Indian AYUSH and Ayurveda Industry

Overview

AYUSH stands for Ayurveda, Yoga and Naturopathy, Unani, Siddha, Sowa-Rigpa, and Homoeopathy. The AYUSH industry has experienced significant growth in recent years.

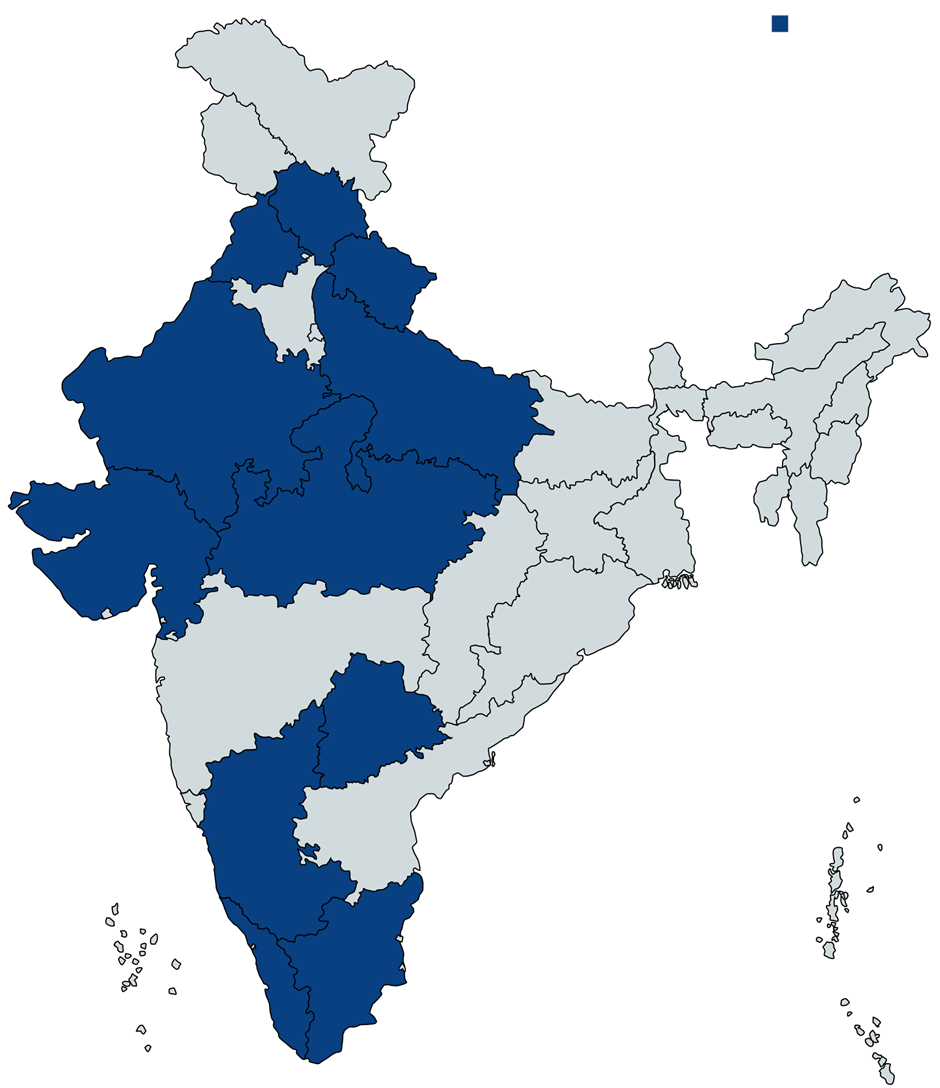

North-West and South Indian states are the leading AYUSH manufacturing states (Marked in blue)

Source: Ministry of Ayush 1

Industry Growth

Manufacturing Sector: Reached INR 1.5 lakh crores (US$ 18 billion) in 2020 and INR 2 lakh crores (US$ 24 billion) by 2024.4

Service Sector: Valued at INR 2.16 lakh crores (US$ 26 billion) in 2024.4

Total Industry Worth: Over INR 4.1 lakh crores (US$ 50 billion) in 2024, projected to reach INR 5.8 lakh crores (US$ 70 billion) by 2025, with an estimated CAGR of ~17% from 2024 to 2032.4

Ayurvedic Products Market

Market Size: Within the Ayush industry, the Indian ayurvedic products market size reached INR 74,850 crores (US$ 8.95 billion) in 2023. 3

Future Projections: Expected to reach INR 3.2 lakh crores (US$ 38.28 billion) by 2032, with a CAGR of 17% during 2024-2032. 3

Key Players: Himalaya, Dabur, Patanjali, Baidyanath, and Zandu. 7

Impact of COVID-19

The COVID-19 pandemic has significantly heightened the demand for Ayurvedic products with naturally sourced ingredients to enhance immunity and lower the risk of infections. This reflects a global trend driven by the rising prevalence of obesity and chronic health issues.

