SMERGERS Blog offers expert insights, trends, and practical advice on SME investments and M&A, helping business owners and investors make informed decisions.

The Effect of War on Small Businesses in Ukraine: Data Insights from 2022–2025

Jun 13, 2025

4 minutes

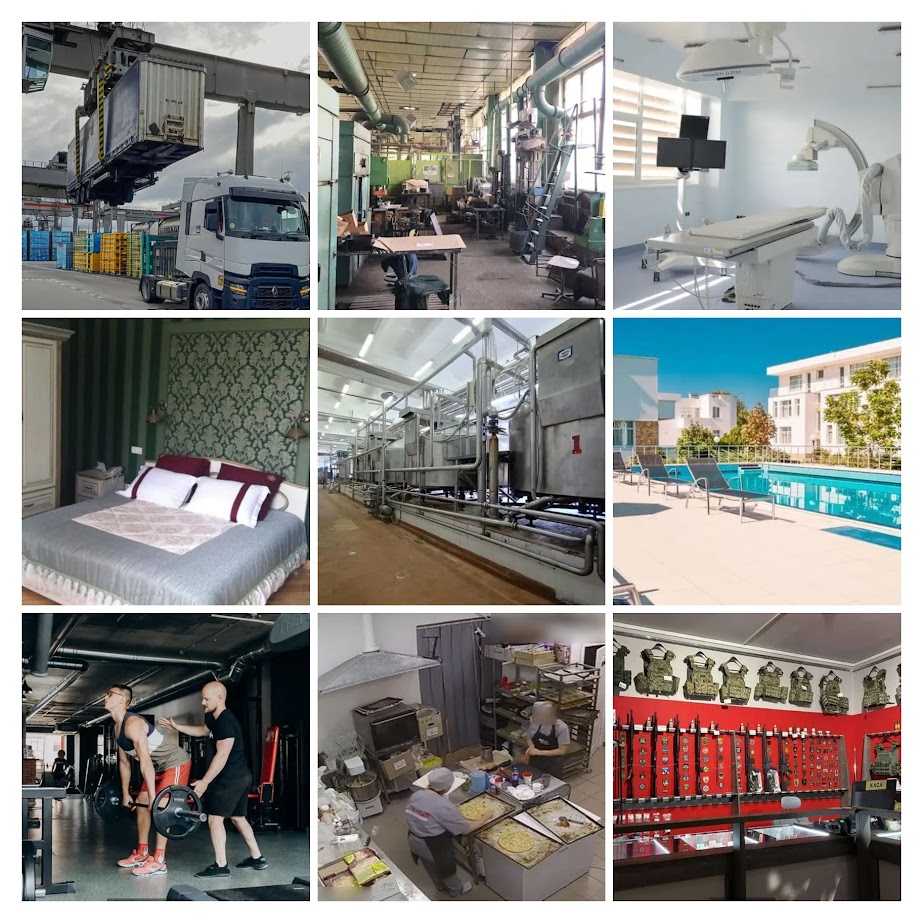

The Russia-Ukraine war in 2022 triggered one of the most disruptive economic

shocks in modern European history, reverberating across every sector of the

country’s business landscape. While the headlines have focused on massive

infrastructure damage and shifting global supply chains, less visible—but no

less critical—are the war’s effects on Ukraine’s small and medium-sized

enterprises (SMEs). These businesses, long the backbone of the national

economy, now face existential threats: dislocation, labor shortages,

diminished demand, and unprecedented operational risk.

Continue

reading..

The Russia-Ukraine war in 2022 triggered one of the most disruptive economic

shocks in modern European history, reverberating across every sector of the

country’s business landscape. While the headlines have focused on massive

infrastructure damage and shifting global supply chains, less visible—but no

less critical—are the war’s effects on Ukraine’s small and medium-sized

enterprises (SMEs). These businesses, long the backbone of the national

economy, now face existential threats: dislocation, labor shortages,

diminished demand, and unprecedented operational risk.

Continue

reading..

Entering the world of franchises can be a golden ticket to business success, but it's crucial to evaluate each opportunity with a magnifying glass. Here, we delve into the less obvious aspects that can make or break your venture into the realm of franchise opportunities.

Continue

reading..

