Indian Organic Farming Market

Introduction:

Organic farming is the production of food without the use of synthetic chemicals or genetically modified components. Organic foods are not necessarily completely chemical free, but the pesticide residues will be considerably lower than those found in produce manufactured with synthetic chemicals. They do not use genetically modified (GM) components or expose food to irradiation.****(Government, 2022)

India's favorable agricultural climatic conditions, coupled with an inherited tradition of organic farming, the country is able to produce high quality organic products which are a hit with consumers not only in India, but abroad as well. Demand for organic products is on the rise globally, driven by growing awareness of the benefits of a healthy lifestyle, increasing urbanisation, knowledge of the hazards associated with the use of chemical fertilisers and pesticides in food production, and rising disposable income

Organic agriculture has significantly expanded and is now practiced in 188 countries, covering over 96 million hectare and managed by at least 4.5 million farmers (Indian Organic Market and Export Promotion Strategy, 2024, p. 23)

Market Size:

In FY 2023, the total Indian organic market is estimated to have been at INR 16,800 crore (~$2 billion), accounting for 1.4% of the global organic market in 2022 11.644 lakh crores ($142 billion). (Indian Organic Market and Export Promotion Strategy, 2024, p. 40)

The global organic food market size accounted for 19.68 lakh crores ($228.35 billion) in 2024 and is predicted to reach around INR 56.75 lakh crores ($658.38 billion) by 2034, growing at a CAGR of 11.17% from 2024 to 2034. (Organic Food Market Size, 2024)

In 2022, 96.4 million hectare was managed organically worldwide, representing only 2.0% of the total farmland. Australia had the maximum organic agricultural land, with an estimated 97% of this land being extensive grazing areas. India ranked second, followed by Argentina in the third place. The ten countries with the largest organic agricultural areas collectively managed 79.3 million hectare, accounting for 82% of the world's organic agricultural land. (Indian Organic Market and Export Promotion Strategy, 2024, p. 24)

Organic Agriculture in India:

India has two major certifications system for organic cultivation — National Programme for Organic Production (NPOP) and Participatory Guarantee System (PGS). As of FY 2023, the total area under organic cultivation in India (NPOP and PGS), including both organic and conversion areas, is approximately 6.4 million hectare. Of this, 84% is certified under NPOP, while 16% is certified under PGS. (Indian Organic Market and Export Promotion Strategy, 2024, p. 34)

The growth of organic agriculture in India can be categorised into three dimensions, each reflecting different motivations and adoption patterns among farmers:

- Traditional: Farmers in low/no-input zones who practice organic methods by default, often uncertified (e.g., 4.05 farmers of the North-Eastern Region of India out of 146 million farmers in India. (Indian Organic Market and Export Promotion Strategy, 2024, p. 26)

- Reactive organic farmers: Farmers shifting away from chemical-intensive practices due to soil degradation, rising costs, and health concerns; includes both certified and uncertified practitioners (4.2 out of 146 million farmers). (Indian Organic Market and Export Promotion Strategy, 2024, p. 26)

- Commercial organic farmers: Certified farmers and enterprises adopting organic farming as a business strategy to access premium domestic and export markets. These include NPOP farmers and part of PGS farmers (3.2 out of 146 million farmers) who want to sell organic certified produces at premium price to global and domestic market. (Indian Organic Market and Export Promotion Strategy, 2024, p. 26)

India ranks first in terms of the total number of producers and currently boasts the largest number of organic producers in the world at 2.3 million. However, this represents only 1.6% of the total 146 million farmers. Among these, 23,58,267 farmers cultivate organic crops within producer groups (organized group of farmers /producers who intend to produce organic products by the organic processes), while 5,340 of them operate independently. In addition to these producers, India has 1,489 processors (companies or units that take raw organic produce (grains, fruits, spices, oils, etc.) and process them into consumable or export-ready products), 627 organic traders (businesses that buy and sell certified organic products, acting as intermediaries between farmers, processors, and consumers), and 136 wild operators (enterprises/groups that harvest organic produce from natural habitats (forests, grasslands, aquatic ecosystems) rather than cultivated farms), including 36,009 wild collectors (individuals or community groups who harvest naturally occurring plants and forest produce under organic certification standards). (Indian Organic Market and Export Promotion Strategy, 2024, p. 29).

The number of organic producers increased by 55% from 2021 to 2022, as more farmers shifted to organic farming after the COVID-19 pandemic to capture the rising demand for organic foods from global and domestic consumers. (Indian Organic Market and Export Promotion Strategy, 2024, p. 30).

