USA Themed Fabrication Industry

The themed fabrication industry is a specialized sector focused on the creation of immersive environments for theme parks, retail spaces, museums, and entertainment venues. It involves a combination of engineering, artistic craftsmanship, and storytelling to provide experiential designs that captivate audiences.

Market Insights

The themed fabrication industry in the USA operates at the intersection of metal fabrication and themed entertainment sectors. At its core, themed fabricators are specialized metal fabricators that integrate artistic craftsmanship and experiential storytelling to cater to high-value clients such as theme parks, retail spaces, entertainment venues, museums, and immersive productions.

- Metal Fabrication Industry :

- Market size: USD 362.4 billion (2020). 1

- Projected value: USD 473.7 billion (2031), growing at a CAGR of 2% (2021-2031). 1

- Themed Entertainment Industry :

- Amusement and Theme Parks:

- Market size: USD 24.6 billion (2025). 2

- Projected value: USD 29.22 billion (2030), with a CAGR of 3.5% (2025-2030). 2

- Immersive Entertainment:

- Market size: USD 32.59 billion (2023). 3

- Projected value: USD 122.86 billion (2030), with a CAGR of 21.9% (2024-2030). 3

Growth Trends

Source: AECOM Theme Index Reports 2015-2023 4

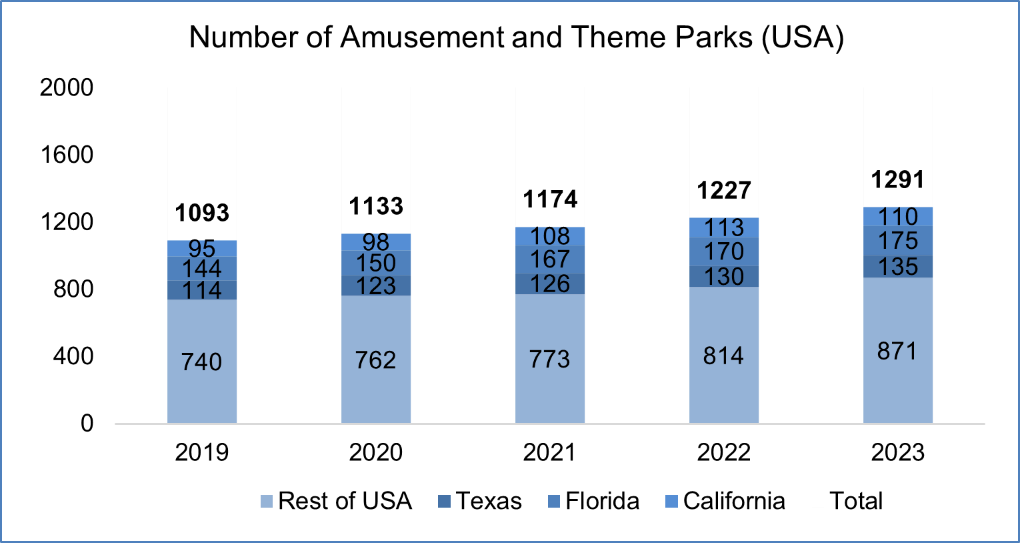

Source: Amusement and Theme Parks in The United States 5

- The number of amusement and theme parks grew by 43% between 2013 and 2023, reaching 1,273 establishments, with the largest annual increase occurring in 2023 (+66 establishments). 5

- Key drivers of demand:

- Consumer preference for immersive experiences.

- Advancements in interactive technologies.

- Growth in global tourism and urbanization.

Major Market Segments

- Amusement & Theme Parks: The largest segment, fueled by rising demand for experiential attractions.

- Museums & Exhibitions: Increasing focus on interactive and educational displays.

- Retail & Hospitality: Enhanced customer engagement through themed environments.

- Film & Entertainment: Custom-fabricated sets and props play a pivotal role.

Key Players

Prominent companies in the industry include:

- Adirondack Studios.

- COST of Wisconsin.

- Brilliant Creative Fabrication (Roto).

- Universal Creative & Disney Imagineering (in-house teams).

Consumer Spending

Source: Consumer Expenditures, 2023 6

In 2023, Americans spent approximately USD 3,635 (4.7% of their annual expenditure) on entertainment, with USD 654 allocated to fees and admissions—highlighting the growing investment in experiential and immersive venues. After essentials like housing, transportation, food, healthcare and personal insurance, US citizens spend most on entertainment. 6

Trading Comparables

| Trading Comparables | |||||

| (In USD millions, as on 19th Feb 2025) | Enterprise Value (EV) 6 | Revenue (TTM) | EBITDA (TTM) 7 | EV / Revenue | EV / EBITDA |

| Company | |||||

| AECOM (ACM) | 14,910 | 16,220 | 1,165 | 0.9x | 12.8x |

Fluor Corporation (FLR) |

4,850 |

15,875 |

533 |

0.3x |

9.1x |

Jacobs Solutions Inc. (J) |

17,120 |

11,624 |

1,180 |

1.5x |

14.5x |

Quanta Services, Inc. (PWR) |

46,690 |

22,903 |

1,971 |

2.0x |

23.7x |

| Median | 1.2x | 13.7x |

Conclusion

Themed fabricators have evolved into highly specialized entities, blending metal fabrication expertise with artistic craftsmanship to create unique, high-value experiences. The continued expansion of this industry aligns with increasing consumer demand for immersive and interactive entertainment.

Porter’s Five Forces

Threat of New Entrants – Moderate

Entry into the themed fabrication industry requires substantial capital investment, specialized expertise, and established relationships with clients. However, advancements in technology and design tools have lowered some barriers, making it moderately challenging for new entrants.

Threat of Substitutes – Low

The unique and customized nature of themed fabrication services means there are few direct substitutes. While digital experiences offer alternative entertainment forms, they do not replace the physical, immersive environments created by this industry.

Bargaining power of customers – Moderate

Clients in this industry, such as theme parks and entertainment companies, often have significant negotiating power due to the large scale and high value of projects. Their ability to choose among multiple fabricators gives them leverage in pricing and contract terms.

Bargaining power of suppliers – Low

Suppliers provide essential materials like metals, plastics, and specialized components. While there are multiple suppliers available, the quality and specificity of materials required can limit options, giving suppliers moderate bargaining power.

Existing Competitive Rivalry – Moderate

The themed fabrication industry comprises a mix of specialized firms and larger companies offering a range of services. While competition exists, the specialized nature of projects and the emphasis on unique designs moderate the intensity of rivalry.

Sources: