Consumer Electronics Business Investment Opportunity in Gurgaon, India

| Established | 1-5 year(s) |

| Employees | 10 - 50 |

| Legal Entity | Sole Proprietorship/Sole Trader |

| Reported Sales | USD 1.09 million |

| Run Rate Sales | USD 1.02 million |

| EBITDA Margin | 5 % |

| Industries | Consumer Electronics |

| Locations | Gurgaon |

| Local Time | 8:21 PM Asia / Kolkata |

| Listed By | Business Owner / Director |

| Status | Active |

Current monthly run rate: INR 75 lakhs with EBITDA margins of 3-5%.

- Revenue model:

Direct sales through partnered e-commerce platforms like Flipkart, Snapdeal and offline stores. There has been a slight drop in sales this year as compared to previous year due to the revised product pricing.

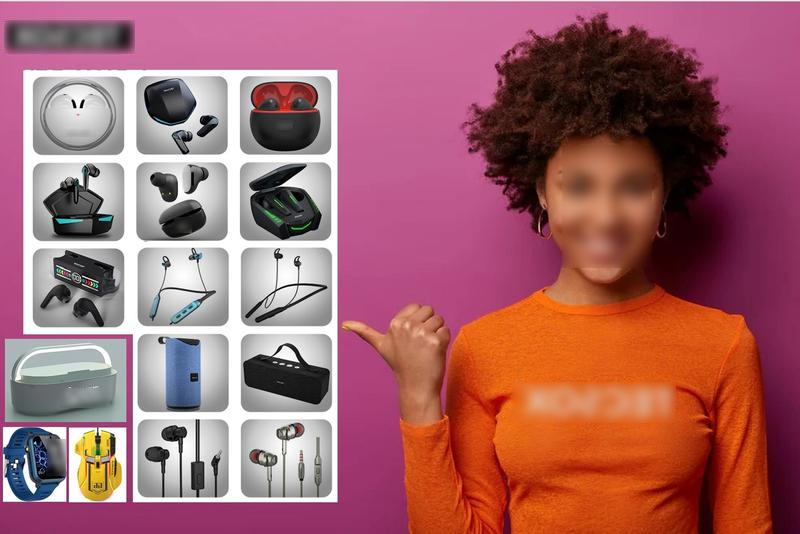

- Product categories: Audio wearables, smartwatches, mobile accessories, and portable projectors.

Focused on affordable pricing and unit economics, ensuring profitability.

- Client base:

Thousands of satisfied customers across India (almost 7 lakh units sold). Primarily millennials and Gen Z customers seeking innovative and budget-friendly tech products.

- Promoter experience:

Founded by ex-CEO of Barista, bringing rich leadership and operational expertise.

Proven track record of scaling ventures and achieving profitability early on.

- Business relationships:

Partnerships with major e-commerce platforms like Snapdeal, Flipkart and more recently Blinkit.

Robust supply chain and manufacturing alliances ensuring quality and timely delivery. Product procurement is through contract manufacturing and imports.

- Milestones:

Broke even on EBITDA within 7 months of operations.

Bootstrapped venture demonstrating financial discipline and market agility.

- Awards and recognitions:

Recognized for customer satisfaction and innovation in consumer electronics. Garnering over 4 star ratings on almost 80% SKUs.

Positive media coverage highlighting the brand’s rapid growth and profitability.

- Future plans:

Expansion into offline markets and newer product categories. Also looking at expansion in international markets.

Strengthening brand visibility through strategic marketing and partnerships.

The company's blend of innovation, affordability, and strategic execution positions it as a standout player in the competitive electronics market.

- Bluetooth earbuds: High-quality sound, immersive bass, ergonomic design.

Users: Millennials, Gen Z, and professionals.

How: For music, calls, workouts, and daily commuting.

- Smartwatches: Stylish, feature-rich with LED touchscreens and long battery life.

Users: Fitness enthusiasts, tech-savvy individuals, and style-conscious users.

How: Fitness tracking, notifications, music control, and everyday productivity.

- Bluetooth neckbands and speakers: Portability and durability with high sound clarity.

Users: Travelers, students, and casual listeners.

How: Leisure, study sessions, and group gatherings.

- Mobile accessories: Chargers, cables, and utility devices.

Users: Smartphone users of all demographics.

How: Reliable day-to-day device management.

- Portable Projector: High-brightness, LTPS LCD technology, multi-device connectivity.

Users: Small business owners, families, and entertainment seekers.

How: For presentations, movie nights, and immersive viewing experiences.

Customer Usage:

Our products are used across diverse scenarios like fitness, entertainment, productivity, and connectivity. The brand targets value-conscious tech enthusiasts who demand quality and affordability. Customers appreciate the brand for its innovative approach, robust features, and user-centric design.

Built-up area:

Compact yet functional setup spanning approximately 1,500–1,700 square feet.

Dedicated spaces for product development, quality control, and logistics management.

Number of floors:

A single-floor facility with segmented zones for inventory, dispatch, and administration (Design, accounts, operations, D2C, customer care & procurement).

Rental/lease details:

The facility is owned by the promoter.

This setup aligns with the company's focus on maintaining a cost-efficient yet effective operational model. The lean infrastructure ensures adaptability and scalability as the business grows.

The investor will not be given stake in the property.

Funding status:

A bootstrapped venture, primarily funded by the promoter (Ex CEO of Barista Coffee Company).

Personal loan: The promoter has availed approximately ₹48 lakh (against fixed deposits) to fund the company.

Additional personal infusion: An additional ₹25–30 lakh has been infused from his personal savings.

Planned transition to Private Limited Company:

Currently in the process of being converted into a Private Limited Company to enable structured growth, scalability, and potential external investments.

Shareholding pattern (Post-conversion):

95% ownership: Retained by the promoter and family, maintaining strategic control.

5% ownership: Allocated to the General Manager, recognizing his pivotal role in the business.

Debt and future repayment strategy:

During the formalization into a corporate entity, plans to raise funds through corporate debt or investor infusion.

A portion of these funds will be utilized to:

Repay the personal loan of ₹48 lakh.

Reimburse his additional infusion of ₹25–30 lakh.

These withdrawals will be accounted for under the head Development Expense, reflecting the investments made to establish and grow the business.

This approach ensures financial discipline while positioning the company for structured growth and rewarding early investments by the founder.

-

Earlier than 15 daysExecutive Director, New Delhi, Financial Consultant connected with the Business