The Confederation of Indian Industry (CII) reported a 15% growth in India's Ayurvedic beauty and wellness market in 2020, as consumers become more aware of the health and environmental risks associated with synthetic chemicals in personal care products. 5

Market Segments

Healthcare Products: Including nutraceuticals, dietary supplements, and Ayurvedic medicines, hold a larger market share compared to personal care products such as skincare, oral care, and hair care.

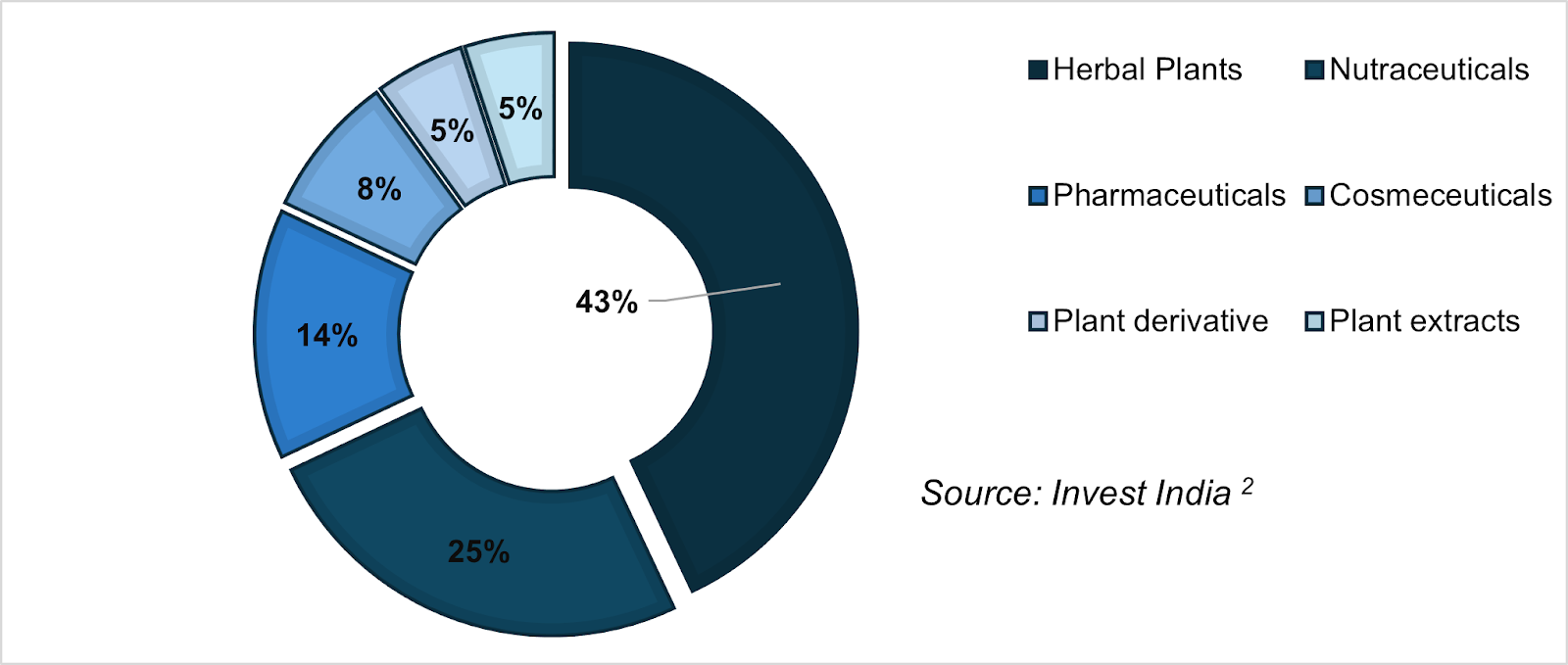

Herbal Plants and Nutraceuticals: Hold the largest revenue share under product categorization in the entire AYUSH industry (2020).3

Herbal plants and Nutraceuticals hold the largest revenue share under product categorization in the entire AYUSH industry (2020)

Source: Invest India 2

Consumer Trends

Ayurvedic Beauty and Wellness Market: Reported a 15% growth in 2020.