As of 2023-24, the area under organic certification (excluding wild harvest areas) is estimated at 4.5 million hectares, accounting for just 2.5% of the total agricultural land in the country. The top four states — Madhya Pradesh (26%), Maharashtra (22%), Gujarat (15%), and Rajasthan (13%) — together represent nearly 76% of the total organically cultivated area in India. (Indian Organic Market and Export Promotion Strategy, 2024, p. 28)

India produced around 3.55 million metric tonne of organic produce (including in conversion production but excluding wild harvest) during FY 2024, at a CAGR of 7% from FY 20-24, under NPOP certification system, which includes food categories such as cereals, pulses, millets, oil seeds, fruits, vegetables, sugar, dry fruits and processed foods, to name a few, and non- food categories such as fodder and fibre, to name a few. (Indian Organic Market and Export Promotion Strategy, 2024, p. 37)

Market Segmentation:

In FY23, the Indian organic market has been primarily driven by exports amounting to about INR 5,520 crore. The organized (branded) domestic organic market is estimated at INR 3,340 crore. Around INR 1,600 crore are attributed to exclusive retail stores, regional brands, and the unorganized segment. Consequently, an estimated INR 6,340 crore of organic produce is sold as conventional products, representing about ~38% of the total market size. (Indian Organic Market and Export Promotion Strategy, 2024, p. 41)

India’s domestic organised organic market, valued at Rs 3,340 crore ($400 million) in FY 23, is projected to clock CAGR of 13-15% and reach Rs 12,500 crore ($1.4 billion) by FY 33. Processed food products are projected to be the fastest-growing segment with a CAGR of 25%, followed by fresh fruits and vegetables at 18%, and dairy at 16%. (Indian Organic Market and Export Promotion Strategy, 2024, p. 61). Growth in the processed food category will be driven by items like breakfast cereals, ready-to-cook products, and ready- to-eat products. This trend is attributed to consumers' increasing preference for healthy and convenient foods, along with rising disposable incomes.

There is significant untapped potential in organizing the organic farming sector and redirecting produce to export channels or organized domestic markets. PGS certificates are not preferred by branded organic manufacturers, leading to weak market linkages and dependency on ICS groups - a quality assurance system used by smallholder groups to ensure they meet organic standards and can be certified as a group. This forces farmers to sell organically grown produce in the conventional market. Addressing these challenges could unlock additional value and contribute to the growth and sustainability of India's organic market.

Source: CRISIL estimate (Indian Organic Market and Export Promotion Strategy, 2024, p. 41)

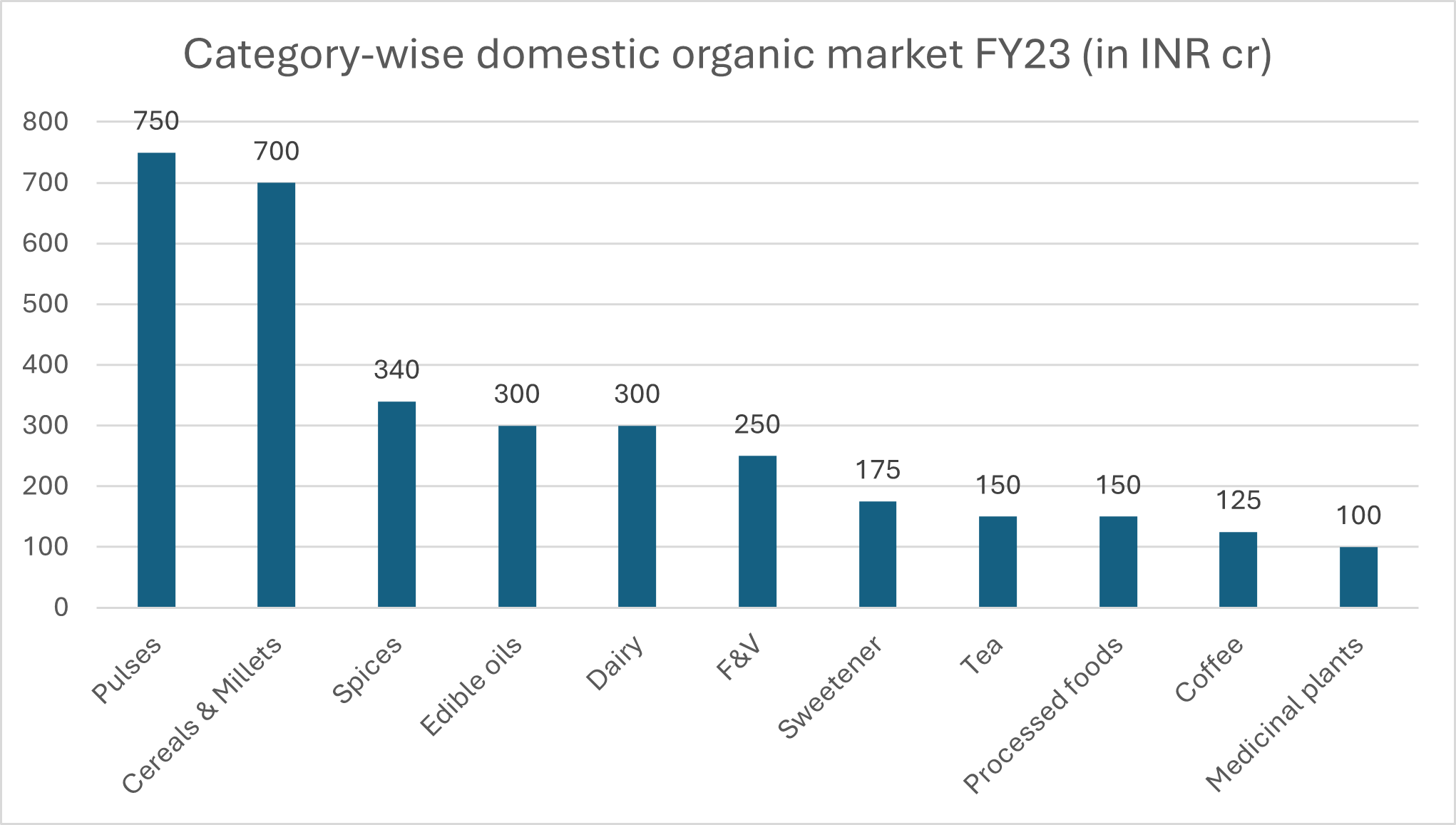

The Indian domestic organic market can be classified into various categories, including cereals and millets, pulses, spices, edible oils, sweeteners, tea, coffee, dairy products, fruits and vegetables, processed foods, and medicinal plant products (supplements).

Source: CRISIL estimate (Indian Organic Market and Export Promotion Strategy, 2024, p. 42)

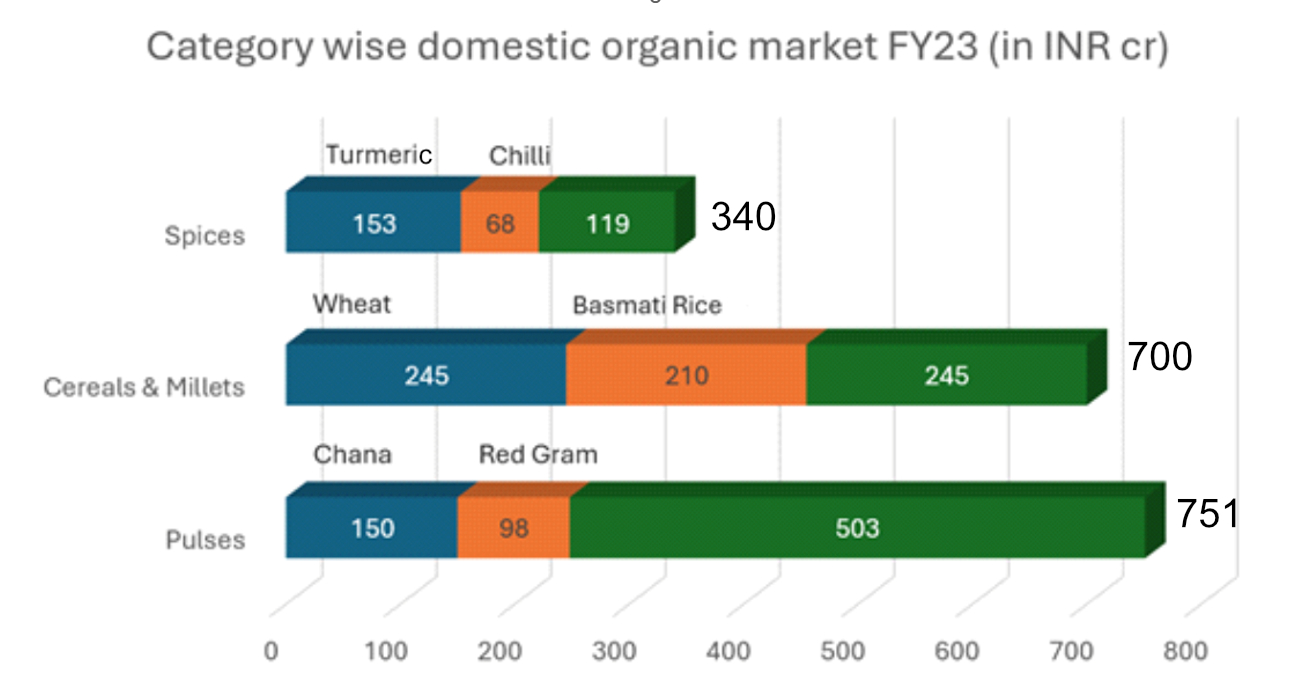

Source: CRISIL estimate (Indian Organic Market and Export Promotion Strategy, 2024, p. 43)

