Singapore Construction Industry

The construction industry in Singapore plays a pivotal role in national development, driven by government-led infrastructure and residential projects. Traditionally, it has maintained a balanced mix of public and private sector demand, supported by a skilled migrant workforce and stable policy environment. However, the sector’s progress encountered an unexpected setback in 2020 due to the COVID-19 pandemic.

Market Size

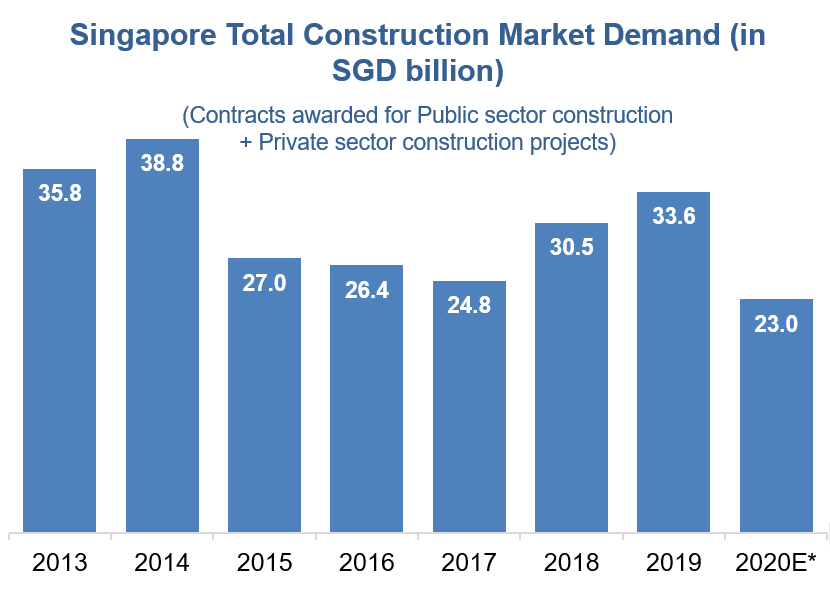

In 2019, Singapore's total construction demand reached SGD 33.6 billion, showcasing steady growth. Prior to the pandemic, the Building and Construction Authority (BCA) projected demand to fall between SGD 18 billion and SGD 23 billion in 2020, anticipating moderate momentum. This dip in projections highlighted caution due to emerging uncertainties even before the pandemic’s full impact was realized.

COVID-19 Impact

The onset of the pandemic brought Singapore’s construction activities to a complete halt during a two-month circuit-breaker lockdown, a period of strict movement control. As a result:

- 58% of all projects were paused, the highest share globally, with the global average at just 25%

- Major public sector projects were delayed , including infrastructure and housing developments

- The overall construction sector contracted by 33.7% in 2020, among the steepest contractions in Southeast Asia

Labor & Operational Challenges

A major challenge for the industry stemmed from its heavy reliance on migrant labor. With COVID-19 clusters emerging in worker dormitories, construction firms faced unprecedented labor shortages and logistical hurdles. Worker dormitory lockdowns, health risks, and strict regulatory measures brought many projects to a standstill. The situation underscored the vulnerabilities of labor-dependent industries during health crises.

Recovery & Growth Outlook

Despite the short-term disruption, the BCA and industry stakeholders remain optimistic about recovery:

- Recovery is expected to be led by public residential developments, upgrading projects, and new healthcare facilities

- Strategic infrastructure projects will serve as key growth levers in revitalizing the industry

- Continued government investment and progressive labor reform will likely reshape operational resilience and reduce over-dependence on migrant workers

The industry’s revival hinges on a mix of public investment, digital transformation, and labor force stabilization, paving the way for a more resilient and efficient construction ecosystem in Singapore.

Global Vertical Farming Industry

Vertical farming has emerged as a promising solution to the global food supply challenge. By enabling year-round crop production with minimal dependency on natural weather conditions, it offers a sustainable, scalable alternative to traditional agriculture. The industry leverages hydroponics, LED lighting, and climate control technologies to maximize yields in limited spaces.

Market Size

The global vertical farming industry was valued at USD 2.9 billion in 2020, and is projected to reach USD 7.3 billion by 2025, growing at a CAGR of 20.2%. This robust growth is driven by rising food demand in urban areas, resource efficiency, and increasing interest in self-reliant agricultural systems.

Growth Drivers

- Higher yield per unit area compared to conventional farming methods

- Technological advancements in LED lighting and climate management

- Year-round production capability, regardless of external weather patterns

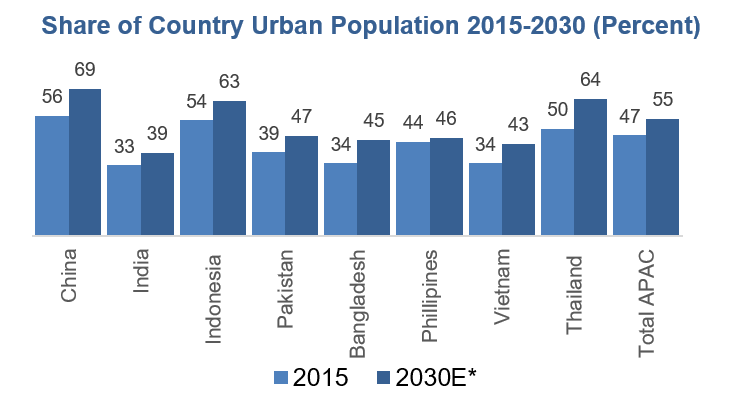

- Urbanization, increasing population density, and food security concerns

- Carbon neutrality goals, with vertical farms offering localized, low-emission production

Asia Pacific Outlook

Asia Pacific was the largest market in 2019, and is projected to reach USD 2.9 billion by 2025, growing at an even faster CAGR of 23.2%. The region's growth is supported by:

- Strong investments from international agri-tech companies

- Government initiatives aimed at food security and sustainability

- Rapid urban growth driving demand for localized food production

Focus on Singapore

Singapore presents a compelling case for vertical farming adoption:

- Has less than 0.8% arable land and produces under 10% of its food needs

- Faces high dependency on food imports and vulnerability in global supply chains

- Sees vertical farming as a strategic solution to reduce food transport wastage, enhance self-sufficiency, and utilize limited land with maximum resource efficiency

The COVID-19 pandemic highlighted the fragility of global food logistics, pushing cities like Singapore to invest in resilient, space-efficient agricultural models.

Trading Comparables

| (In SGD Million, As on 28th Jan, 2021) | Enterprise Value (EV) | Revenue (TTM) | EBITDA (TTM) | EV / Revenue | EV / EBITDA |

| Company | |||||

AECOM 1 |

7,043 |

9,930 |

565 |

0.7x |

12.5x |

IBI Group Inc. 2 |

330 |

363 |

35 |

0.9x |

9.5x |

| Median | 0.8x | 11.0x |

Sources: