Indian Spirits Market

The Indian spirits market includes whisky, rum, vodka, gin, brandy, and liqueurs. Unlike most consumer goods, alcohol is regulated at the state level, which makes every state and union territory in India an independent market. Alcohol is excluded from the Goods & Services Tax (GST) 1, and the State List grants states authority to legislate on matters related to the production, manufacture, possession, transport, purchase, and sale of intoxicating liquors 16.

Market Size

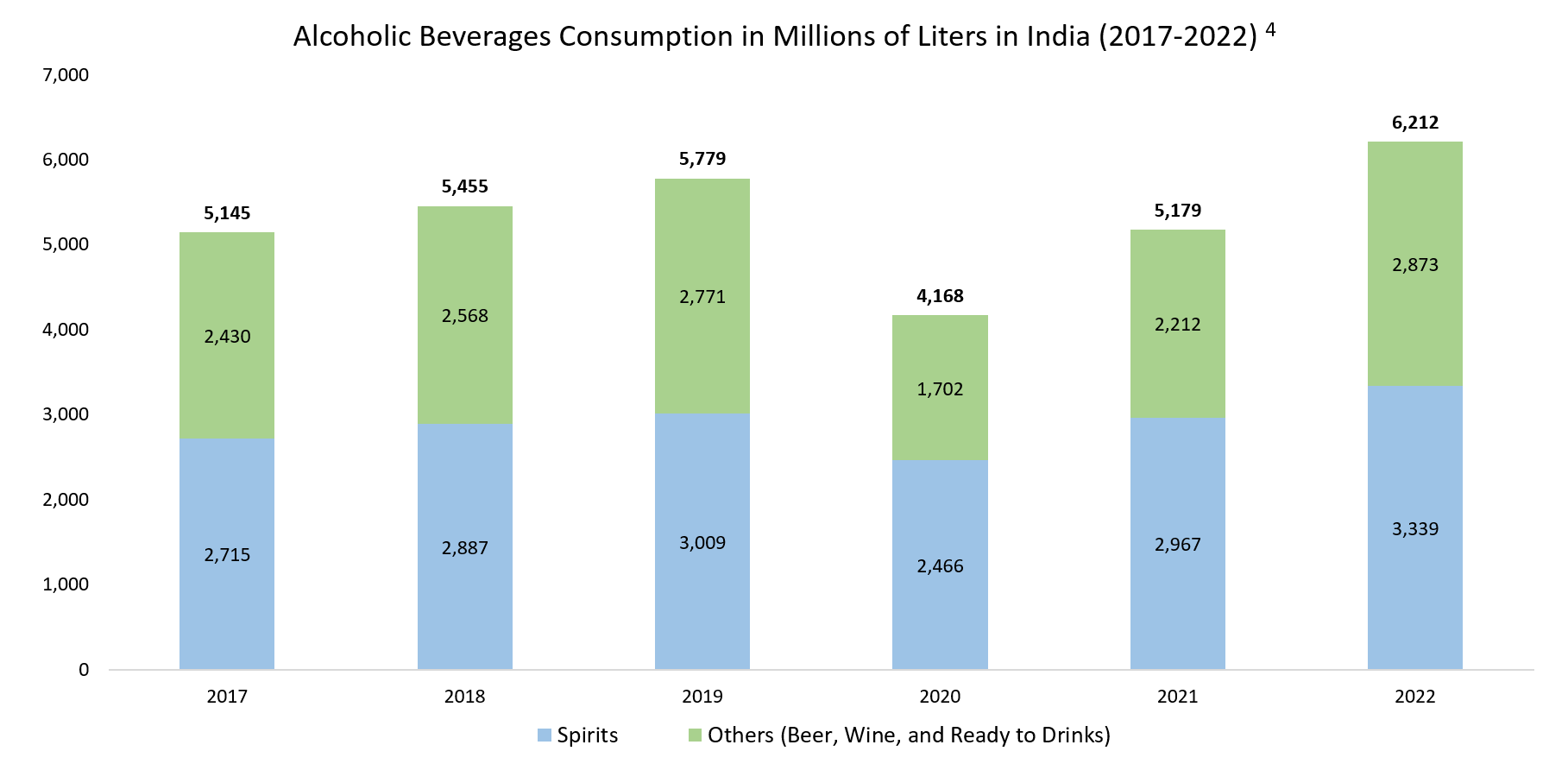

India is the world’s third-largest alcoholic beverage market. In FY24, total alcoholic beverage sales reached ₹3.9 lakh crore ($44 billion) 3. Spirits accounted for roughly 54% of this market (see chart below) in 2022 4, translating into a market size of ₹2.09 lakh crore ($23.65 billion).

Sales volumes have grown from 228 million cases in FY11 to 412 million cases in FY24. The sector saw a downturn during the Covid-19 pandemic but has since recovered. In FY21, sales were 311 million cases, compared to 330 million cases in FY18 2.