In the Indian organic market, organic pulses lead with a market value of INR 750 crore ($89.7 million), accounting for 22% of the total domestic market. India is the largest producer (26 million MT) and consumer of conventional pulses, which serve as a major protein source for the predominantly vegetarian population (43%). This trend extends to organic pulses, with over 90% of organic consumers purchasing them. From 2016 to 2020, the organic pulses category logged a CAGR of 20-25%, though growth has stabilized over the past two years following skyrocketing prices of conventional pulses. (Indian Organic Market and Export Promotion Strategy, 2024, p. 43)

Following closely, organic cereals and millets constitute the second-largest category, capturing 21% of the total domestic market share. Within this category, wheat atta has the highest share of 35% in the northern and eastern regions, while rice is predominant in the southern and western regions due to regional dietary preferences. Millets have experienced exponential growth of more than 25% annually, driven by increased post-pandemic consumption and government initiatives such as the 'International Year of Millets 2023'. (Indian Organic Market and Export Promotion Strategy, 2024, p. 43)

In the sweetener segment, products like jaggery and honey have grown at a CAGR of 15-20% in the past 3 years, with jaggery reaching sales of 5,000 MT annually in domestic markets. (Indian Organic Market and Export Promotion Strategy, 2024, p. 43)

In 2023, The southern region was the largest contributor to the domestic organic food products market revenue, with metro cities like Bengaluru, Chennai, and Hyderabad driving 35% of the market due to higher awareness and higher per capita income (INR 1.57 lakh). The northern region held a 30% market share, led by cities such as Delhi and Gurugram, which also have high per capita income levels (Rs 1.34 lakh). The western region contributed 25% to the market revenue, with significant demand from cities like Mumbai, Pune, and Ahmedabad. The eastern region accounted for a smaller share of 10%, with Kolkata and Bhubaneshwar leading the consumption. (Indian Organic Market and Export Promotion Strategy, 2024, p. 45)

Source: CRISIL estimate (Indian Organic Market and Export Promotion Strategy, 2024, p. 45)

Market Channels of Organic Products:

Organic foods and farm products are available through three main distribution channels: modern trade (MT), general trade (GT), and online platforms (e-commerce and quick commerce). In 2023, significant changes in food purchasing habits emerged due to post-Covid consumer behavior, increased e-commerce penetration, urbanization, and evolving preferences. Traditionally, most grocery purchases were made in-store, driven by factors such as the cost of delivery fees and perceived freshness of fruits and vegetables when personally selected. However, the expansion of the e-commerce industry, fuelled by deepening mobile internet penetration and increased smart device usage, has significantly boosted the online grocery market.

Currently, about 40% of the organic product sales occur through MT, 35% through GT and the balance 25% through online platforms. (Indian Organic Market and Export Promotion Strategy, 2024, p. 48)

The growth of the online grocery market is propelled by urbanisation and technological advancements in recent years, offering consumers the convenience of home delivery. The shift has pushed up the demand for organic products, making them more accessible to a broader audience. As a result, the online grocery market for organic products is growing strongly, reflecting a significant transformation in consumer buying behaviour.

Source: CRISIL estimate (Indian Organic Market and Export Promotion Strategy, 2024, p. 48)

Due to rising demand for organic products, e-commerce players like Amazon, Flipkart, and BigBasket have started sourcing directly from farmers, boosting turnover and farmers' income. Amazon and Flipkart have introduced 'Organic Store' categories, while BigBasket launched its own organic brand, BB Royal Organic. However, online sales of pulses and cereals are lower compared to spices, beverages, sweeteners, and fruits & vegetables, owing to their value- to-weight ratio, indicates that these items, being bulkier than their value, incur higher transportation costs and logistical challenges making them less attractive for online purchases. (Indian Organic Market and Export Promotion Strategy, 2024, p. 48)

Key Drivers of Domestic Demand:

India’s Organic Exports Market:

India's organic exports peaked at 8.9 lakh MT (INR 8,964 crores - $1.04 billion) in FY 2021 but declined to 2.6 lakh MT (INR 4,223 crores - $0.49 billion) by FY 2024, with a CAGR decline of 9% in volume and 0.2% in value from fiscals 2018 to 2024. Key factors include trade regulations, export bans on wheat and sugar, the US anti-dumping policy on Indian soymeal, and the withdrawal of the recognition agreement in 2021. These regulatory changes significantly impacted India's organic product exports. (Indian Organic Market and Export Promotion Strategy, 2024, pp. 88-91)

