Medical Software Company Investment Opportunity in Daytona Beach, USA

| Established | 5-10 year(s) |

| Employees | 10 - 50 |

| Legal Entity | C Corporation |

| Reported Sales | USD 200 thousand |

| Run Rate Sales | USD 240 thousand |

| EBITDA Margin | Nil |

| Industries | Medical Software + 1 more |

| Locations | Daytona Beach |

| Local Time | 4:50 PM US / Pacific |

| Listed By | Business Owner / Director |

| Status | Active |

Client Base:

- Over 50,000 clients have been served to date across the U. S. and Canada; post-M&A expansion will unlock thousands more through in-network clinics.

Revenue model:

- Hybrid B2C and B2B2C model with revenue from private pay, employer programs, and insurance reimbursements from major payers.

- Gross margins range from 30–80%, depending on service type and channel.

Post M&A, our top-selling services will be:

- Virtual therapy (CBT, trauma, couples)

Integrative wellness plans (mental, physical, nutritional)

- AI-powered care engagement tools.

- Post-session therapist support via in house chat app.

- Dietitian consults, ABA, PT/OT, and chronic care (scaling post-rollup)

Promoter/leadership experience:

- Led by a founder & CEO with 16+ years of experience in healthcare, technology, and startup growth.

- Supported by Kevin Harrington, an original Shark Tank investor, as strategic advisor and investor.

- Executive team with expertise in capital strategy, M&A, and scaling health-tech businesses to exit.

Business relationships:

- Strong payer contracts in place for scalable insurance reimbursement.

- Active partnerships with clinics, wellness providers, and therapist networks.

- Positioned to integrate with employer wellness programs and national health plans.

Recognition & momentum:

- Our company has grown organically and through strategic partnerships.

- Selected by top accelerators and recognized for innovation in virtual mental wellness.

- Rapidly expanding footprint across the U. S. and Canada.

Future outlook (Post-M&A & rollup strategy):

- Expansion via acquisition of in-network, profitable behavioral health clinics.

- Preparing for IPO in 18–24 months.

- Targeting 10x+ investor ROI with a 10-digit valuation.

- Positioned to lead a new category in hybrid, tech-powered wellness delivery.

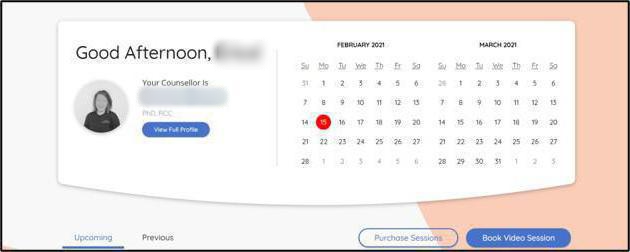

1. Online video therapy (pay-as-you-go/monthly subscription)

Monthly subscription plans:

2. Add-on app (EHR) for therapists.

3. Add-on app (self-help) for clients.

Post-M&A, our top offerings will include:

- Virtual therapy sessions (CBT, trauma, couples)

- Integrative wellness plans (mental, physical, nutritional)

- AI-driven care tools for personalization and engagement.

- Therapist-client progress tracking & post-session support (via our in house chat technology)

- Dietitian consultations for mental-physical health alignment.

- ABA therapy, PT/OT, and chronic care management (expanding post-rollup)

These services are used by individuals seeking accessible, personalized care and by clinics and therapists to boost outcomes and operational efficiency. Most services are reimbursable through insurance providers and large payers, enabling scalable, high-margin growth. As we scale, our company will define the next category of hybrid wellness delivery.

- Match-making software algorithm (IP)

- Integration of AI within our product suite.

- Digital mental health tools (IP)

- Unique systems and processes.

- Client psychological data to develop/create new products/services that compliments our long-term vision.

Primary operations are remote and cloud-based, enabling scalable, cost-efficient service delivery across the U. S. and Canada.

Corporate offices are based in Florida (Daytona Beach), with leased administrative space used for leadership and coordination.

Post-M&A, we will integrate with brick-and-mortar behavioral health clinics that typically include:

- 3,000–10,000 sq. ft. facilities.

- 1–2 floors with multiple therapy rooms.

- Long-term leases or owned premises, depending on the clinic.

- In-network payer relationships and compliant with all local health regulations.

- This hybrid model (post M&A) will allow us to combine virtual care with in-person services for enhanced engagement, outcomes, and insurance reimbursement.

Current funding:

- The company has been funded through a combination of founder capital, angel investors, and a seed equity round, with approximately USD 4M raised to date.

Outstanding debt:

- The company currently carries approximately USD 700K in debt on favorable, non-dilutive terms, used strategically to support growth initiatives, product development, and operational scaling.

Future capital strategy:

- As part of our roll-up and IPO roadmap, we are currently raising a nine-figure growth round through a blend of senior debt and institutional equity, targeting a 10-digit valuation and preparing for a public listing within 18–24 months.

Shareholders & ownership:

- The founder & CEO holds majority ownership with full voting rights, ensuring the ability to drive strategic decisions and long-term vision.

- Supported by high-conviction angel investors and strategic advisors, including Kevin Harrington, an original Shark from ABC’s Emmy-winning show Shark Tank.

- This founder-led, strategically backed structure enables is to scale aggressively through M&A while remaining aligned with long-term investor returns and public market readiness.

-

Earlier than 15 daysProduct Manager, Bio-pharmaceutical Solutions, Croydon, Individual Investor / Buyer connected with the Business

-

Earlier than 15 daysDirector, IT, Hyderabad, Corporate Investor / Buyer connected with the Business