Global Oil & Gas Industry

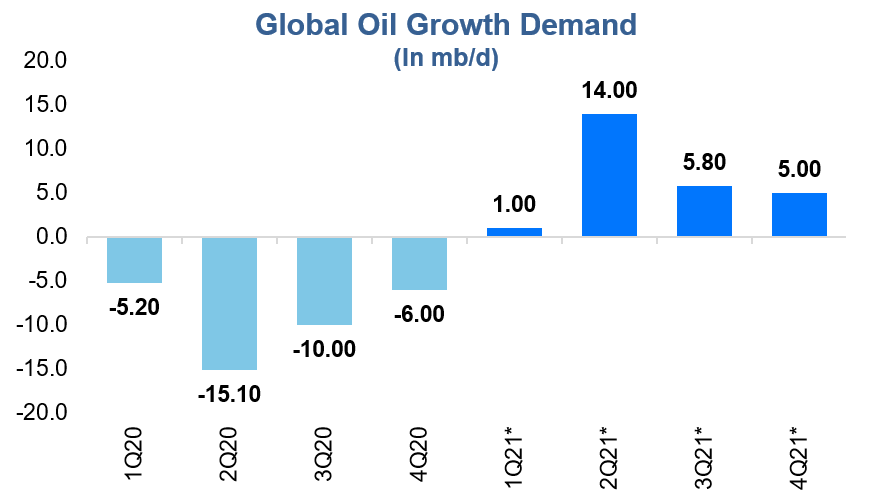

The global oil and gas industry was severely impacted by the COVID-19 pandemic in 2020, with demand falling sharply due to widespread lockdowns, reduced mobility, and a slowdown in industrial activity. Total oil demand averaged 90.4 million barrels per day (mb/d) during the year, a drop of 9.6 mb/d year-on-year.

The most affected sectors were transportation and aviation, which together account for nearly 50% of global oil consumption. These segments saw disproportionate declines as international travel halted and road traffic dropped.

Recovery and Growth Outlook

A gradual recovery began in 2021, with demand projected to rise by 5.9 mb/d to reach 96.3 mb/d. However, experts predicted that it would take two to four years for global oil demand to return to pre-pandemic (2019) levels, depending largely on GDP recovery across major economies.

Demand recovery is anticipated to be strongest in the second half of 2021, driven by:

- Partial revival in transport fuel usage

- Increased demand for petrochemical products

- Economic reopening and stimulus-driven industrial activity

OECD Market Trends

In the OECD region, oil demand was expected to grow by 2.6 mb/d, reaching 44.6 mb/d in 2021. This recovery was supported by:

- A stronger-than-expected economic rebound

- High vaccination coverage leading to easing of restrictions

- Renewed demand for industrial and mobility-related fuels

The demand trajectory in developed markets has become closely tied to public health and macroeconomic indicators.

Long-Term Implications

Although a rebound in demand was projected, the crisis has accelerated discussions around long-term transitions away from fossil fuels. The oil and gas sector may continue to see increased volatility, and long-term structural changes in energy consumption patterns could challenge traditional growth forecasts.

Demand in emerging markets and the role of petrochemicals will be key determinants of the industry’s long-term stability.

Slovakian Service Station Industry

The Slovakian service station industry consists of fuel filling stations and associated forecourt retail outlets selling convenience products. Fuel pricing in Slovakia is heavily influenced by taxation, which forms a substantial 7% of the country’s total national income, highlighting the government’s financial reliance on fossil fuel usage. As of 2019, the country had 910 service stations.

Market Composition

- Slovnaft is the market leader, operating 253 stations and controlling a 28% share.

- Independent operators represent around 51% of the market and typically use discount-driven models to attract customers.

- Multinational brands such as Shell, OMV, MOL, and ORLEN account for a combined 21% share and focus heavily on revenue from non-fuel sales like food, beverages, and automotive products.

Consumer and Vehicle Trends

Slovakia has seen a consistent rise in vehicle ownership, with the motorization rate increasing from 376 to 439 passenger cars per 1,000 inhabitants between 2015 and 2019. As of 2019:

- There were 2.39 million passenger vehicles

- 97% of these ran on petrol or diesel

The high share of traditional fuel vehicles underscores the continued importance of conventional service stations.

Future Outlook

Customer preferences are shifting toward greater convenience, safety, and speed. This has led to a growing demand for unmanned petrol stations, fully automated outlets that offer faster and more secure transactions.

This evolution could significantly reshape the retail fuel landscape in Slovakia, providing both cost efficiency and customer convenience while reducing labor dependency.