During FY 2020 to FY 2024, there has been a modest shift in the composition of India's organic exports, particularly in the balance between bulk and retail segments. In FY 2020, bulk exports dominated the market, accounting for 98-99% of the total exports, with retail products such as roasted cashew nut, canned/bottled fruits, medicinal plant capsules, tea bag cut, etc., constituted a mere 1-2%. During FY 2024, the retail segment grew at a moderate 5-7% of the total exports. (Indian Organic Market and Export Promotion Strategy, 2024, p. 88)

The key products include RTE products (ready to eat foods), wild and natural honey, seed oils, roasted cashew and cooked/roasted corn, among others. This shift highlights the growing consumer demand for packaged and RTE organic products, reflecting a broader trend towards convenience and direct consumer engagement in the global organic market. RTE food products have grown at 63% CAGR over the period. (Indian Organic Market and Export Promotion Strategy, 2024, p. 88)

Several leading Indian companies are expanding their organic product ranges and shifting export strategies, aiming to increase the retail segment of RTE and ready-to-cook items, cereals, mixes, snacks, superfoods, and medicinal products in major markets such as the US, EU and the Middle East. This is even as they currently focus on bulk exports of staples such as rice, pulses and oilseeds, with plans to increase consumer packaging by fiscal 2030. Middle East is the major focus for most of the companies.

The composition of India's retail organic exports is expected to rise to 12-15% by fiscal 2030. It will be driven by increasing global demand for RTE foods, snack items, health mixes, processed foods such as fruit juices, edible oils, wild honey, spices and medicinal plant products. This anticipated growth reflects significant shifts in consumer preferences towards convenient, health focused organic products. (Indian Organic Market and Export Promotion Strategy, 2024, p. 88)

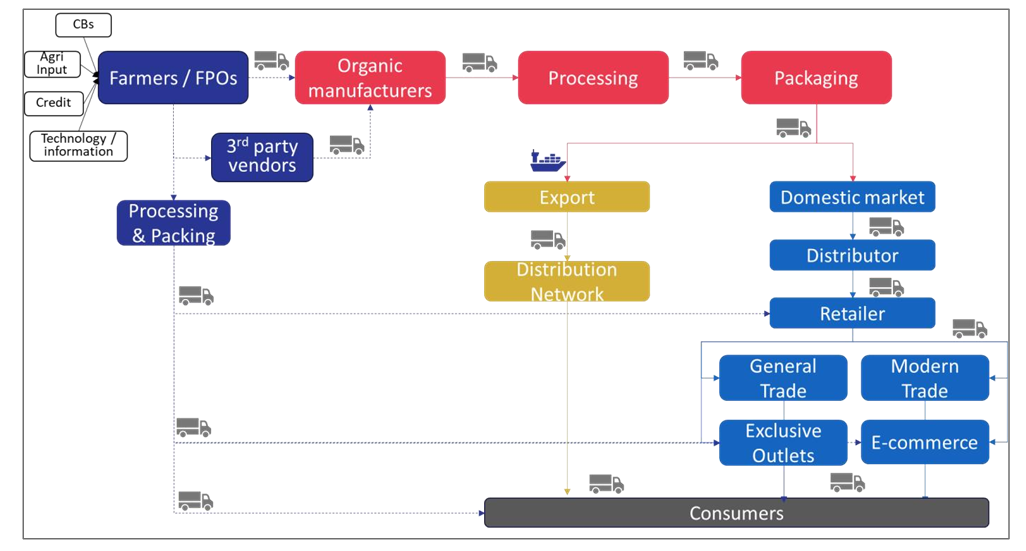

Value Chain:

Government Schemes:

The government has been promoting organic farming as a priority in the country since 2015-16 through the Paramparagat Krishi Vikas Yojana (PKVY) and Mission Organic Value Chain Development for North-Eastern Region (MOVCDNER). Both schemes emphasise end-to-end support to farmers engaged in organic farming — from production to processing, certification, post-harvest management and marketing. Training and capacity building are also an integral part of the schemes.

PKVY : The Paramparagat Krishi Vikas Yojana (PKVY) is implemented in a cluster mode with a minimum land size of 20 ha. States have been advised to implement the scheme in cluster sizes of 1,000 ha in plain areas and 500 ha in hilly areas to facilitate marketing of organic produce. While all farmers are eligible for the benefits, one farmer within a group can avail benefits for up to a maximum of 2 ha of land. Additionally, the assistance provided is capped at Rs. 50,000 per ha. Of this, 62% or Rs 31,000 is provisioned as incentive for organic conversion, inputs and production infrastructure, among other things, and is paid through the direct benefit transfer (DBT) during the conversion period of three years. (Indian Organic Market and Export Promotion Strategy, 2024, p. 102)

MOVCDNER : The Mission Organic Value Chain Development for North Eastern Region (MOVCDNER) scheme aims to develop commodity-specific, concentrated and certified organic production clusters in a value chain mode in the Northeast. It provisions linking growers with consumers and supporting the development of the entire value chain, starting from inputs, seeds and certification to the creation of facilities for collection, aggregation, processing, marketing and brand building. The scheme focuses on export of organic produce from the region.

