, 2015, Bengaluru - Vishal Devanath, Founder & CEO of SMERGERS was invited for a round table conference organized on the theme of Valuations for SMEs and Startups. The conference, organized by Arthakul, Finance Club of Welingkar Institute of Management Development and Research, is a platform which brings together Industry experts, intellectuals and other stake holders. The event was an interface between Industry and Academia and was held at Welingkar campus in Electronic City, Bengaluru.

September 10, 2015, Bengaluru - Vishal Devanath, Founder & CEO of SMERGERS was invited for a round table conference organized on the theme of Valuations for SMEs and Startups. The conference, organized by Arthakul, Finance Club of Welingkar Institute of Management Development and Research, is a platform which brings together Industry experts, intellectuals and other stake holders. The event was an interface between Industry and Academia and was held at Welingkar campus in Electronic City, Bengaluru.

SMERGERS presentation on PE financing, M&A and Valuation in Chandigarh

Apr 28, 2015

April 10, 2015, Chandigarh - SMERGERS team was invited to share insights on how businesses can leverage SMERGERS.com platform to find and connect with prospective acquirers and private equity investors for their business at a conference organized by Mohali Industries Association (MIA) and Federation of Indian Micro, Small and Medium Enterprises (FISME) at Hotel Mountview, Chandigarh.

April 10, 2015, Chandigarh - SMERGERS team was invited to share insights on how businesses can leverage SMERGERS.com platform to find and connect with prospective acquirers and private equity investors for their business at a conference organized by Mohali Industries Association (MIA) and Federation of Indian Micro, Small and Medium Enterprises (FISME) at Hotel Mountview, Chandigarh.

SMERGERS at Profit Mantras for Businesses - Organized by FISME and KCCI

Mar 18, 2015

March 12, 2015, Kochi - The Federation of Indian Micro, Small and Medium Enterprises (FISME) and Kerala Chamber of Commerce and Industry (KCCI), in association with Hewlett Packard (HP) organized a seminar on 'Profit Mantras for Businesses' to share key information in the field of Finance, Technology and Marketing for SME businesses. Mr. Vishal Devanath, Founder and CEO of SMERGERS.com spoke about alternative methods of financing.

March 12, 2015, Kochi - The Federation of Indian Micro, Small and Medium Enterprises (FISME) and Kerala Chamber of Commerce and Industry (KCCI), in association with Hewlett Packard (HP) organized a seminar on 'Profit Mantras for Businesses' to share key information in the field of Finance, Technology and Marketing for SME businesses. Mr. Vishal Devanath, Founder and CEO of SMERGERS.com spoke about alternative methods of financing.

Economic Times - Bangalore-based online marketplace for small and medium businesses matches profiles with algorithms, filters and ratings

Jun 06, 2014

Another Bangalore-based online marketplace for small and medium businesses matches profiles with algorithms, filters and ratings. "This is a large and neglected sector, and the demand for investments is increasing," said Vishal Devanath, 28, cofounder of SMERGERS, which has profiles of 4,000 SMEs and investors.

Another Bangalore-based online marketplace for small and medium businesses matches profiles with algorithms, filters and ratings. "This is a large and neglected sector, and the demand for investments is increasing," said Vishal Devanath, 28, cofounder of SMERGERS, which has profiles of 4,000 SMEs and investors.

Crazy Engineers - In an exclusive interview with CrazyEngineers, Vishal Devanath talks about SMERGERS

May 21, 2014

Founded by Vishal Devanath and Krishna Bharadwaj in February 2013, SMERGERS is a Bangalore-based startup that specializes in the online financial services market. An Small and Medium Enterprise (SME) focused Online Investment Bank, SMERGERS specialize in Mergers & Acquisitions (M&A), Fund Raising, Venture and Private Equity (PE) services to SMEs, family owned businesses and growth startups.

