Malaysian Playschool Industry

Overview

Malaysia’s private education market is expected to reach a market value of RM 19 billion by 2026, driven by the rise of private schools. The private school market is projected to grow at a CAGR of about 5.6% between 2021-2026. 1,4

Curriculum and Enrollment

National Preschool Curriculum : Kindergartens must adhere to this curriculum, which includes play, thematic, integrated approach, and IT communication. It mandates 2 weekly hours dedicated to Malay language and Islamic education or moral education.

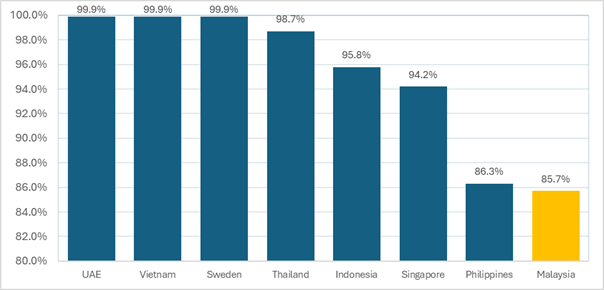

Malaysia Education Blueprint (2013-2025) : Aimed to achieve universal preschool enrollment by 2020, but fell short due to lack of availability and affordability. Enrollment rates increased from 67% in 2009 to 84% in 2020, but still lag behind regional peers. 2

While these efforts have led to increasing enrolment rates from about 67% in 2009 to about 84% in 2020, Malaysia still lags behind enrollment rates in comparison to its regional peers. 2

Malaysia’s preschool enrollment rate is low compared to high-income countries

and regional peers (2019)

Enrollment Trends

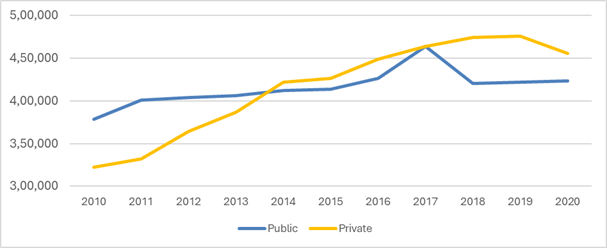

Private Playschool Enrollment : Has outpaced public playschool rates since 2014. Public playschool enrollment fell from 54% in 2010 to 48% by 2020. 3

Playschool enrolment rates in Malaysia

In 2020, for the first time in ten years, there was a decline in the number of students enrolling in private institutions. This trend suggests a temporary decreased preference for private preschools that charge fees, coupled with a growing interest in public preschools that are free or offer significant subsidies, particularly during the pandemic period

Parental Preferences : Parents believe an enrolment in private playschools lead to an improved quality of the facilities and an enhanced pupil-student ratio thus leading to an increase in private playschool enrolments.

Importance of Early Education

Neuroscientific Research : Neuroscientific research shows the critical impact of early childhood experiences on brain development, underscoring the importance of quality preschool education.

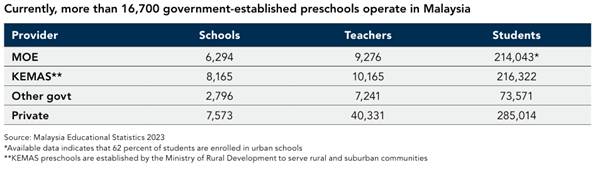

Current Landscape

Number of Schools : As of 2023, Malaysia has about 16,700 government- established preschools and 9,100 privately run playschools. However, around 25% of privately run playschools shuttered during the COVID-19 pandemic and never reopened. 5 p68

This is not enough to meet demand however, as around 25% of Malaysia’s privately run playschools had shuttered in 2020-21 due to the COVID pandemic and never reopened for business.6

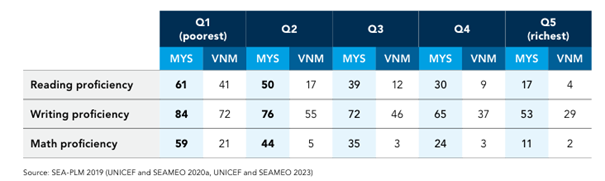

Educational Performance : By the time a child in Malaysia is 15 years old, he/she is far behind in reading, science, and mathematics as measured by PISA, compared to Malaysia’s aspirational peers, such as Hong Kong SAR, China, Japan, and Singapore. This child is also performing below his/her peer in Vietnam, which spends a fraction of what Malaysia spends on education.

A larger percentage of children from the bottom two quintiles lack proficiency in reading, writing, and mathematics at the end of Grade 5

Expenditure and Growth Potential

Expenditure on Pre-Primary Education : In 2017, Malaysia spent 0.15% of GDP on pre-primary education, significantly lower than the OECD-recommended 1%. There is substantial room for growth and improvement in the sector. 5p66

World Bank report concludes that in addition to the government’s ongoing efforts, Malaysia needs to double down in certain areas including improving access to early education for bigger impact.

Porter’s 5 Forces Analysis

Threat of New Entrants - Medium

The school industry in general is highly incentivised by the Malaysian Government and private schools are expected to grow at a CAGR of 5.6% between 2021-26 due to an increased preference for such schools among Malaysians which could lead to an increase of new schools in the region.

Existing Competitive Rivalry - Medium

The private play school market in Malaysia is highly fragmented with most private schools having just one branch. Due to this, schools try their best to capture significant market share leading to fierce rivalry among players in the market.

Threat of Substitutes - Low

Education from a school is a fundamental need for humans to function on a daily basis; it helps to structure thinking and make informed decisions. Substitutes could include methods like home schooling but, this does not lead to the same positive impact that an offline school might have over a child and their future.

Bargaining Power of Customers - Medium

Since the competition between private play schools is very high in the market and given that government preschools are free of cost customers can decide to switch to other alternatives given a rise in fees for the playschool.

Bargaining Power of Suppliers - Low

The playschool industry would look to procure study material and furniture both of which have stable prices and hence the bargaining power for suppliers is pretty low.

Trading Comparables

| Trading Comparables | |||||

| (In MYR, As on 17th July 2024) | Enterprise Value (EV) | Revenue (TTM) | EBITDA (TTM) | EV / Revenue | EV / EBITDA |

| Company | |||||

REAL Schools (Part of Paramount Corporation Berhad)7 |

1,36,00,00,000 |

99,03,03,000 |

15,58,05,000 |

1.4x |

8.7x |

Overseas Education Limited 8 |

51,94,19,943 |

28,63,80,629 |

4,11,05,952 |

1.8x |

12.6x |

SISB Public Company Limited 9 |

4,02,96,27,705 |

26,30,46,211 |

12,19,74,029 |

15.3x |

33.0x |

| Median | 1.8x | 12.6x |

References

1. Malaysia Private K12 Education Market

2. Shaping First Steps: A Comprehensive Review of Preschool Education in Malaysia (worldbank.org)

3. Can M'sia's goal of enrolling every child in preschool be achieved? | The Star

4. Private-Higher-Education-in-Malaysia-Avoiding-a-Hidden-crisis.pdf (penanginstitute.org)

5. World Bank Report - Improving Early Education Essential to Improve Skills in Malaysia

7. Paramount Corporation Berhad (1724.KL) Valuation Measures & Financial Statistics

8. Overseas Education Limited (RQ1.SI) valuation measures and financial statistics

9. SISB Public Company Limited (SISB.BK) Income Statement - Yahoo Finance