Impact on Farmers:

- Farmers experienced 14–19% lower costs but also 12–18% lower yields compared to conventional farming. (Reddy et al., 2022)

- Profitability increased marginally (3–6%) depending on the crop. (Reddy et al., 2022)

- Rainfed and hilly farmers benefited more, as their baseline chemical input use was already low.

- Certification and marketing bottlenecks limited farmers’ ability to capture premium prices.

Impact on Soil:

Organic farming practices contribute positively to soil health, with measurable improvements in organic matter and carbon content. Increased application of farmyard manure and compost, 20 to 50 percent higher than conventional systems, enhances soil fertility and sustainability. These benefits are most pronounced in rainfed and hilly areas, where soils are naturally richer in organic matter. (Reddy et al., 2022)

Scientific studies confirm that organic management is a powerful remedial technology for India's degraded soils, significantly improving soil organic carbon (SOC) by as much as 33.3%, nutrient availability (N, P, K), and microbial biodiversity. This "living soil" provides greater resilience through improved water retention and porosity. (Panwar et al., 2022)

Impact on Consumer Health:

The rising demand for organic produce is largely driven by consumer concerns regarding chemical residues and food safety. Affluent consumers, in particular, demonstrate a willingness to pay premium prices for certified organic products, perceiving them as healthier and safer alternatives. This trend underscores the role of organic agriculture in addressing public health concerns associated with intensive chemical use.

For consumers, the primary benefit is not superior macronutrient content, which is largely non-significant, but a quantifiable reduction in public health risks. Conventional crops contain higher pesticide levels while organic crops contain "higher levels of phytochemicals"; compounds shown to have health-protective antioxidant and anti-inflammatory properties. Organic consumption is a proven method to avoid pesticide exposure, a significant concern given that 2.2% of conventional samples in India exceed legal MRLs. (Monitoring of pesticide reisdue in Food Products, 2019, p. 1)

Challenges:

- One of the primary challenges in India's organic agriculture sector is the limited availability of certified organic seed varieties. A lag in research and development for organic seeds that will be suitable of various ago climatic zones of India, identification of variety of seeds that will suit for export market to name a few are key challenges. Besides, the organic seeds varieties are often scarce in both the market and state seed corporations, further compounding the issue

- The transition from conventional to organic farming, known as the conversion period, presents multiple challenges. During this time, the yield and quality of marketable produce are often lower compared with conventional farming, leading to reduced prices and returns. Higher cultivation costs, and certification and inspection fees add to farmers’ financial cost. During this period, farmers cannot sell their produce as organic and thus miss out on premium prices, making the transition financially strenuous

- Farmers often do not have access to reliable information on market prices and demand for organic produce. Additionally, India lacks specific markets for the sale of organic produce, making it difficult for farmers to find appropriate channels to sell their goods. Improved market intelligence systems and the establishment of dedicated organic markets are essential to help farmers gain better market access and fetch fair prices for their produce

- Exporters face challenges with multiple certification systems (NPOP for export from India, EU for processed organic food, NOP for the USA, Organic JAS for Japan). Manufacturers often need to work with different certifying bodies, doubling the certification costs

- While most branded firms prefer NPOP certification, obtaining NPOP certification for seasonal crops is challenging and expensive for farmers.

- Regulatory decisions such as the US’ anti-dumping policy on Indian soymeal and the withdrawal of a recognition agreement by the US in 2021 had a substantial impact on India's organic product exports.

The Next Harvest: Future Outlook and Innovation:

The future trajectory of India's organic sector will be defined by the intersection of a robust government policy framework and the disruptive potential of AgriTech innovation. Together, these forces are positioned to solve the sector's most deep-seated structural challenges.

The Government of India's strategy is anchored by two flagship schemes: Paramparagat Krishi Vikas Yojana (PKVY) and Mission Organic Value Chain Development for North Eastern Region (MOVCDNER).

These policy frameworks extend beyond a conventional subsidy; it functions as a carefully structured de‑risking instrument. The three‑year funding cycle is deliberately calibrated to bridge the critical “valley of death” faced by farmers during the conversion period, when yields typically decline and the organic price premium cannot yet be legally applied. By directly subsidizing this transitional phase, the government ensures that farmers remain economically viable until the system stabilizes and profitability improves.

In addition, the policy explicitly tackles structural challenges such as sectoral fragmentation and weak market linkages, thereby addressing two of the most significant barriers to scaling organic agriculture.

