Greece Furniture Retail Industry

Market Overview

Revenue Projection : The furniture market in Greece is expected to generate EUR 1,150 million in revenue in 2023, with a compound annual growth rate (CAGR) of 2.45% from 2023 to 2028.1

Global Ranking : Greece's furniture market ranks 57th in the world in terms of revenue, behind countries such as the US, China, and Germany. In global comparison, the most revenue is generated in the United States (EUR 222 billion in 2023).1

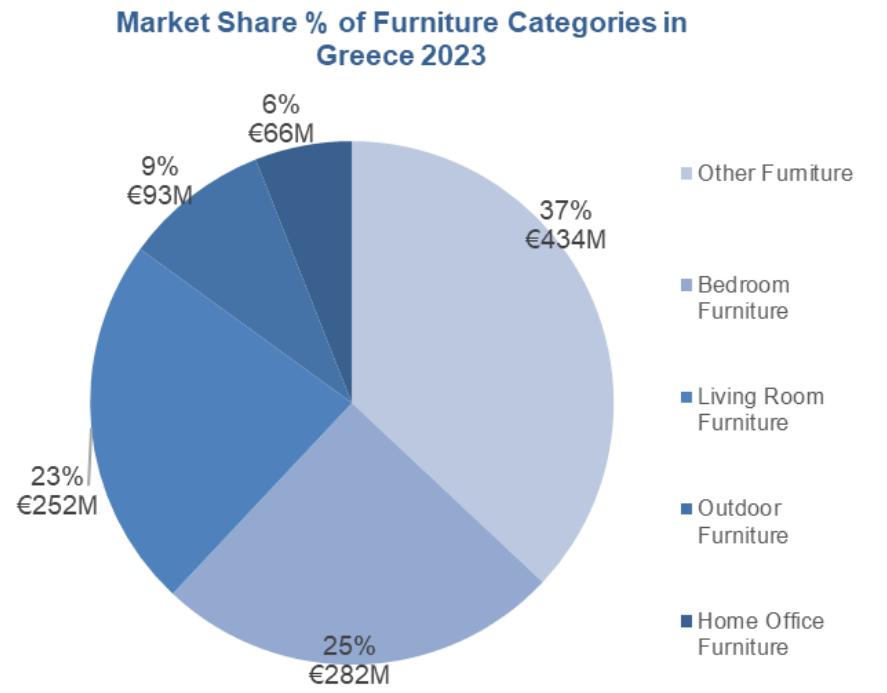

Market Segmentation

The furniture market in Greece is divided into six segments based on the room where the furniture is used:

- Bedroom

- Living Room

- Kitchen and Dining Room

- Bathroom

- Outdoor

- Home Office

Source: Statista1,3,5,6,7

2023

Source: Statista1,3,5,6,7

2023

Market Drivers

Millennial Generation : A potential driver is the millennial generation, who are expected to buy their first homes in the next few years.

Online Shopping : Furniture, home accessories, and gardening products remain the third most popular product category, ordered by 29% of online customers.2

Growth Drivers

House Price Increases : House prices in Greece’s urban areas soared by 14.14% during the year to Q2 2023, indicating a strong recovery of the housing market after a decade of decline and stagnation. This recovery could boost the demand for furniture and home furnishings.8

Foreign Buyers : The total value of real estate purchases by foreign buyers, which accounts for 80% to 85% of all real estate purchases in Greece, soared by 39.9% year-on-year to €1.1 billion in the first half of 2023. The Golden Visa Program, offering residency to non-EU investors purchasing or renting property worth over €500,000, has attracted foreign investors.8

Economic Growth : Greece’s economic activity is expected to grow by 2.4% in 2023, supported by the Recovery and Resilience Plan (RRP) and a resilient labour market. The economic recovery could improve consumer confidence and spending power, increasing demand for furniture and household goods.9

Tourism : The property market accounts for about 20% to 35% of total foreign direct investment (FDI) in Greece annually. Foreign interest in Greek tourism property is increasing, driving demand for tourism accommodation and facilities, creating opportunities for the furniture retail business, especially in coastal areas and islands.8

Imports and Suppliers

Import Dependency : Greece relies on imports to meet its domestic demand. Furniture import shipments in Greece stood at 85,000, imported by 679 Greece importers from 583 suppliers in 2023.4

Key Import Sources : Imports are mainly from India, Italy, Germany, Poland, and Turkey.

Main Import Categories : The main categories of imported furniture are seats, wooden furniture, metal furniture, and mattresses.

Leading Retailers

Some of the leading furniture retailers in Greece include:

KONIANOS, E.

BROS O.E.

S &H HOME CREATION

Furniture Gallery

IKEA

| Trading Comparables | |||||

| (In EUR million, As on 11th Jan 2024) | Enterprise Value (EV) 6 | Revenue (TTM) | EBITDA (TTM) | EV / Revenue | EV / EBITDA |

| Company | |||||

N. Varveris-Moda Bagno S.A. 10 |

20 |

26 |

3 |

0.8x |

6.9x |

N. Varveris-Moda Bagno S.A. 11 |

50 |

25 |

5 |

2.0x |

9.7x |

Haverty Furniture Companies, Inc. 12 |

589 |

848 |

91 |

0.7x |

6.5x |

Ethan Allen Interiors Inc. 13 |

664 |

674 |

125 |

1.0x |

5.3x |

| Median | 0.9x | 6.7x |

| Transaction Comparables (in INR Cr) | ||||||||

| Date | Target | Acquirer / Investor | Target Description | EV (in EUR million) | EV/ Revenue | EV/ EBITDA 6 | ||

Oct-22 |

Weber 14 |

BDT Capital |

Manufactures and distributes outdoor cooking products and accessories |

2,724 |

1.9x |

NA |

||

Oct-22 |

International Wholesale Tile 15 |

Victoria |

Distributes marble and granite products |

26 |

0.5x |

4.1x |

||

Oct-22 |

Martin Door 16 |

PGT Innovation |

Provides garage doors for residential and commercial customers |

168 |

3.1x |

8.5x |

||

Sep-22 |

Purple Innovation |

Colisuem Capital Management |

Designs and manufactures mattresses, pillows, and cushions |

469 |

0.8x |

NA |

||

| Median | 1.4x | 6.3x |

Porter's Five Forces

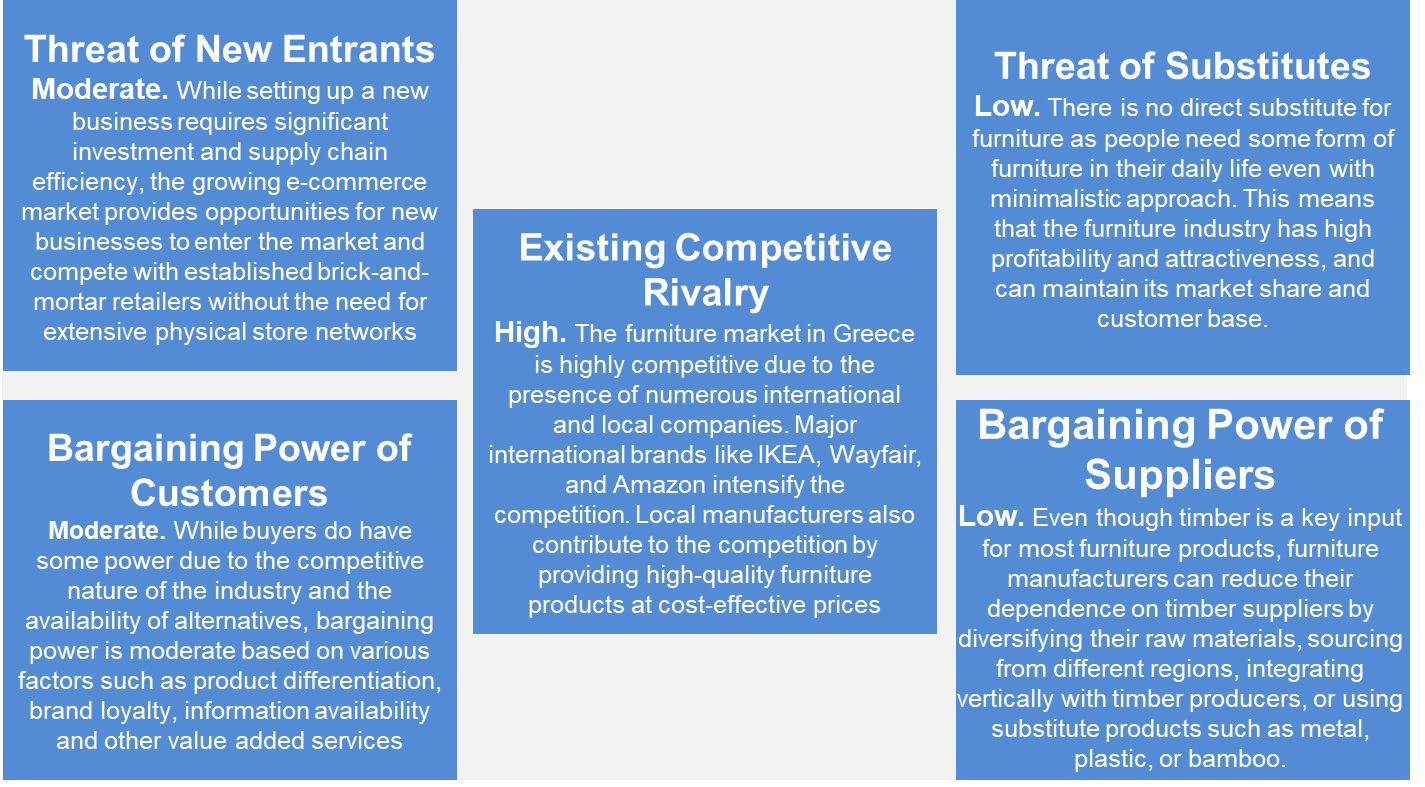

Threat of New Entrants - Moderate

While setting up a new business requires significant investment and supply chain efficiency, the growing e-commerce market provides opportunities for new businesses to enter the market and compete with established brick-and-mortar retailers without the need for extensive physical store networks.

Existing Competitive Rivalry - High

The furniture market in Greece is highly competitive due to the presence of numerous international and local companies. Major international brands like IKEA, Wayfair, and Amazon intensify the competition. Local manufacturers also contribute to the competition by providing high-quality furniture products at cost-effective prices.

Threat of Substitutes - Low

There is no direct substitute for furniture as people need some form of furniture in their daily life even with minimalistic approach. This means that the furniture industry has high profitability and attractiveness, and can maintain its market share and customer base.

Bargaining Power of Customers - Moderate

While buyers do have some power due to the competitive nature of the industry and the availability of alternatives, bargaining power is moderate based on various factors such as product differentiation, brand loyalty, information availability and other value added services.

Bargaining Power of Suppliers - Low

Even though timber is a key input for most furniture products, furniture manufacturers can reduce their dependence on timber suppliers by diversifying their raw materials, sourcing from different regions, integrating vertically with timber producers, or using substitute products such as metal, plastic, or bamboo.

References

1 Furniture - Greece | Statista Market Forecast

2 The State of the Furniture Industry and How to Prepare for 2023 (cylindo.com)

3 Bedroom Furniture - Greece | Statista Market Forecast

4 Furniture Imports in Greece - Volza

5 Living Room Furniture - Greece | Statista Market Forecast

6 Outdoor Furniture - Greece | Statista Market Forecast

7 Home Office Furniture - Greece | Statista Market Forecast

8 Greece's Residential Property Market Analysis 2025

9 Economic forecast for Greece - European Commission

10 DROME.GR | Dromeas S.A. Annual Balance Sheet - WSJ

11 N. Varveris-Moda Bagno S.A. (MODA) Stock Price Today - WSJ

12 Haverty Furniture Companies, Inc. (HVT) Income Statement - Yahoo Finance

13 Ethan Allen Interiors Inc. (ETD) Valuation Measures & Financial Statistics

15 Oman-India PE fund invests Rs100 crore in Prince Pipes IPO