Consumer Willingness: A Nielsen survey revealed that 77% of urban Indian consumers are willing to pay a premium for natural or herbal personal care products.5

Global Reliance: The World Health Organization notes that 70-80% of the global population relies on non-conventional medicines, primarily herbal sources, for healthcare.6

Government Initiatives - AYUSH

The Ministry of AYUSH has been actively promoting the industry through various initiatives and policies.

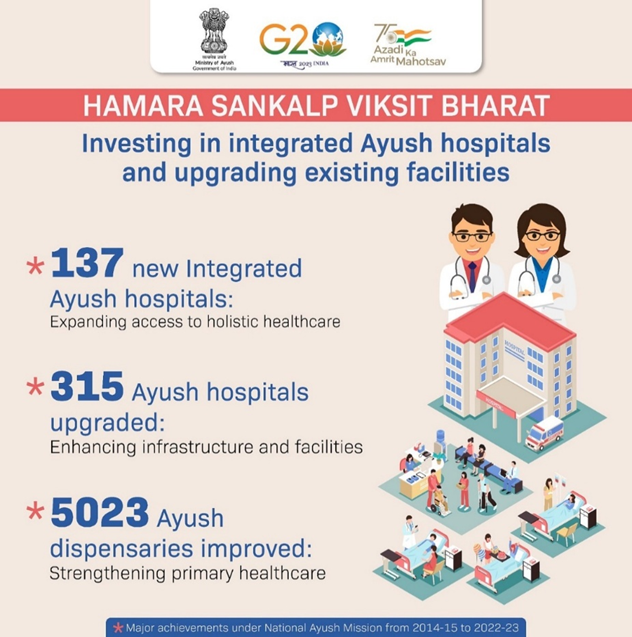

The National AYUSH Mission (NAM), launched in 2014, is a centrally funded program aimed at enhancing AYUSH services nationwide.

Increased Government Spending: The total allocation of budget to Ayush Ministry has increased by 20% to INR 3,647 Cr. Budget allocation to centrally sponsored National Ayush Mission (NAM) has got a 50% increase in allocation from INR 800 cr to INR 1,200 cr.8

The Ministry of Ayush signed a Memorandum of Understanding (MoU) with the Ministry of Micro, Small & Medium Enterprises (MSME) for the promotion of Ayush enterprises. As per the latest data from the Ministry of MSME, Udyam Portal, the number of MSMEs in Ayush has grown up from 38,216 in August, 2021 to 53,023 in January, 2023.1

As part of EoDB and reducing compliance burden, the government has allowed 100% Foreign Direct Investment in Ayush sector through an automatic route and the drug license for setting up manufacturing for ASU drugs is made swift, paperless and more transparent by bringing the application system online through E-Aushadhi.1

Source: Ministry of Ayush 9

Porter’s 5 Forces Analysis

Threat of New Entrants - Medium

The industry has lower regulatory barriers compared to allopathic pharma and establishing credibility, trust, and compliance with existing regulations can be challenging. Established players benefit from economies of scale, which can be a barrier to new entrants.

Existing Competitive Rivalry - High

The market is fragmented with numerous players, leading to high competition. Rapid market growth offers opportunities, but also intensifies competition as players vie for market share.

Continuous innovation and aggressive marketing efforts by companies further heighten rivalry.

Bargaining Power of Customers - Medium

Increasing awareness and demand for natural health products.

There is a mix of price-sensitive and quality-conscious consumers, leading to medium customer power.

Bargaining Power of Suppliers - Low

The industry relies on a diverse range of natural ingredients, which can be sourced from multiple suppliers, reducing the power of any single supplier. While high-quality suppliers can command better prices, the overall supplier power remains low due to the availability of multiple sources.

Threat of Substitutes - Medium

Other traditional systems like Unani, Siddha, and Homeopathy pose a significant threat.

Conventional allopathic medicines are strong substitutes, particularly for consumers seeking quick, scientifically-backed remedies. Growing preference for natural treatments moderates the threat to some extent.

References

1. Ayush manufacturing industry grows six times in seven years: Ministry of Ayush

2. Investment Opportunities in Ayush - Invest India

3. India Ayurvedic Products Market Size, Share and Forecast 2024-2032

4. India's Ayush Industry & National AYUSH Mission | IBEF

5. Ayurveda personal care: Indians are shifting from chemical based to herbal products

6. Ayurvedic research and methodology: Present status and future strategies - PMC

7. Ayurvedic Industry Analysis: Key Players and Strategies in the Ayurvedic Market

8. Investment Opportunities in Ayush - Invest India

9. Ministry of Ayush on X

-

To acquire or invest in Alternative Medicine and Alternative Medicine Facility businesses, visit SMERGERS