Australian Supermarket, Grocery and Online Grocery Industry

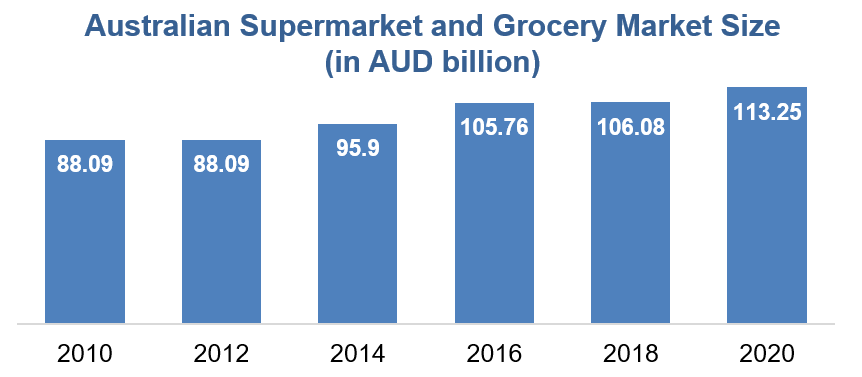

The Australian supermarket and grocery industry was valued at AUD 113 billion in 2020, witnessing a growth of 4.6% during 2019-2020. The market is projected to grow at an annualized rate of 2.6%, reaching approximately AUD 129.6 billion by 2025-26. This growth has been driven by a combination of structural shifts in consumer behavior, COVID-19 induced changes in retail patterns, and broader macroeconomic trends.

The industry consists of both large-scale supermarket chains and smaller independent grocery stores. With food retail being an essential service, the sector maintained stability through the pandemic, adapting rapidly to shifts in demand and delivery models.

Market Drivers

-

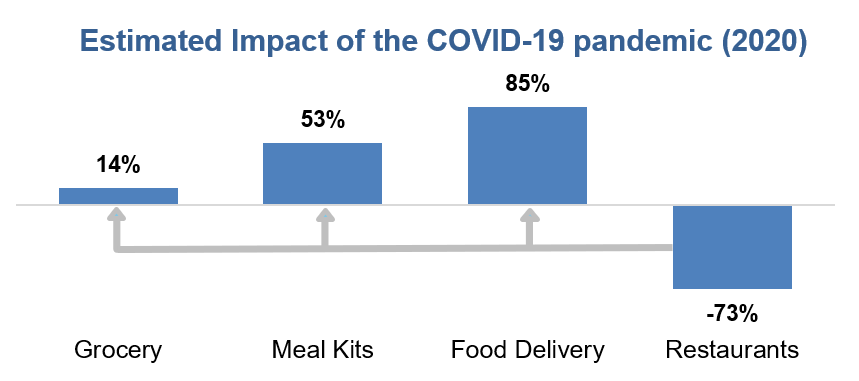

Pandemic-led Consumption Shift

Lockdowns and COVID-19 restrictions forced traditional brick-and-mortar shoppers to turn to online channels and neighborhood stores. This shift significantly benefited independent and specialty grocery outlets, which saw increased footfall due to proximity and convenience. -

Changing Household Behavior

As restaurants temporarily shut down and remote work became the norm, Australians increased their in-home food consumption. Panic buying and hoarding at the start of the pandemic gave way to steady, recurring purchases focused on pantry staples and daily essentials. -

Consumer Sentiment and Economic Pressure

With household discretionary income declining by 3.1% in 2020-21, more consumers turned towards value-based purchasing, opting for home cooking over dining out. The economic uncertainty also influenced shopping behaviors across income groups.

Consumer Segmentation

As the economy stabilizes post-COVID, two major consumer segments are emerging:

-

Insulated Consumers

Typically higher-income households who are more likely to spend on discretionary grocery items, meal kits, and premium branded products. These consumers prefer convenience and are willing to pay more for ready-made or high-quality offerings. -

Constrained Consumers

Impacted by falling income levels, these consumers are more price-sensitive. They increasingly rely on private label products, affordable staples, and cheaper meal preparation methods. Sustainability and cost-effectiveness are key drivers for this segment

Online Grocery Industry

The online grocery market in Australia experienced explosive growth due to the pandemic, valued at AUD 5.8 billion in 2020, up 56% from the previous year. It is projected to grow at a CAGR of 10.1%, reaching AUD 9.8 billion by 2025—outpacing the broader grocery sector and the overall economy.

Key developments include:

-

Click-and-Collect and Drive-Through Pickups

Many players have integrated hybrid models, allowing online orders with in- store pickup, effectively reducing last-mile delivery costs. -

Last-Mile Delivery Innovations

Retailers are partnering with third-party logistics and courier services to ensure faster deliveries and improved customer experience. -

Meal Kits and Convenience Offerings

Rising demand for meal kits has prompted online grocery providers to expand their offerings, particularly to serve insulated consumers prioritizing convenience.

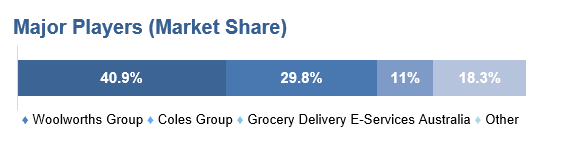

Business Models and Competitive Landscape

The industry comprises a mix of:

-

Bricks-and-Mortar Giants

Supermarket chains with significant online operations benefit from economies of scale, extensive inventory, and broad price ranges that cater to multiple consumer segments. -

Online-Only Retailers

These digital-first players focus on premium products and niche categories, offering curated experiences, especially in health and organic segments. -

Hybrid Clicks-and-Mortar Models

Emerging as the most sustainable format, combining the reach of physical stores with the efficiency of online shopping.

Future Outlook

The supermarket and grocery sector in Australia is expected to:

- Continue its digital evolution as consumer preferences increasingly shift towards online and omnichannel shopping.

- See further consolidation and partnerships between traditional grocers and tech-enabled logistics or last-mile companies.

- Experience growing pressure on profit margins for value retailers catering to constrained consumers, while premium grocery players may see higher margins from affluent and convenience-seeking buyers.

Despite macroeconomic challenges, the sector remains resilient, underpinned by essential consumption, rapid innovation, and diversified consumer needs.