AgriTech is emerging as the direct solution to the bottlenecks identified above. The future of Indian organic farming is not a back-to-nature movement; it is a high-tech, hybrid system that weds traditional organic principles with 21st-century technology.

- Solving the Input Gap: Sustainable inputs or biologicals are a key investment area. AgriTech startups are now scaling the production of the very bio-fertilizers and bio-pesticides that are in short supply.

- Solving the Yield Gap: AgriTech allows for precision organic farming. Innovations like soil sensors and satellite-based crop health analytics allow farmers to optimize natural inputs, enhancing soil fertility and moving beyond the low-yield paradigm.

- Solving the Market & Trust Gap: Blockchain-based traceability is being deployed to trace the origin of the food. This technology makes the supply chain transparent, proves organic integrity (combating fraud ), streamlines certification, and directly connects the farmer to the premium-paying consumer.

Top Companies in India

| Company Name | Product Portfolio |

Sresta Natural Bioproducts Pvt.Ltd |

Organic grains, pulses, spices, oils, sugar, snacks, and other food products |

24 Mantra Organics |

Spices, Sugar, Tea Flavours |

Organic India Pvt. Ltd. |

Tulsi Green Tea, Spices, Tea Flavours |

Organic Tattva |

Pulses, Millets, and Flour |

Nature Bio Foods Limited |

Organic rice, pulses, spices, grains, and other food products |

Nourish Organics Foods Pvt Ltd |

Snacks, breakfast cereals, cookies, and protein bars |

Phalada Pure & Sure |

Basmati Rice, Virgin Olive Oil, Himalayan Salt |

Suminter India Organics Private Limited |

Organic grains, pulses, spices, herbs, fruits, vegetables, dairy products, and meat |

Praakritik |

Fruits & veggies, rice & flour, ghee & oil, millet, sugar & salt, spices, superfoods |

Adya Organics |

Gir Cow A2 Milk, Honey, Almond Oil, Ghee, Jaggery Cookies |

Wellbefoods |

Breakfast Cereals, Snacks, Jams & Spreads, Foodgrains, oils & Masala, flours & Rava |

Organic Mandya |

Fresh Milk |

(Kumar, 2022) (Matur, 2023)

Private Equity and M&A Activity in the Indian Organic Industry

Year |

Acquirer |

Target |

Transaction Note |

Type |

2018 |

True Farm India |

Reliance Fresh |

True Fram India, a 100% Organic food company and is looking to raise 100cr to fund the commercial operations like expansion to roll out wide range of product offerings including sweetners, flours, nuts and superfoods. For which it has tied up with Reliance Fresh and other leading retail chains to achieve a turnover of 25 cr in the first year [1] |

PE |

2017 |

Sequoia Capital and CDC group |

Sresta Natural Bio Products |

Venture capital fund Sequoia Capital and UK government-owned CDC group are bidding jointly, around 70-80% stake in the Hyderabad-based company Sresta natural for nearly $100 million or Rs 680 crore, sources said[2] |

M&A |

2016 |

Sresta Natural Bioproducts Pvt. Ltd |

The Hyderabad-based firm, which sells the 24 Mantra brand of rice, pulses and oil among others, is in early talks with private equity funds and a deal is likely at ₹ 600-650 crore ($100 million)[4] |

PE | |

2013 |

Seaf and Sarona’s Capital Investment |

Khyati Foods |

Small Enterprise Assistance Funds (SEAF) and Canada-based private equity investor Sarona Asset Management have jointly invested INR 6.2Cr (US$750k) in Khyati Foods, an Indian organic cotton and soybean processor, for a minority stake[5] |

PE |

2022 |

Peepul Capital and Venture East |

24 Mantra |

24 Mantra has filed a DRHP with SEBI to launch an IPO, existing investors Peepal Capital and Venture East to sell 2.25million shares and 4.45million share respectively[6] |

PE |

2013 |

Fab India |

Organic India |

Fabindia has acquired a 40% stake in Organic India, a Lucknow-based organic food and supplements firm[7] |

MA |

2015 |

SIDBI Capital Venture |

Natureland Organics India |

Rajasthan based organic food producer and supplier Naturelands food organic pvt ltd has raised an undisclosed amount from SIDBI venture capital to ramp-up its operations and expand market presence[8] |

PE |

2022 |

Perfect Day |

Sterling Biotech |

Precision fermentation ingredient maker Perfect Day completed the acquisition of India’s Sterling Biotech Limited, the sixth-largest manufacturer of gelatin in the world.[10] According to Economic Times Perfect Day was the winning bidder for the company, which was sold at a bankruptcy auction for 638 crore rupees ($78.1 million)[9] |

