UAE Fitness Industry

The global health and fitness club market size was valued at AED 381.8 billion (USD 104 billion) in 2022 and is projected to grow to AED 743.1 billion (USD 202.8 billion) by 2030, at a CAGR of 8.8%. North America dominated the global market with a 42.6% share in 2022.1

In the UAE, the overall fitness industry was valued at over AED 1.2 billion (USD 320 million) in 2023, supported by strong government initiatives promoting fitness and wellness tourism².

UAE Gym & Training Market

The Gym & Training segment alone is expected to generate approximately AED 222.5 million (USD 60.7 million) in revenue by 2025³.

While the Traditional Gym sub-segment is expected to see a CAGR of -4.9% from 2025 to 2030, this decline is likely to be offset by the rise of digital fitness, which is projected to grow nearly 1.3x by 2030⁵.

Growth Drivers

Several structural and demographic factors continue to make the UAE fitness market an attractive investment:

- Government-backed initiatives that promote fitness and health at the community level⁴

- A young and growing population (ages 15–64) increasingly focused on preventive health

- An industry shift beyond gym memberships to include value-added services like physiotherapy, coaching, and wellness⁴

Digital Fitness & Wellbeing

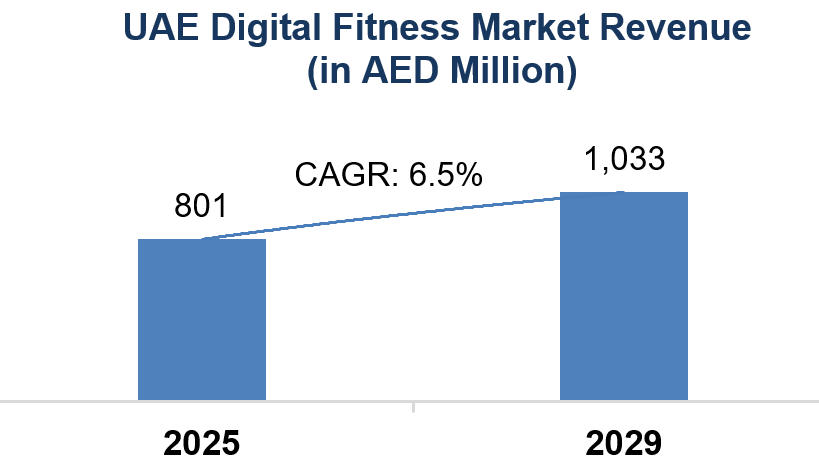

The UAE digital and virtual fitness market is forecasted to grow from AED 801 million (USD 218.3 million) in 2025 to AED 1.033 billion (USD 281.2 million) by 2030, at a CAGR of approximately 6.54%⁵.

Key reasons for its explosive growth:

- Scalability

- Affordability

- On-demand access

- Highly personalized experiences

While traditional gyms remain relevant, virtual fitness has overtaken them in market share, especially in urban areas where accessibility and convenience are critical⁵.

Key Players

Leading fitness service providers in the UAE include:

- GymNation

- Fitness First

- Snap Fitness

- Club Pilates

- Gold’s Gym⁶

Fitness Locations in UAE

Organized fitness centers are mostly concentrated in urban, high-income

neighborhoods due to higher membership fees. Demand remains lower in suburban

regions.

The key catchment areas include:

- Dubai: Jumeirah, Dubai Internet City, Al Barsha

- Abu Dhabi: Al Khalidiyah, Al Zahiyah, Al Wahdah

- Sharjah: Al Majaz, Maliha Road, Al Nahda

- Al Ain: Central District, Al Mutawaa⁷

Virtual Fitness Segments

In 2022, group sessions were the largest revenue-generating category. However, solo sessions are expected to be the fastest-growing and most lucrative segment going forward⁸.

Health & Fitness Trends in UAE

- Females: More likely to opt for weight loss and lifestyle medicine-based workouts

- Males: Prefer traditional strength training

- Middle-aged adults (36–64 years): Favor health clubs, spas, and yoga

- Students: More likely to report athletic goals over part- or full-time employees⁹

UAE Nutrition Market

- 89.6% of UAE healthcare units employ dietitians, but most do not offer personal coaching or lifestyle programs

- The UAE clinical nutrition market is projected to reach AED 3.2 billion (USD 0.86 billion) by 2028, growing at a 10.1% CAGR

- 57.6% of UAE residents trust online nutrition advice from professionals, making social media a powerful channel for consultation services¹⁰

Postnatal Fitness

Postnatal exercise programs are now widely recognized for helping new mothers regain:

- Strength

- Flexibility

- Overall wellness

These programs are structured and take into account physical changes due to

childbirth.

In Dubai, they form a key part of postnatal physiotherapy and are gaining

popularity for their role in supporting long-term recovery and mental

health¹¹.

Government Initiatives

Fit@Home

Launched in 2025 by the Department of Community Development, Abu Dhabi, the

program encouraged at-home fitness.

During Ramadan 2020, average daily exercise time rose 5x compared to Ramadan

2019¹².

CBUAE–ADSC MoU

In 2024, the Central Bank of UAE (CBUAE) signed a Memorandum of Understanding

(MoU) with the Abu Dhabi Sports Council (ADSC) to collaborate on sports and

wellness-related initiatives¹³.

Masar Project

This is a national youth health initiative implemented in partnership with:

- Ministry of Education

- Sharjah Private Education Authority

- KHDA (Dubai)

- Private sector wellness partners¹⁴

Mergers & Acquisitions

- In a management-led buyout, GymNation was sold by JD Gyms (which had acquired it in 2022). The deal was backed by TriCap Investments and Ruya Partners, who invested AED 91.8 million (USD 25 million) as private credit¹⁵.

- GymNation also acquired Fitness First’s Motor City, Dubai branch and invested AED 70 million (USD 19 million) in a world-class facility¹⁶.

Porter’s Five Forces for the UAE Fitness Industry

Threat of New Entrants - High.

Sustainable advantage lies in innovation, while regulatory and capital barriers are low, especially for boutique and digital-first platforms, the real differentiator lies in delivering superior customer experience, retention strategies, and integrated service ecosystems. Established players can defend their position through brand strength, loyalty programs, and scalable tech- enabled services.

Threat of Substitutes - Medium

Alternatives such as home workouts, YouTube fitness content, mobile apps, outdoor fitness events, and personal trainers provide customers with flexible choices. However, these substitutes don't fully replace in-gym experiences or specialized training

Bargaining Power of Customers – Medium

Customers have a growing number of fitness options such as gyms, online platforms, and wellness clubs, but brand loyalty and personalized offerings reduce their switching power somewhat. Price sensitivity varies by income group and location

Bargaining Power of Suppliers - Low

Fitness equipment, supplement providers, and software vendors are abundant globally. Gyms can choose from various suppliers, and large chains can negotiate favorable contracts, keeping supplier power low

Existing Competitive Rivalry - High

Nonetheless, there is ample room for differentiation. The market is crowded with local chains (e.g., GymNation), international brands (e.g., Fitness First, Gold’s Gym), and niche studios (e.g., FitnGlam for women). However, operators can stand out through unique value propositions such as tech integration, holistic wellness offerings, community-centric models, or specialized programs for targeted demographics

Sources

- Global Market

- UAE Fitness Market

- UAE Gym & Training Market

- Growth Reasons

- Digital Fitness and Wellbeing UAE

- Major Players

- UAE Fitness Locations

- Virtual Fitness Market - Segments

- Health & Fitness Trends in UAE

- UAE Nutrition Market

- Post Natal Fitness

- Fit@Home

- CBUAE and ADSC sign MoU

- Masar Project

- JD Gyms deal

- Gymnation acquires Fitness First