Global Smoking Accessories and Cannabis Industry

Overview of Global Smoking Accessories Market

Market Size: Valued at USD 64.4 billion in 2021.1

Growth: Expected to expand at a CAGR of 4.0% from 2022 to 2030.1

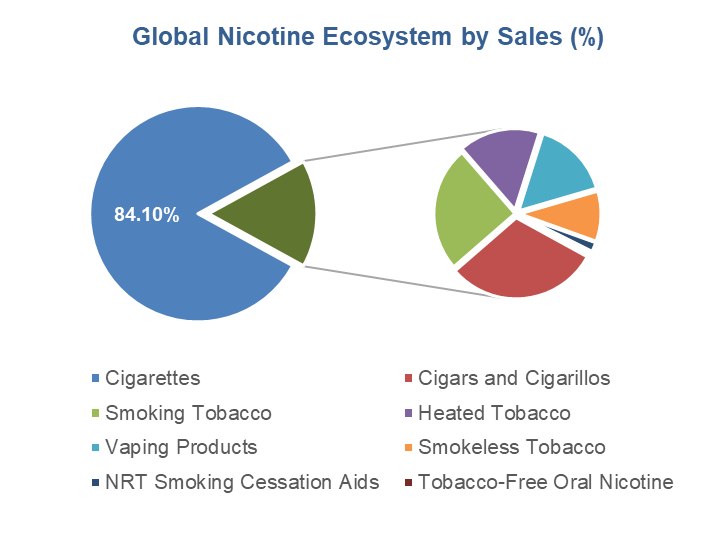

Source: SmokeFreeWorld, 20212

Trends and Developments

Shift in Consumption: The global tobacco market is undergoing a significant shift in consumption trends, most notably away from cigarettes due to consumer demand for safer non-smoking products

Tobacco-Free Oral Nicotine: The emergence of a new category, tobacco-free oral nicotine, is one of the notable developments in the global nicotine ecosystem in recent years.

Waterpipes and Vaporizers: High usage and demand of waterpipes and vaporizers due to their property of portability and ability of filtration is contributing to market growth. Flavored tobacco products are frequently used in conjunction with accessories like vaporizers and waterpipes, resulting in a significant demand for such equipment.

Market Drivers

Online Retail Platforms: Major driver as most smoking accessories companies have their own web-based retail stores providing access to product information, reviews, and pricing.

Product and Distribution Analysis

Based on product type, the smoking accessories market is bifurcated into grinders, water pipes, rolling paper, vaporizers, and others.

Product Types -

Water Pipes: Major market share in 2020.3

Grinders: Projected to grow at the highest CAGR until 2030.3

Distribution Channels -

Offline Segment: The offline segment led the smoking accessories market with over 75% revenue share in 2021 and is expected to remain dominant. This is due to the high reach and accessibility of offline channels, especially in crowded areas. Consumers prefer buying from offline stores for immediate purchase and instant demand fulfillment, as well as the considerable discounts offered.1

Online Platforms: The online segment is projected to grow at the fastest CAGR of 4.4% from 2022 to 2030 in the smoking accessories market. This growth is driven by the rising popularity and use of online shopping portals, especially among young consumers. The increase in app-based sellers and the wide range of products, discounts, and offers available online further contribute to this segment's expansion.1