M&A |

2021 |

LT Foods India |

Leev.nu |

LT Foods LTD an Indian rice milling company acquired 30% stake in Netherland based organic food specialty company Leev.nu, which offers a range of food products including breakfast bars and healthy snacks. This acquisition is to strengthen LT position in Netherlands[10] |

M&A |

[1] (Truefarm Foods to raise around Rs. 100 crore from private equity investors, 2018)- https://nuffoodsspectrum.in/2018/01/18/truefarm-foods-to- raise-around-rs-100-crore-from-private-equity- investors.html

[2] (Kurian, 2017)- https://timesofindia.indiatimes.com/business/india- business/sequoia-cdc-eye-organic-foods- brand/articleshow/56409841.cms

[3] (Saurabh, 2017)

https://forum.valuepickr.com/t/white-organic-agro-ltd-patanjali-and-organic- food-play/12761

[4] (Reghu Balakrishnan &, 2016), (Sresta Natural Bioproducts Ltd IPO, 2021)

https://www.5paisa.com/ipo/sresta-natural-bioproducts-ltd- ipo

[5] (SEAF, 2013)

https://www.seaf.com/seaf-fund-invests-in-organic-food-processor-khyati- foods/

[6] (Agarwal, 2022)

[7] (Chakravarty, 2013)

[8] (Gupta, 2015)

https://www.vccircle.com/organic-food-co-natureland-raises-funding-sidbis- samridhi-fund

[9] (Poinski, 2022)

https://www.fooddive.com/news/perfect-day-buys-sterling-biotech-limited- gelatin-india/637551/

Top global Listed Players

| Company Name | Data (in Crore INR) | Valuation | |||||

| EV | EBITDA(TTM) | EBIT(TTM) | Revenue (TTM) | EV/EBITDA (TTM) | EV/EBIT(TTM) | EV/Revenue (TTM) | |

Danone SA |

404.09 |

34.82 |

23.62 |

214.67 |

11.61x |

17.11x |

1.88x |

Dole PLC |

20.41 |

2.49 |

1.45 |

77.79 |

8.20x |

14.05x |

0.26x |

FMC Corporation |

88.46 |

7.63 |

7.63 |

41.34 |

11.59x |

11.59x |

2.14x |

The Hershey Company |

361.61 |

23.13 |

19.77 |

92.96 |

15.64x |

18.29x |

3.89x |

Herbalife |

29.74 |

4.38 |

3.44 |

41.88 |

6.78x |

8.64x |

0.71x |

Archer-Daniels-Midland Company (ADM) |

396.51 |

53.52 |

44.89 |

807.14 |

7.41x |

8.83x |

0.49x |

Mondelez International, Inc (Clif Bar & Company) |

950.29 |

60.35 |

50.44 |

294.86 |

15.75x |

18.84x |

3.22x |

| Industry Median | 11.59x | 14.05x | 1.88x |

**All values are as of December 2022

***Conversion Rate: 1 USD = 83.3 INR

References

Government, V. S. (2022, July 08). Organic Food. Retrieved from Better Health Channel: https://www.betterhealth.vic.gov.au/health/healthyliving/organic- food

Indian Organic Market and Export Promotion Strategy. (2024, August). Retrieved from APEDA: apeda.gov.in/sites/default/files/study_reports/Report_Indian_Organic_Market_and_Export_Promotion_Strategy.pdf

Organic Food Market Size. (2024, August 2024). Retrieved from Precendence Research: https://www.precedenceresearch.com/organic-food- market

Reddy, A.A., Melts, I., Mohan, G., Rani, C.R., Pawar, V., Singh, V., Choubey, M., Vashishtha, T., Suresh, A. and Bhattarai, M. (2022). Economic Impact of Organic Agriculture: Evidence from a Pan-India Survey. Sustainability, [online] 14(22), p.15057. https://www.mdpi.com/2071-1050/14/22/15057

Monitoring of pesticide reisdue in Food Products. (2019). Retrieved from FSSAI: https://www.fssai.gov.in/upload/advisories/2019/10/5da705b31ca78Letter_Report_Pesticides_MRL_16_10_2019.pdf

Panwar, A.S., Ansari, M.A., Ravisankar, N., Babu, S., Prusty, A.K., Ghasal, P.C., Choudhary, J., Shamim, M., Singh, R., Raghavendra, K.J., Dutta, D., Meena, A.L., Chauhan, G.V., Ansari, M.H., Singh, R., Aulakh, C.S., Singh, D.K. and Sharma, P.B. (2022). Effect of organic farming on the restoration of soil quality, ecosystem services, and productivity in rice–wheat agro-ecosystems. Frontiers in Environmental Science , 10. doi:https://doi.org/10.3389/fenvs.2022.972394. - https://www.frontiersin.org/journals/environmental- science/articles/10.3389/fenvs.2022.972394/full