Entering the world of franchises can be a golden ticket to business success, but it's crucial to evaluate each opportunity with a magnifying glass. Here, we delve into the less obvious aspects that can make or break your venture into the realm of franchise opportunities.

Continue

reading..

Malaysia, with its robust economy and strategic position in Southeast Asia, is becoming a popular destination for investors seeking to buy businesses. However, choosing the right city in this diverse nation can significantly impact your business success. Let’s explore the top ten cities in Malaysia to consider when looking to purchase a business and uncover some unexpected insights along the way.

Continue reading..Exploring Global Business Opportunities: A Comprehensive Guide to Businesses for Sale

Dec 26, 2024

2 minutes

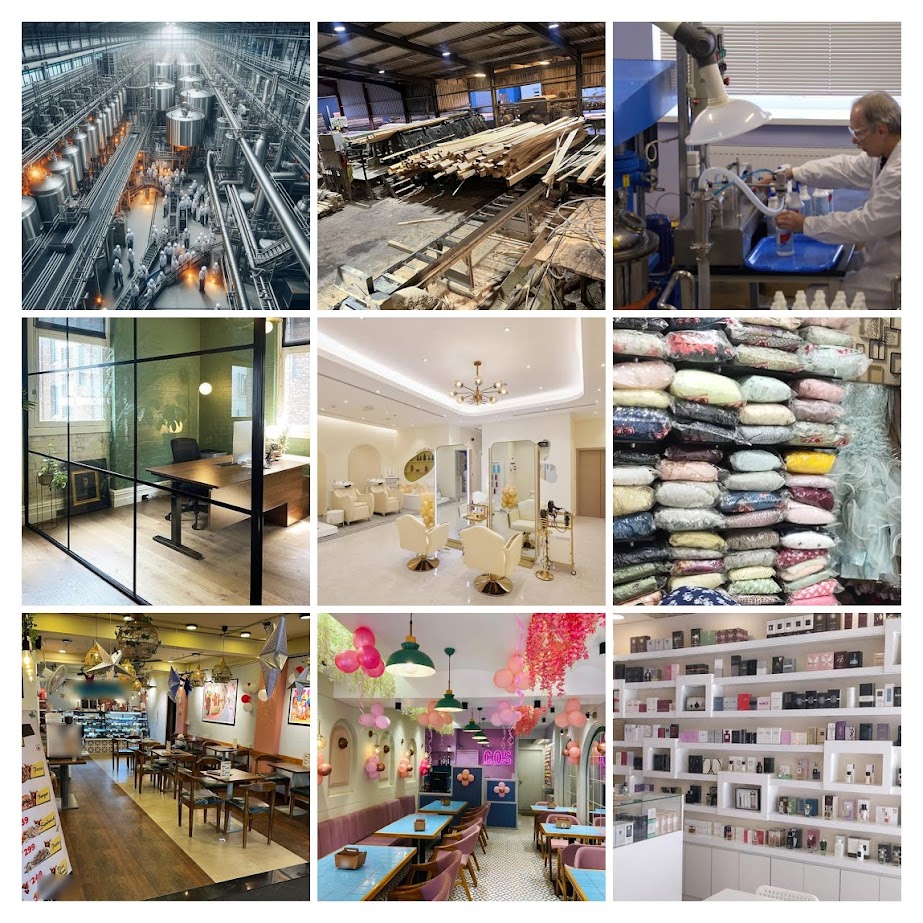

Are you looking for your next business venture? The market is brimming with opportunities, from bustling cities like Bangalore and Hyderabad to international hotspots like Singapore, Qatar, Portugal, South Korea and Canada. Here's a guide to navigating the vast landscape of businesses for sale

Continue

reading..

Are you looking for your next business venture? The market is brimming with opportunities, from bustling cities like Bangalore and Hyderabad to international hotspots like Singapore, Qatar, Portugal, South Korea and Canada. Here's a guide to navigating the vast landscape of businesses for sale

Continue

reading..

In the evolving landscape of the 21st-century economy, the definition of value and what makes a company valuable and asset rich have transformed. Traditional notions of assets tied to physical objects or properties have changed and given way to the rise of intangible assets. As we navigate this paradigm shift, understanding what intangible assets are, types of intangible assets, how to value them, how companies have valued them, and their pivotal role in determining a company's worth becomes imperative.