Market Segmentation

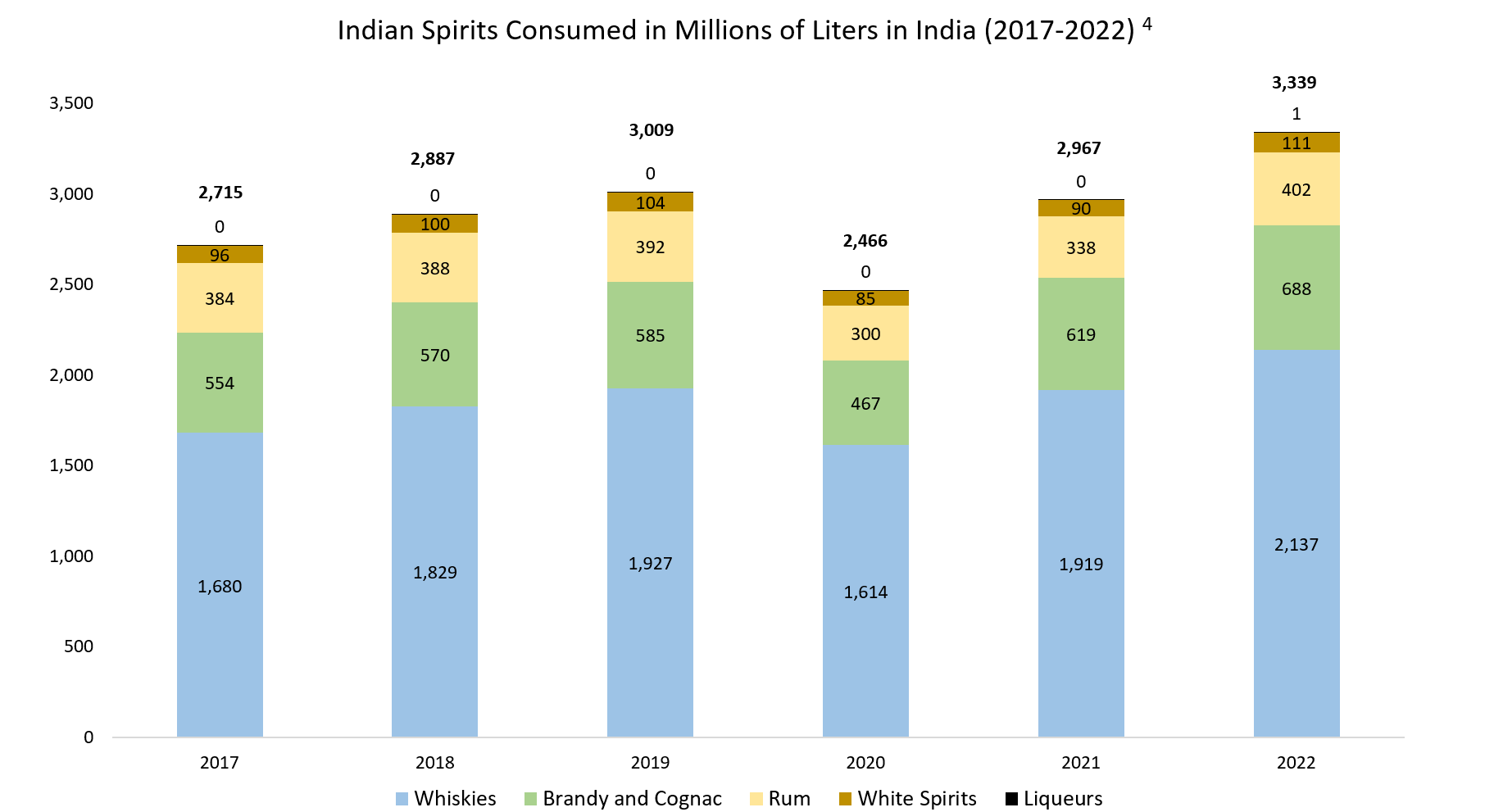

Whisky dominates the category, accounting for 64% of the spirits market in 2022. Brandy, rum, and white spirits (vodka and gin) also hold significant shares 4

Rum and white spirits are forecasted to outpace overall market growth, with 7.8% and 7.9% CAGR (2023–2027), respectively 4.

Value Chain

The value chain covers raw material procurement (grain, molasses), distillation, blending, bottling, state-controlled distribution, and retail.

Challenges

- State-level regulations: Every state has its own excise structure and trade rules, making nationwide consistency difficult. For instance, United Breweries suspended operations on January 8, 2025 in Telangana due to unfavorable conditions. The suspension of supply ended on January 21, 2025. 5

- Taxation: Spirits remain one of the most heavily taxed consumer categories.

- Illicit market: Unrecorded consumption continues to undermine formal players.

Market Channels

Retail (off-trade) dominates Indian spirits consumption, accounting for 84.7% of sales in 2022. On-trade channels (restaurants, bars, hotels) comprised 15.3%, but are projected to expand at 7.3% CAGR between 2023 and 2027, driven by urban lifestyle changes 4.

On trade means any alcohol that is sold in a trade establishment like a restaurant, or bar while off trade implies any alcohol sold in a retail store. This chart indicates that about 84.7% of the sales happen on retail counters across India, these can include alcohol retail shops, and hypermarkets.