Founded by Vishal Devanath and Krishna Bharadwaj in February 2013, SMERGERS is a Bangalore-based startup that specializes in the online financial services market. An Small and Medium Enterprise (SME) focused Online Investment Bank, SMERGERS specialize in Mergers & Acquisitions (M&A), Fund Raising, Venture and Private Equity (PE) services to SMEs, family owned businesses and growth startups.

YourStory - Bangalore-based SMERGERS, serving the online financial services market, is a technology platform that connects businesses and investors across the globe

Apr 09, 2014

SMERGERS is a Bangalore-based company in the online financial services market that was founded by Vishal Devanath and Krishna Bhardwaj in February 2013. It is a technology platform that connects businesses and investors across the globe.

SMERGERS is a Bangalore-based company in the online financial services market that was founded by Vishal Devanath and Krishna Bhardwaj in February 2013. It is a technology platform that connects businesses and investors across the globe.

SME Times - SMERGERS assisting SMEs for Mergers & Acquisitions of firms

Sep 30, 2013

In an exclusive interview with the Managing Director of SMERGERS, Vishal Devanath and Executive Director, Reema Mukherjee, SME Times finds that Small and Medium Enterprises (SMEs) can get funding through Private Equity, Venture Capital firms or Strategic Acquirers. They said, strategic acquirer not only brings in money but also expertise and network which the SME can benefit from.

In an exclusive interview with the Managing Director of SMERGERS, Vishal Devanath and Executive Director, Reema Mukherjee, SME Times finds that Small and Medium Enterprises (SMEs) can get funding through Private Equity, Venture Capital firms or Strategic Acquirers. They said, strategic acquirer not only brings in money but also expertise and network which the SME can benefit from.

Media Kit

Company Profile

SMERGERS is a user-friendly and transparent online platform that connects SMEs and franchise brands with the right investors, buyers, and M&A advisors globally. Boasting a robust network of over 20K businesses, 80K investors and buyers, 4K advisors, and 2K franchises, we provide a level playing field for businesses and investors of all sizes. Our platform features verified members with up-to-date listings and efficient price discovery to ensure a fair marketplace for all parties involved. Leveraging advanced technology and AI-powered matchmaking, we offer pocket-friendly pricing plans. Our dedicated customer support is readily available via email and WhatsApp, ensuring a seamless user experience.

Logo

Contact

SMERGERS in Media

Budget 2022: How about reduction in GST rates for MSMEs and Covid-affected industries, FM?

To explain the woes of the travel and hospitality industry, a quick search on SMERGERS showed that over 1,017 companies were listed in the travel, hotel, and restaurant industry segment. SERGERS is a portal that facilitates sales or investments.

SMERGERS, an online matchmaking platform for SMEs. The platform has 70,000 pre-screened businesses along with investors from over 170 countries.

Thousands of micro, small businesses are on sale right now. SMERGERS is an online investment banking platform facilitating buying and selling of businesses.

Buyer interest in SME space has gone up post-Covid: Vishal Devanath, founder, SMERGERS

Professionals pick bargain investments in Covid-hit MSMEs listed on SMERGERS.

SMERGERS sees more than 4,900 owners listing their businesses for sale

MSME schemes 2020: What was announced, what was utilised, and what is needed in 2021

SMERGERS sees a sharp uptick in registrations, indicating the need for external funding support amongst small businesses

5 alternative investment ideas: How can you put your money to work?

SMERGERS has thousands of small and mid-sized businesses, investors, acquirers, advisors, and franchisors advertising their deals

Nimit Finance buys 50% stake in Gujarat based Avity Agrotech via SMERGERS

For the World's 460 Million SMEs, FinTech Firm SMERGERS to Become a One-stop Investment Bank

Bangalore-based online marketplace for small and medium businesses matches profiles with algorithms, filters and ratings

Bangalore-based SMERGERS, serving the online financial services market, is a technology platform that connects businesses and investors across the globe