U.S. Telehealth Market

Market Size and Growth

U.S. Telehealth Market : Valued at USD 10 billion in 2020, projected to grow to USD 43 billion by 2026 at a CAGR of 28%. 1

Global Telehealth Market : Estimated at USD 60.9 billion in 2020, with an anticipated growth rate of 18.2% CAGR from 2021 to 2027. 2

Key Drivers of Growth

Impact of COVID-19 Pandemic :

- The pandemic significantly accelerated telehealth adoption as consumers and providers sought safer healthcare delivery methods.

- Telehealth usage increased 38 times compared to pre-COVID-19 levels. 3

- During April 2020, telehealth utilization for office visits and outpatient care surged 78 times compared to February 2020. 3

Specialty and End-User Adoption :

- Telehealth claims varied substantially across specialties, with psychiatry experiencing the highest claims.

- Healthcare providers emerged as dominant end-users, utilizing telehealth for disease management and post-acute care programs.

Technological Advancements :

The rise in mobile phone penetration and broadband internet accessibility led to the dominance of web/app-based telehealth platforms.

Key Market Segments

End-User Segment :

Healthcare Providers: Increased adoption among patients and expanded use in disease and post-acute care management.

Mode of Delivery :

Web/App-Based Telehealth: The most prominent delivery method, driven by technological convenience and widespread smartphone usage.

| Trading Comparables | |||||

| (In USD Millions, As on 16th August, 2021) | Enterprise Value (EV) | Revenue (TTM) | EBITDA (TTM) | EV / Revenue | EV / EBITDA |

| Company | |||||

Teladoc Health, Inc. 4 |

23,420 |

1,630 |

-390 |

14.4x |

-60.1x |

American Well Corporation 5 |

1,760 |

241 |

-180 |

7.3x |

-9.8x |

ModivCare Inc.6 |

2,770 |

1,650 |

174 |

1.7x |

15.9x |

1Life Healthcare, Inc. |

3,110 |

465 |

-62 |

6.7x |

-50.1x |

| Median | 7.0x | -30.0x |

Conclusion

The U.S. telehealth market is undergoing rapid growth, driven by the pandemic, technological advancements, and the demand for safe and convenient healthcare options. This evolution has positioned telehealth as a pivotal component of modern healthcare, with promising prospects for continued expansion across diverse specialties and delivery modes.

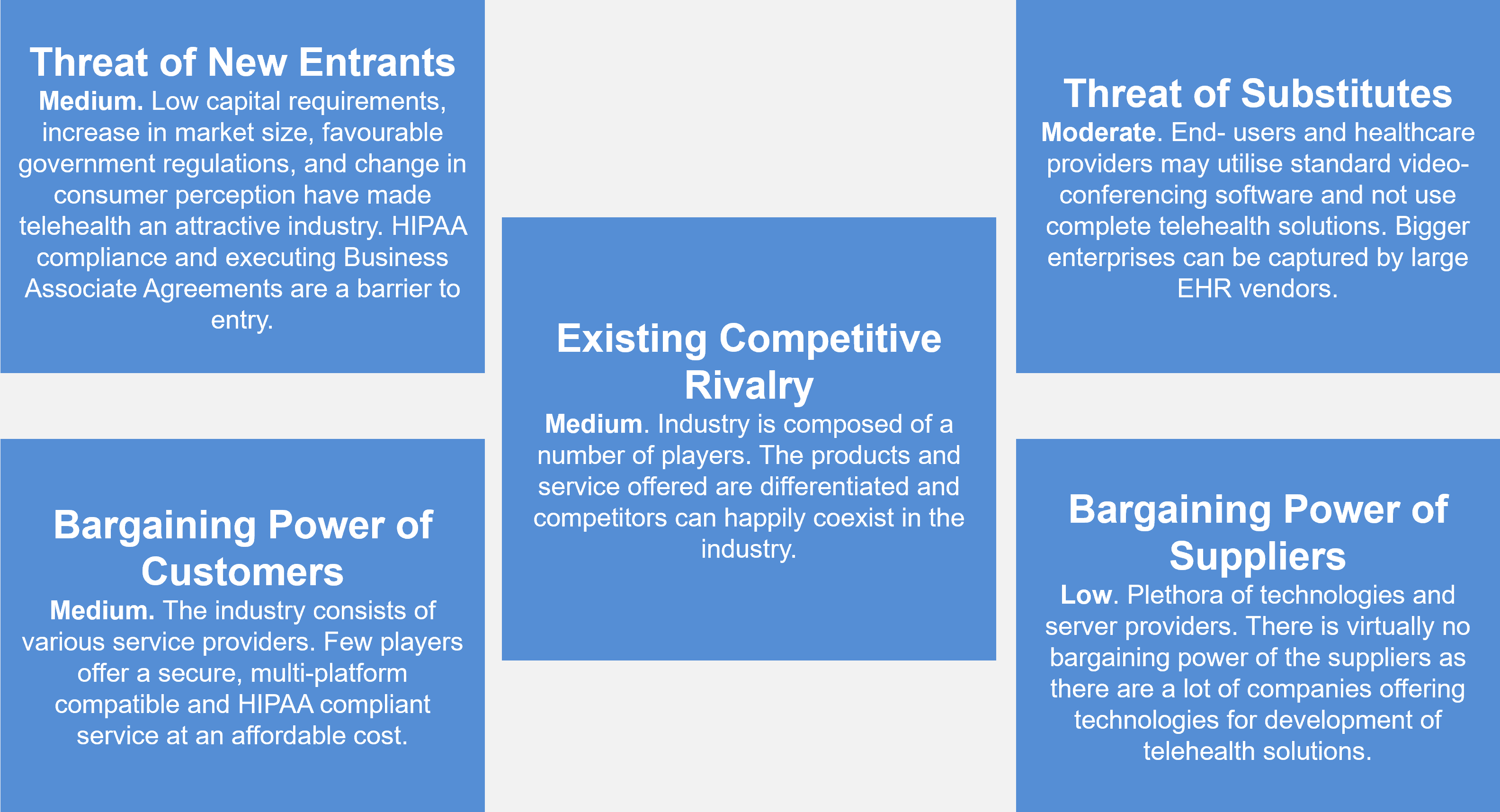

Porter’s 5 Forces Analysis

Threat of New Entrants – Medium

Low capital requirements, increase in market size, favourable government regulations, and change in consumer perception have made telehealth an attractive industry. HIPAA compliance and executing Business Associate Agreements are a barrier to entry.

Threat of Substitutes - Moderate

End- users and healthcare providers may utilise standard video-conferencing software and not use complete telehealth solutions. Bigger enterprises can be captured by large EHR vendors.

Bargaining Power of Customers – Medium

The industry consists of various service providers. Few players offer a secure, multi-platform compatible and HIPAA compliant service at an affordable cost.

Bargaining Power of Suppliers - Low

Plethora of technologies and server providers. There is virtually no bargaining power of the suppliers as there are a lot of companies offering technologies for development of telehealth solutions.

Existing Competitive Rivalry – Medium

Industry is composed of a number of players. The products and service offered are differentiated and competitors can happily coexist in the industry.

Sources

- U.S. Telehealth Market Size | Research Report | 2021-2026

- Telemedicine Market Share – Growth Report, 2032

- Telehealth: A post-COVID-19 reality? | McKinsey

- Teladoc Health, Inc. (TDOC) Valuation Measures & Financial Statistics

- American Well Corporation (AMWL) Valuation Measures & Financial Statistics

- ModivCare Inc. (MODV) Valuation Measures & Financial Statistics