Continue

reading..

In the evolving landscape of the 21st-century economy, the definition of value and what makes a company valuable and asset rich have transformed. Traditional notions of assets tied to physical objects or properties have changed and given way to the rise of intangible assets. As we navigate this paradigm shift, understanding what intangible assets are, types of intangible assets, how to value them, how companies have valued them, and their pivotal role in determining a company's worth becomes imperative.

Continue

reading..

One investment is all it takes to make your dream of owning a restaurant a reality - buying an already-established one. But before you make an offer on the restaurant of your dreams, you need to be aware that there are still plenty of challenges associated with buying an existing one, just like when opening a new restaurant. Careful research and consideration must be taken before taking the leap and investing in your ambitions. Owning a restaurant can be one of the most rewarding experiences, and with the right preparation and dedication, you can make it happen!

Continue

reading..

One investment is all it takes to make your dream of owning a restaurant a reality - buying an already-established one. But before you make an offer on the restaurant of your dreams, you need to be aware that there are still plenty of challenges associated with buying an existing one, just like when opening a new restaurant. Careful research and consideration must be taken before taking the leap and investing in your ambitions. Owning a restaurant can be one of the most rewarding experiences, and with the right preparation and dedication, you can make it happen!

Continue

reading..

The pandemic has engulfed a major part of 2020. The world started going into lockdown around the month of March and small and medium businesses across the world were the segment that has been affected the most. The industries that have evidently been affected include – real estate & construction, hotel, restaurant, and transportation. As the world ventures into a new year, here is a look at the pandemic’s effect on small businesses.

Continue

reading..

The pandemic has engulfed a major part of 2020. The world started going into lockdown around the month of March and small and medium businesses across the world were the segment that has been affected the most. The industries that have evidently been affected include – real estate & construction, hotel, restaurant, and transportation. As the world ventures into a new year, here is a look at the pandemic’s effect on small businesses.

Continue

reading..

A business exit strategy is a method used by investors such as venture capitalists and angel investors to receive a cash out of their investment. It gives them a way to reduce or liquidate stake in a business and if the business is successful make a substantial profit. It also helps to limit losses in case the business has not been successful. Some of the common exit strategies include initial public offerings (IPO), strategic acquisitions and management buyouts (MBO). The strategy chosen for exit would depend on numerous factors with each method offering its own advantages and disadvantages.

Continue

reading..

A business exit strategy is a method used by investors such as venture capitalists and angel investors to receive a cash out of their investment. It gives them a way to reduce or liquidate stake in a business and if the business is successful make a substantial profit. It also helps to limit losses in case the business has not been successful. Some of the common exit strategies include initial public offerings (IPO), strategic acquisitions and management buyouts (MBO). The strategy chosen for exit would depend on numerous factors with each method offering its own advantages and disadvantages.

Continue

reading..

The right financing for your business can come in many forms, as well as many sources. There’s crowdfunding, alternative lenders, bank loans, unsecured loans, secured loans, lines of credit, term loans, equity, debt, and many more.

At a particular point, you may want to settle for a straightforward and simple personal loan instead. However, the question is, can you use it for business purposes? Is personal loan better than a business loan?

Continue

reading..

The right financing for your business can come in many forms, as well as many sources. There’s crowdfunding, alternative lenders, bank loans, unsecured loans, secured loans, lines of credit, term loans, equity, debt, and many more.

At a particular point, you may want to settle for a straightforward and simple personal loan instead. However, the question is, can you use it for business purposes? Is personal loan better than a business loan?

Continue

reading..

While e-commerce may never eclipse in-store retail sales, e-commerce is a giant that continues to grow. Currently, about 14% of all retail sales are done online while by 2022, that number is expected to increase to 20%. That’s 1 in every 5 purchases will be made online!

Many people are choosing to jump onto the ecommerce ship for their new business or existing one. It’s simply another way to build up the business, attract new customers, and increase sales over time.

Continue

reading..

While e-commerce may never eclipse in-store retail sales, e-commerce is a giant that continues to grow. Currently, about 14% of all retail sales are done online while by 2022, that number is expected to increase to 20%. That’s 1 in every 5 purchases will be made online!