Growth Drivers

- Rising Disposable Incomes:

- Per Capita: Gross National Disposable Income rose from ₹1,20,052 in 2012 to ₹1,97,676 in 2021, a growth of 64.7% 6.

- National: The total disposable income further increased to ₹296.38 lakh crore in 2023, from ₹273.36 lakh crore in 2022 (+8.5% YoY) 7. - Urbanization: India’s urban population grew by 2.27% in 2023, reaching 522.9 million 8.

- Cultural Shifts: Spirits are deeply embedded in social occasions, especially in urban India, sustaining long-term demand.

Premiumization & Market Segmentation Trend

Indian spirits landscape is witnessing clear premiumization. Rising disposable incomes, urban aspirations, and exposure to global brands are shifting consumption from mass-market IMFL toward premium and craft segments. Entry-level whiskies and rums continue to dominate volumes, but value growth is increasingly driven by premium and super-premium labels. Reflecting this shift, United Spirits Limited (USL) divested and franchised its popular mass brands such as Haywards and Old Tavern to Inbrew Beverages in 2022, focusing instead on its premium portfolio. This strategic pivot aims to enhance margins 17.

Key Players

The market is dominated by both multinationals and domestic producers:

- United Spirits (Diageo) – India’s largest producer with broad whisky, rum, and brandy portfolio.

- Pernod Ricard – Leader in premium whisky, with brands like Chivas Regal.

- Radico Khaitan – Maker of Magic Moments vodka and 8PM whisky.

- Allied Blenders & Distillers – Known for Officer’s Choice whisky.

- Amrut Distilleries – Pioneer of Indian single malts with international acclaim.

The Indian spirits market features a mix of multinational corporations and strong domestic players, segmented by production origin and brand ownership. Multinationals like Diageo, Pernod Ricard, and Rémy Cointreau are present in the premium and imported segments, while Indian firms such as Radico Khaitan, Tilaknagar, SOM, and United Spirits are present in domestic brands and Indian Made Foreign Liquor (IMFL), a category referring to spirits manufactured in India using imported or locally sourced ingredients, including whisky, rum, vodka, and brandy.

M&A and Private Equity Activity

- 2017 – U.S.-based Sazerac Company acquired a minority stake in John Distilleries (Original Choice, Paul John Single Malt), marking its entry into India 9.

- 2012–2014 – Diageo acquired a controlling stake in United Spirits Limited (USL) for ₹18,100 crore ($2.04bn), beginning with 10% in 2012 and culminating in majority control by 2014 10.

- 2006 – Radico Khaitan formed a joint venture with Diageo to produce and market IMFL; the partnership later evolved as Diageo built its own distribution 11.

- 2016–2021 – Bira 91 raised significant funding: ₹53.25 crore ($6M) from Sequoia (2016), ₹443.75 crore ($50M) from Sofina (2018), and ₹266.25 crore $30M from Kirin Holdings (2021) 12.

Key Listed Players

- United Spirits Limited (Diageo) – EV ₹1,09,000 crore ($12.28bn); Revenue ₹11,415 crore ($1.29 bn); EV/Revenue 9.52x; EV/EBITDA 54.53x 13.

- Radico Khaitan Limited – EV ₹15,000 crore ($1.69 bn); Revenue ₹2,500 crore ($0.28 bn); EV/Revenue 6.0x; EV/EBITDA 30.0x 14.

- Globus Spirits Limited – EV ₹2,000 crore ($0.23 bn); Revenue ₹1,600 crore ($0.18 bn); EV/Revenue 1.25x; EV/EBITDA 21.09x 15.

These multiples underscore the premium attached to strong brands and scale advantages in India’s spirits market.

Sources

- https://cleartax.in/s/taxation-liquor-related-products

- https://www.business-standard.com/industry/news/india-s-spirits-market-witnesses-remarkable-surge-what-s-behind-the-boom-124042700363_1.html

- https://www.fas.usda.gov/data/india-distilled-spirits-wine-and-beer-market-update-2024

- https://agriculture.canada.ca/en/international-trade/market-intelligence/reports/sector-trend-analysis-beer-wine-and-spirits-india "Spirits consumption is ~54% = 3,339/6,212"

-

https://www.rbi.org.in/Scripts/PublicationsView.aspx?id=21807

-

https://tradingeconomics.com/india/disposable-personal-income

-

https://www.macrotrends.net/global-metrics/countries/IND/india/urban-population

-

https://www.thespiritsbusiness.com/2017/10/sazerac-enters-indian-whisky-with-john-distilleries-deal/

-

https://www.livemint.com/Companies/yLTfKC5T6CeFKusNiu3v4O/Bira-eyeing-30-million-funding-from-private-equity-firms.html , https://timesofindia.indiatimes.com/venture-capital/bira-91-raises-rs-335-crore-by-belgian-fund-sofina/articleshow/64073851.cms

- https://www.shankariasparliament.com/current-affairs/states-jurisdiction-over-liquors

- https://brandequity.economictimes.indiatimes.com/news/business-of-brands/usl-completes-sale-franchising-of-its-popular-brands-to-inbrew-beverages/94576012

Currency Conversion as of October 3, 2025: 1 USD = 88.75 INR