Global Car Carrier Industry

The car carrier industry is a sub-segment of the broader Finished Vehicle Logistics (FVL) sector, responsible for transporting fully built vehicles from OEM factories, ports, and auction yards to dealerships, fleet buyers, and end- customers. Transport spans domestic, regional, and international routes, often requiring multimodal solutions. Car carrier operations span road (open/enclosed trucks), rail (auto racks), and sea (Ro-Ro vessels), each supporting different legs of finished vehicle transport.

The finished vehicle logistics market is valued at BGN 249.1 billion (EUR 127.76 billion) in 2024 and projected to reach BGN 363.1 billion (EUR 186.24 billion) by 2033, growing at a CAGR of 4.26%. 1

The industry serves OEMs, distributors, dealerships, fleet operators, and used-car platforms. It is shaped by stringent emission norms, Euro 6/7 standards, and growing EV-specific transport guidelines accelerating investment in compliant and enclosed fleet infrastructure.

Key Demand Drivers:

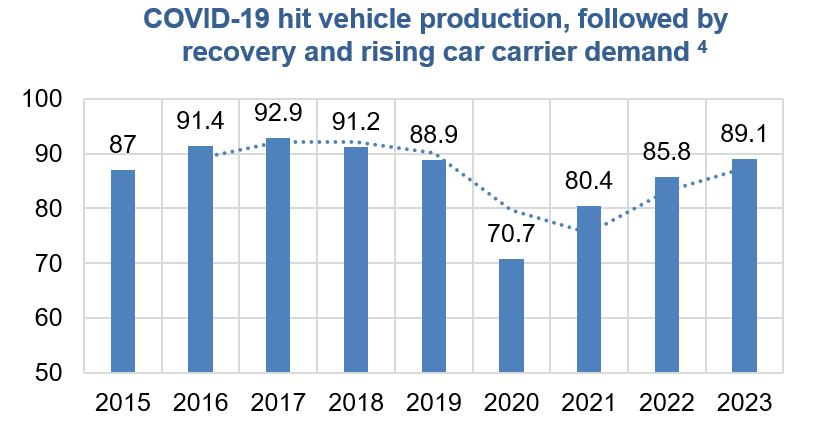

- Global auto sales grew 1.7% YoY to 89.6 million units in 2024, according to S&P Global Mobility 2

- Battery electric and plug-in hybrid vehicles (BEVs/PHEVs) made up 15.2% of new EU registrations in Q1 2025, increasing demand for enclosed and temperature-controlled carriers 3

- Used-Car E-Commerce: AUTO1 posted EUR 6.3 billion in 2024 revenue, fueling long-haul cross-border moves from Western to Southeast Europe

Car Carrier Industry: Asia & Europe Regional Analysis

Cross-Border Transport Overview (Europe-Asia):

Asia-Pacific

- The Asia-Pacific Finished Vehicle Logistics Market is valued at approximately BGN 112.9 billion (EUR 57.92 billion) in 2024 and is projected to grow to BGN 150.1 billion (EUR 76.93 billion) by 2030 6

- This growth is driven by rising automotive manufacturing, increasing vehicle exports, and the adoption of multimodal transport solutions

- The region has experienced strong momentum, fueled by surging vehicle production and exports across key markets such as China, India, and Japan

- China leads the region, producing over 28 million vehicles and exporting an estimated 7.5 million units as of mid‑2024 7

Europe

- Electric car market: In the first quarter of 2025, new battery-electric car sales grew by 23.9%, to 412,997 units, capturing 15.2% of total EU market share 8

- The European finished‑vehicle logistics market was valued at approximately BGN 110.06 billion (EUR 59 billion) in 2024 and is forecast to grow to around BGN 185.13 (EUR 94 billion) by 2030, at a CAGR of ~8 % 9

- Europe reached over 1 million public EV charging points by Q1 2025, supporting long-haul battery-electric logistics and EV-compatible routing

Car Carrier Industry: Bulgaria Deep Dive

Bulgaria's Role

- Bulgaria plays a critical role in cross-border car transport due to its strategic location along the EU–Turkey–Caucasus corridor and its position as a key entry point into Europe

- Its proximity to major border crossings enables fast vehicle movement between Western Europe, Turkey, and Central Asia

- The country’s growing automotive market, dominated by used vehicle imports and supported by increasing EV adoption, continues to fuel demand for international car logistics. Bulgaria’s ongoing investment in road infrastructure and its expanding fleet base make it an essential hub for cross-border vehicle flows between Europe and Asia

Factors Helping the Growth

- Rising Vehicle Fleet & Import Volume: Bulgaria recorded around 302,000 car registrations in 2023, with projections estimating a rise to 453,000 units by 2028 reflecting a 6.3% average annual growth rate. This continued surge in registrations highlights growing demand for international transport, particularly for used and imported vehicles 10

- Strategic Transit Advantage: Bulgaria’s geographic position at the EU-Asia gateway makes it a critical land route for vehicle flows between Western Europe and regions like Turkey and the Caucasus. High-volume corridors such as the Kapitan Andreevo crossing support Bulgaria’s status as a key logistics node for cross-border automotive transport

- Infrastructure Modernization Initiatives: Ongoing investments in Bulgaria’s transport infrastructure including highway and customs corridor upgrades aim to reduce delays and improve cost-efficiency. Backed by national and EU funding, these enhancements are improving the reliability of vehicle delivery across borders

- Shifting to EV Logistics: Bulgaria’s EV stock rose by 53.5% in 2024, reaching 19,020 units, largely due to used EV and hybrid imports. This shift is reshaping cargo requirements, pushing logistics providers to adapt to battery-safe transport, charging infrastructure, and tailored cross-border handling protocols 11

Porter’s Five Forces for the Car Carrier Industry

Threat of New Entrants – Low

The industry demands significant capital investment in fleet acquisition, workshop infrastructure, and compliance systems. Strict EU regulations on emissions, safety, and cross-border documentation further discourage new players

Threat of Substitutes – Low

While rail can move vehicles over long distances, it often lacks flexibility,

speed, and the door-to-door service required by carmakers.

Air and sea freight are either uneconomical or impractical for inland and

just-in-time deliveries, limiting substitution threats

Bargaining Power of Customers – High

Large OEMs and leasing companies command strong negotiating power due to their scale and ability to multi-source. Contracts are typically volume-driven and price-sensitive, with high expectations on service quality, tracking, and turnaround times

Bargaining Power of Suppliers – Low

Truck OEMs and trailer manufacturers offer some differentiation, but Ruven and peers can choose from multiple suppliers. Fuel remains a major cost, but pricing is market-driven and hedging can reduce volatility. Tech platforms and maintenance vendors offer flexibility

Existing Competitive Rivalry – Medium

While the European car carrier market is fragmented, many players operate in defined niches or differentiate through fleet size, route specialization, or value-added services (e.g., PDI, secure storage). Players like Girteka and Waberer’s lead with scale, but others compete through tailored logistics solutions and tech-enabled dispatch. This reduces direct overlap and tempers rivalry despite the high number of operators

Transaction Comparables (in BGN million)

| Date | Target | Acquirer / Investor | Target Description | EV | EV/Revenue | EV/EBITDA |

Nov-24 |

DB Schenker 12 |

DSV |

Global logistics provider offering a wide range of services including freight forwarding, contract logistics, and supply chain management. |

28,028 |

0.55x |

5.31x |

Jul-24 |

Gram Car Carriers 13 |

MSC Mediterranean |

Global car shipper with a fleet of distribution vessels, mid-size vessels, and Panamax vessels. |

1,161 |

3.10x |

3.90x |

Aug-24 |

Sese 14 |

Undisclosed Investor |

Operator of a transport and logistics company intended to serve automotive, consumption, technology, and commercial industries. |

82 |

0.42x |

0.97x |

| Median | 0.5x | 3.9x |

Trading Comparables (In BGN million, As on 12th August 2025)

| Company | Enterprise Value (EV) 6 | Revenue (TTM) | EBITDA (TTM) | EV / Revenue | EV / EBITDA |

Wallenius Wilhelmsen ASA 15 |

9,219 |

8,988 |

3,328 |

1.03x |

2.77x |

Bremer Lagerhaus-Gesellschaft - Aktiengesellschaft von 1877 16 |

1,287 |

2,393 |

390 |

0.54x |

3.30x |

| Median | 0.8x | 3.0x |

Sources:

- Finished Vehicles Logistics Market Size

- 2025 Auto Sales Forecast

- New car EV registrations

- Global Light Vehicle Production – PDF page number 14

- Global Automobile Production by Region – Table 2

- APAC Finished Vehicle Logistics Market Valuation

- Asia Pacific Finished Vehicle Logistics Market Size

- EU New car registrations

- Europe automotive logistics market, 2018-2030 (US$M)

- Bulgaria Light Vehicle Industry Outlook

- Bulgaria: Total EV stock grew by 53,5% in 2024

- DSV Acquires DB Schenker and DB Schenker Financials 2024

- MSC Mediterranean Shipping Company Acquires Gram Car Carriers

- Sese Acquisition and Sese Financials

- Wallenius Wilhelmsen ASA

- Bremer Lagerhaus-Gesellschaft - Aktiengesellschaft von 1877

Notes:

1 EUR = 1.96 BGN as of August 15, 2025

1 USD = 1.68 BGN as of August 15, 2025

1 NOK = 0.16 BGN as of August 15, 2025