Many people are choosing to jump onto the ecommerce ship for their new business or existing one. It’s simply another way to build up the business, attract new customers, and increase sales over time.

Continue

reading..

Entrepreneur's Guide to Raising Finance for Business Acquisition and Funding Initial Cash Flow

Oct 22, 2019

8 minutes

What’s in this guide: with nearly a decade's worth of experience in business financing, franchising, and business selling, we at SMERGERS have a tried and tested guide to help entrepreneurs raise finance for business acquisitions. This guide covers all three aspects of business financing, beginning with closing costs, varieties of financing options, and funding operational expenses.

Continue

reading..

What’s in this guide: with nearly a decade's worth of experience in business financing, franchising, and business selling, we at SMERGERS have a tried and tested guide to help entrepreneurs raise finance for business acquisitions. This guide covers all three aspects of business financing, beginning with closing costs, varieties of financing options, and funding operational expenses.

Continue

reading..

In this post we explain the fundamentals of M&A, we describe specialists who are part of the M&A process, and we highlight 12 most common jargons used during an M&A transaction. M&A stands for Mergers and Acquisitions. M&A is a process where companies sell and buy each other. There can be instances where even individuals invest or buy small businesses. When an entrepreneur decides to sell his business, the reasons can be many. He may want to retire, relocate to a different city, focus on another business or simply move on from the business and receive a lucrative offer to buy a beach property.

Continue

reading..

In this post we explain the fundamentals of M&A, we describe specialists who are part of the M&A process, and we highlight 12 most common jargons used during an M&A transaction. M&A stands for Mergers and Acquisitions. M&A is a process where companies sell and buy each other. There can be instances where even individuals invest or buy small businesses. When an entrepreneur decides to sell his business, the reasons can be many. He may want to retire, relocate to a different city, focus on another business or simply move on from the business and receive a lucrative offer to buy a beach property.

Continue

reading..

Is your business set for profit or value? Modern day technology and fewer entry barriers in most industries have changed the business landscape around the world. Starting a business now is easier than ever before in human history. However, starting is just the first step. Convincing people to work for your business or product idea, convincing customers to buy your product and most importantly convincing investors to put money into your business are the most challenging aspects for a business owner. Once you have put a strong business foundation and created an interesting product people want to buy, you will need to raise funds to grow or sell your business. Convincing a buyer is as challenging as convincing investors to invest in your business.

Continue

reading..

Is your business set for profit or value? Modern day technology and fewer entry barriers in most industries have changed the business landscape around the world. Starting a business now is easier than ever before in human history. However, starting is just the first step. Convincing people to work for your business or product idea, convincing customers to buy your product and most importantly convincing investors to put money into your business are the most challenging aspects for a business owner. Once you have put a strong business foundation and created an interesting product people want to buy, you will need to raise funds to grow or sell your business. Convincing a buyer is as challenging as convincing investors to invest in your business.

Continue

reading..

Buying a business is generally cheaper than starting one. And what’s also important is that there are huge advantages that you get when buying a business rather than starting it from scratch. Entrepreneurship through acquisition, or buying a business gives you the added advantage of existing customer base, working marketing strategy, already hired employees, easy financing, avoiding delays of compliance and regulatory approvals, etc. But if you end up buying a business without proper due diligence it may cost you much more time, money and energy that what you would have spent starting one. Hence it is important to check the below listed aspects before you take the plunge.

Continue

reading..

Buying a business is generally cheaper than starting one. And what’s also important is that there are huge advantages that you get when buying a business rather than starting it from scratch. Entrepreneurship through acquisition, or buying a business gives you the added advantage of existing customer base, working marketing strategy, already hired employees, easy financing, avoiding delays of compliance and regulatory approvals, etc. But if you end up buying a business without proper due diligence it may cost you much more time, money and energy that what you would have spent starting one. Hence it is important to check the below listed aspects before you take the plunge.

Continue

reading..

In most countries, of all the registered companies only 60-70% of them are actively in business. Some businesses fail in their planning phase, some are declared dormant and some just run out of money. For most of the young entrepreneurs out there, this is a harsh reality. You might think that your idea is good, but if not executed properly, it can be one of the worst mistakes you do in your life. A bad business will have heavy consequences and will drain your financial resources and time.