Cannabis Industry in Europe

Legal Status and Market Overview

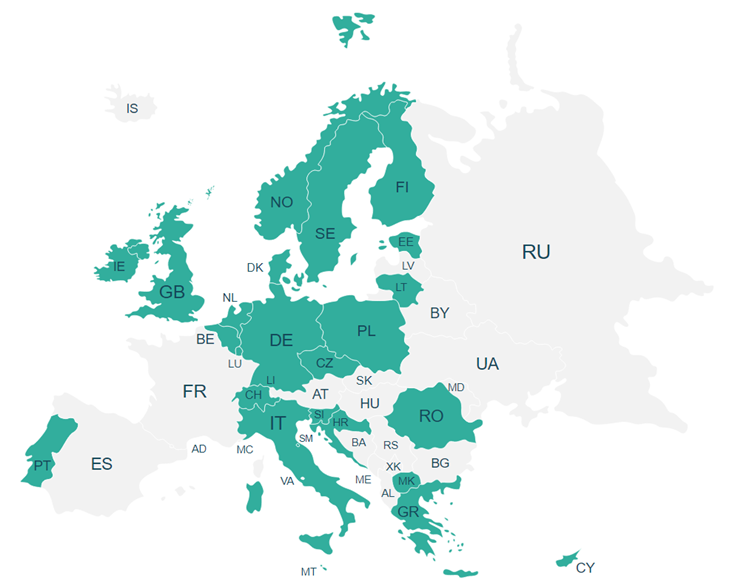

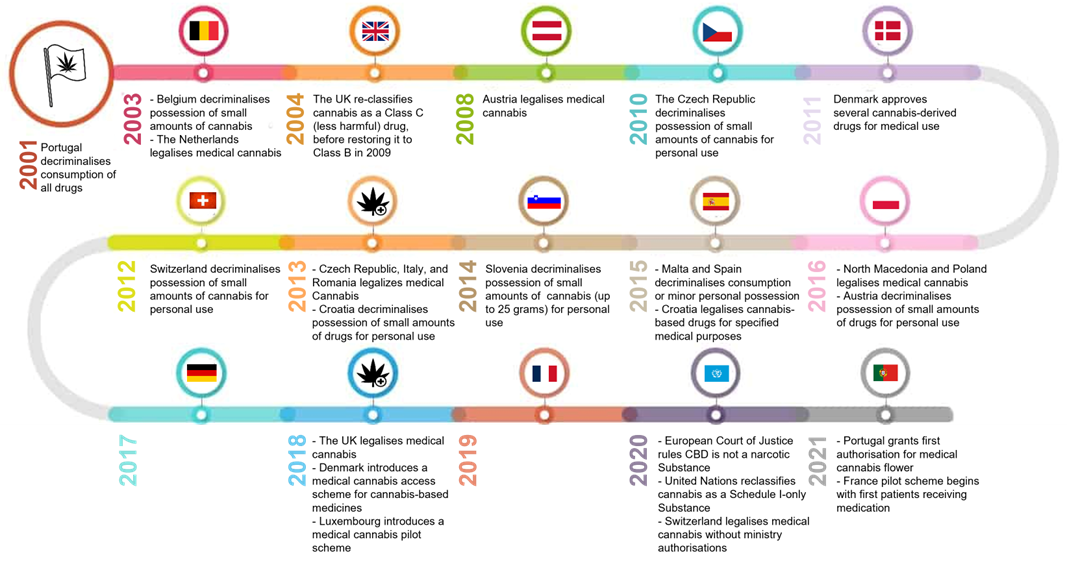

Legal Status: The legal status of cannabis use varies across the EU. Each EU Member State decides how to deal with drug use offences, whether by criminal or administrative measures.

The majority of European countries have legalized medical marijuana in recent years and a growing number of countries have decriminalized possession of small amounts of cannabis, transforming marijuana laws in Europe so that criminal penalties are largely a thing of the past.

Where cannabis is legal in Europe

Source: Cannigma, 20235

Medical Marijuana: The majority of European countries have legalized it; a growing number have decriminalized possession of small amounts.

Germany: Largest cannabis market in Europe with over 120,000 patients; medical cannabis expenditure is €500/month per patient. Plans to legalize adult-use cannabis, allowing purchase and home cultivation.4,6

Netherlands: Dual approach; major producer of medical cannabis and tolerates recreational use in coffee shops.

Spain: Personal use and cultivation decriminalized; selling and trading remain criminal offenses. Cannabis clubs provide private access.

Sweden: Recreational cannabis is illegal; medical use is highly restricted, with limited licenses and availability.

Key Insights

The global smoking accessories market is poised for steady growth, driven by shifts in consumption trends and demand for modern products like vaporizers and waterpipes.

The European cannabis market is rapidly evolving with varying legal frameworks, significant market potential in countries like Germany, and a trend towards decriminalization and legalization.

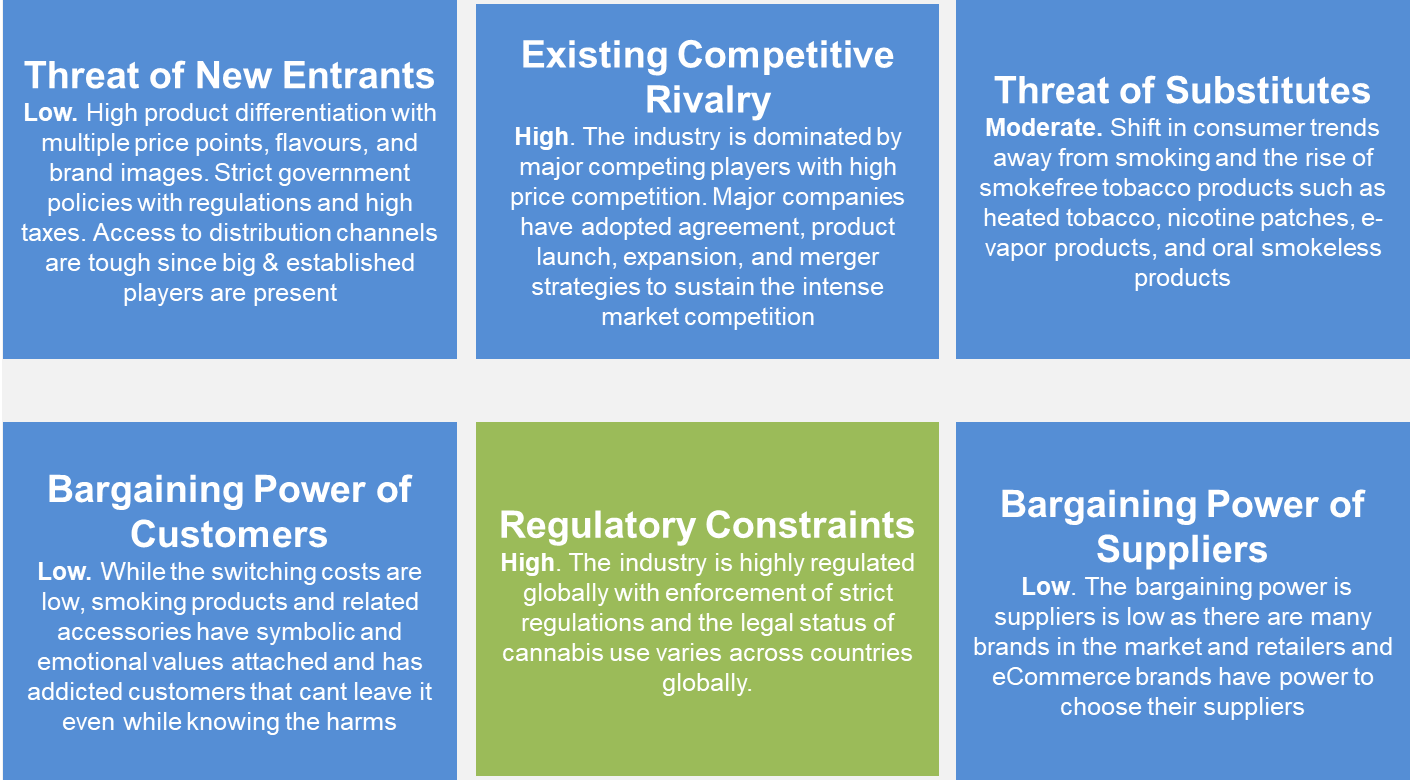

Porter's Five Forces

Threat of New Entrants - Low

High product differentiation with multiple price points, flavours, and brand images. Strict government policies with regulations and high taxes. Access to distribution channels are tough since big & established players are present.

Existing Competitive Rivalry - High

The industry is dominated by major competing players with a high price competition. Major companies have adopted agreement, product launch, expansion, and merger strategies to sustain the intense market competition.

Threat of Substitutes - Moderate

Shift in consumer trends away from smoking and the rise of smokefree tobacco products such as heated tobacco, nicotine patches, e-vapor products, and oral smokeless products.

Bargaining Power of Customers - Low

While the switching costs are low, smoking products and related accessories have symbolic and emotional values attached and have addicted customers who can't leave them even while knowing the harm.

Regulatory Constraints - High

The industry is highly regulated globally with enforcement of strict regulations and the legal status of cannabis use varies across countries globally.

Bargaining Power of Suppliers - Low

The bargaining power is suppliers is low as there are many brands in the market and retailers and eCommerce brands have power to choose their suppliers.

References

1. Smoking Accessories Market Size & Share Report, 2022-2030

2. Global Trends in Nicotine Report December 2021

3. Smoking Accessories Market Expected to Hit $6.3 Billion by 2030

4. Prohibition Partners - The European Cannabis Report 6th Edition.pdf (hubspotusercontent-eu1.net)

5. Where Is Weed Legal in Europe? 2023 Updated European Marijuana Laws (cannigma.com)

6. Germany to introduce bill to legalize possession and sale of cannabis (cnbc.com)