Continue

reading..

In most countries, of all the registered companies only 60-70% of them are actively in business. Some businesses fail in their planning phase, some are declared dormant and some just run out of money. For most of the young entrepreneurs out there, this is a harsh reality. You might think that your idea is good, but if not executed properly, it can be one of the worst mistakes you do in your life. A bad business will have heavy consequences and will drain your financial resources and time.

Continue

reading..

As an entrepreneur you’ve have spent a lot of time, money and other resources to build and grow your ecommerce business, that you want to sell now. But, how do you proceed with the sale? Pointers below will help you to prep-up for the sale of your eCommerce site.

Continue

reading..

Entrepreneurs with surplus funds often like to start a franchise business. It may not be their primary source of income but it can lend them a great deal of profitability because the business model is already proven successful and is led by a strong existing and recognised brand.

Continue

reading..

If you’re a small business owner, a franchise can be one of the best ways to build your business. Many entrepreneurs dream about exponentially growing their business and making their brand a household name, but typically lack the growth capital required to get to such a stage. Franchising your business ensures a low cost scaling model, though it requires diligence and a laser focussed execution strategy.

Continue

reading..

If you’re a small business owner, a franchise can be one of the best ways to build your business. Many entrepreneurs dream about exponentially growing their business and making their brand a household name, but typically lack the growth capital required to get to such a stage. Franchising your business ensures a low cost scaling model, though it requires diligence and a laser focussed execution strategy.

Continue

reading..

As an entrepreneur, the eventual exit from the business, however successful, can be made sour unless the tax structure of the sale is optimized. Many business owners have paid over 40% of the sale amount to the Government as taxes, merely due to bad financial planning. In this article, we’ll attempt to decipher some of the less understood points about the taxes incurred while selling your business.

Continue

reading..

As an entrepreneur, the eventual exit from the business, however successful, can be made sour unless the tax structure of the sale is optimized. Many business owners have paid over 40% of the sale amount to the Government as taxes, merely due to bad financial planning. In this article, we’ll attempt to decipher some of the less understood points about the taxes incurred while selling your business.

Continue

reading..

Every business owner has to exit their business at some point – be it for personal or professional reasons. Though selling the business can be a challenge, attempting to sell it quickly poses a unique set of problems. The aim of this article is to educate small business owners on how to sell your business fast.

Though every sale transaction is unique, a well-run business generally takes around 90-180 days to be sold. Most business owners prefer a quick sale, but it makes the acquirers nervous as they like to have enough time to do their due diligence.

Continue

reading..

For those who’re ready to take the entrepreneurial leap, starting a business from scratch might not be the only option. When you build a business from ground up, there’re many challenges in the same including initial set up, finding early customers, hiring key employees, managing cash flow, etc. These issues are negated when you choose to buy a business which has a proven track record of customers, internal processes, revenue and profit. If you’re asking yourself ‘How can I buy a business?’ this article is for you

Continue

reading..

For those who’re ready to take the entrepreneurial leap, starting a business from scratch might not be the only option. When you build a business from ground up, there’re many challenges in the same including initial set up, finding early customers, hiring key employees, managing cash flow, etc. These issues are negated when you choose to buy a business which has a proven track record of customers, internal processes, revenue and profit. If you’re asking yourself ‘How can I buy a business?’ this article is for you

Continue

reading..

Selling a business is never an easy task so you can always enlist the services of a broker to sell your business. They are intermediaries between a business owner who’s selling their business and an acquirer who want to purchase it. They play an important role in sale of businesses in providing expertise needed to get the sale done, a trait most small business owners lack. Also, selling a business takes time, so working with a broker allows the business owner to focus on operating the business while the broker does the leg work required to complete the sale.

Continue

reading..

Selling a business is never an easy task so you can always enlist the services of a broker to sell your business. They are intermediaries between a business owner who’s selling their business and an acquirer who want to purchase it. They play an important role in sale of businesses in providing expertise needed to get the sale done, a trait most small business owners lack. Also, selling a business takes time, so working with a broker allows the business owner to focus on operating the business while the broker does the leg work required to complete the sale.

Continue

reading..

If you’re a business owner with a great firm and are wondering why you aren’t able to attract buyers/investors, perhaps you’re committing some of these classic mistakes (with easy fixes) we’ve seen hundreds of businesses commit.

Continue

reading..

📈 Industry Watch

Automobile industry facing a tough time as vehicle demand is sluggish. Valuations of companies on the lower end. Autocomponent industry is also expected to witness a flat growth this fiscal because of weak automobile demand. The industry will remain

Fitness industry in India is worth Rs.4,500 crore and is growing at 16-18% annually and is expected to cross Rs.7,000 crore by 2017. The industry is fragmented with majority of the market dominated by unorganized and independent gyms outlets. The

Low utilization rates and weak demand from realty and infrastructure sectors is driving consolidation in the Indian cement industry. More mergers & acquisitions are expected in the medium-to-long-term as valuations are attractive to buyers and

Demand for electronics hardware in India is projected to grow at 25% compared to only 15% growth in production, expected to create a demand supply gap of Rs.14.8 lakh crores by FY20. This creates a unique opportunity for electronics companies

The ecommerce space in India is still evolving and companies have limited history. Many of them function at negative operating cashflows and are dependent on investments from venture capital firms. Using traditional valuation methods like DCF

The food processing industry in India is getting a shot in the arm with increased focus from the government and policy makers, higher involvement of scientists to help increase food processing productivity, and establishment of mega food parks

The Staffing Industry includes companies which list employment vacancies, place applicants in employment, supply temporary workforce and all other employment related services. Market size of the Indian staffing industry was INR 26,650 crore in 2014

Global acquisitions by Indian IT firms rising with a majority of the transactions happening in Europe and North America. Primary reasons driving these acquisitions are increasing local presence in the US and Europe, acquiring employees with a

The Indian healthcare market is expected to reach ₹ 24 lakh crore by 2022 from ₹ 9 lakh crore in 2016 growing at a CAGR of 17.7% driven by rising incomes, greater awareness, prevalence of lifestyle diseases and increasing penetration of medical

Nutraceuticals (also called health supplements) are specially processed or formulated foods designed to satisfy particular dietary requirements and/or provide medicinal or health benefits. They generally contain extracts from plant & animal sources,

The Apparel industry or the Ready-Made Garments (RMG) Industry is the largest segment of the Indian Textiles and Apparel (T&A) Industry accounting for approximately 50% of the total industry. Given that apparel manufacturing is economically viable

Facility Management (FM) refers to the use of a third-party service providers to maintain a part or entire building facility in a professional manner. It is increasingly gaining popularity amongst commercial as well as residential clients driven by

Fuel additives are fuel-soluble chemicals added in small quantities to enhance the properties of the fuel, improve fuel handling and fuel performance. The rapidly increasing demand for hydrocarbon fuels from transportation and power industries have

Advertising spends in India are expected to grow 12.6% year on year to Rs 48,977 crore for the year 2015. The ad spend in 2014 was Rs. 43,490 crore, which reflected a 12.5% increase over 2013. Firms in the advertising industry prepare advertisements

The worldwide ERP software grew by 6.4% in 2014 to reach $27B market size. The segment is anticipated to garner $41 billion in sales by 2020 with a CAGR of 7.2% during 2014-2020. ERP software is second fastest growing segments within Enterprise

It is widely believed that India has not fully leveraged its strength in the Manufacturing sector in the last decade, but the sector is expected to emerge stronger in next decade as companies innovate and adopt new business models. To support this

Pharmaceutical industry seems to be entering a growth phase after a muted growth over the last few quarters. Valuations of pharma companies fairly high as they are expected to perform. Indian Pharmaceuticals industry is the world’s third largest in

The Indian restaurant industry is highly unorganized and fragmented but is getting rapidly organized with Quick Service Restaurant (QSR) segment leading the way. Private Equity and Venture Capital firms have shown increased interest in this sector

The salon industry in India is largely unorganized but is getting organized at a fast pace. The average per person spending on salons in India is a minuscule of spending in other locations such as North America, Europe, and Asia. Even a small growth

India is world’s second largest producer of textile and apparel after China. China is slowly reducing its focus on textiles and this has had a positive impact on the Indian textile and apparel industry. But not everything in the garden is rosy as

Indian managed farmland industry provides a lucrative passive investment opportunity. Managed farmland lets investors own farm plots while companies handle operations, sharing profits from produce sales. With India's 159.7M hectares of arable land

The Indian AYUSH and Ayurveda industry is booming!

AYUSH: Ayurveda, Yoga, Naturopathy, Unani, Siddha, Sowa-Rigpa, Homoeopathy.

Growth: Manufacturing sector hit INR 2 lakh crores (US$ 24B) by 2024. Total industry worth INR 4.1 lakh crores (US$ 50B)

The global e-commerce market is expected to grow from $16.6 trillion in 2022 to $70.9 trillion by 2028. Key players like Shopify are driving this growth, while M&A activity, including seed funding for apps like Okendo, highlights the dynamic nature

Fueled by innovation, aging populations, and chronic illnesses, the market is set to reach USD 863.2B by 2030. With segments like diagnostic imaging, cardiovascular, and dental devices, this sector spans essential healthcare tools. The USA leads

The UAE foodservice market is rapidly expanding, driven by growing consumer demand, diverse cuisines, and innovative restaurant technologies. With a projected CAGR of 17.10%, it’s set to reach AED 161.53 billion by 2029. Discover key insights on the

Australia’s supermarket and online grocery industry is evolving fast, valued at AUD 113B and projected to hit AUD 129.6B by 2026. Post-COVID trends, digital adoption, and economic shifts are reshaping how Aussies shop. Discover insights into market

Global oil demand is rebounding post-pandemic, driven by transport and industrial fuel needs, while Slovakia’s fuel retail market modernizes through automation and strong independent players. Our latest Industry Watch dives into trends, recovery

Singapore’s construction industry faced a sharp 33.7% decline in 2020 due to COVID-19, labor shortages, and project delays. However, recovery is underway, led by public housing, healthcare, and infrastructure. With renewed investments and policy

The global toy industry is booming, expected to surpass $120B by 2023! Europe is the 3rd largest market, with 99% of manufacturers being SMEs. Offline sales still lead, but online channels are growing fast. Innovation, regional demand, and

The $193B global gaming industry is evolving fast — not just play, but earn.

Gamers are creators, streamers, and income earners, with Web3 and NFTs unlocking asset ownership and digital economies.

By 2025, the industry hits $211B, driven by mobile

Unlock investment opportunities in Malaysia's lightning protection industry!

High Demand: Malaysia experiences extremely high lightning discharges, with cities like Bayan Lepas having 293 lightning days per annum.

Critical Infrastructure: Over 70%

Unlock the potential of the Greece furniture retail market!

Market Growth: Expected to generate EUR 1.15B in 2023 with a CAGR of 2.45% until 2028.

Key Segments: Bedroom, Living Room, Kitchen & Dining, Bathroom, Outdoor, Home Office.

Global

The global robotic mower industry is booming!

Market Size: Valued at USD 1.5 billion (EUR 1.36 billion) in 2021, expected to reach USD 3.9 billion (EUR 3.56 billion) by 2027 at a CAGR of 12%.

Western Europe: Leading the market with consumers

The global smoking accessories and cannabis industry is evolving!

Market size (global smoking accessories): USD 64.4B in 2021, projected to grow at 4.0% CAGR till 2030.

Trends: Shift from cigarettes to safer non-smoking products. Rise of

The Malaysian playschool industry is on the rise!

Market Growth: Expected to reach RM 19 billion by 2026, with a CAGR of 5.6% (2021-2026).

Curriculum: Adheres to the National Preschool Curriculum, emphasizing play, thematic, integrated

The community management software is transforming customer engagement, brand advocacy, and support. Valued at AUD 13.33B (USD 8.32B) in 2023, this market is set to hit AUD 58.66B (USD 36.68B) by 2032, growing at 17.93% CAGR. Driven by remote work

Dive into the world of themed fabrication! From crafting immersive experiences for theme parks to creating interactive museum exhibits, this industry blends engineering, artistic craftsmanship, and storytelling like no other. With booming sectors

Revolutionizing healthcare in the U.S.! The telehealth market has surged with a CAGR of 28%, projected to hit $43 billion by 2026. Fueled by mobile technology, broadband connectivity, and increasing demand for safe, convenient care post-pandemic,