UAE Restaurant Industry

The UAE restaurant industry’s market size is estimated at AED 73.38 billion ($19.98 billion) in 2024 and is expected to reach AED 161.53 billion ($43.98 billion) by 2029, growing at a Compound Annual Growth Rate (CAGR) of 17.10% during the forecast period (2024-2029)¹.

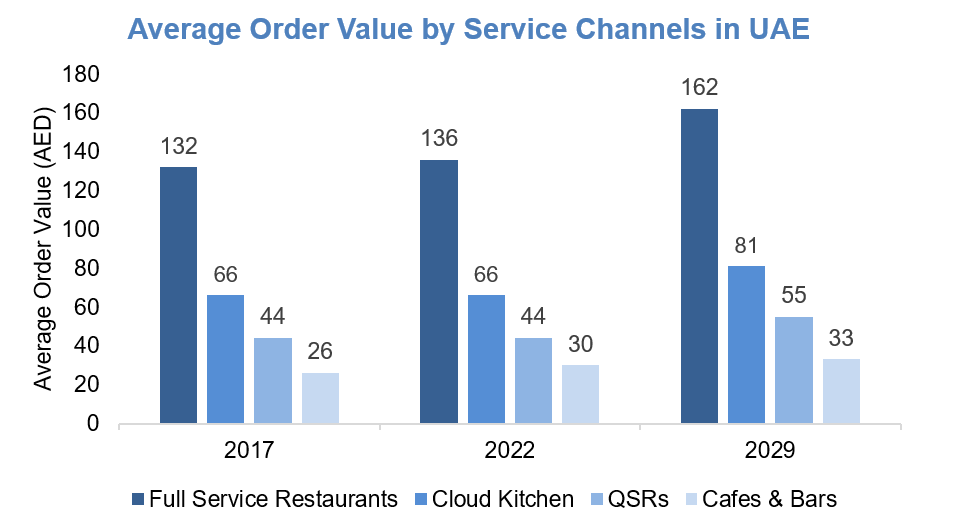

Full-service restaurants accounted for the largest share of the market in 2022, with Middle Eastern and Asian cuisine accounting for a 72.60% share. Arabic cuisine is especially popular in the UAE. Due to the large ex-pat population in the UAE, there are also many international cuisines available, such as Italian and Chinese¹.

Key Factors Driving the Market Growth

Dubai’s gastronomy scene is fast-growing and diverse, reflecting the city’s status as a cultural melting pot with over 200 nationalities². The city’s gastronomy industry is a key driver of the global tourism sector.

The food and beverage sector in Dubai attracted new FDI worth AED 2,119 million ($577 million) from 2019 to 2023³. This investment was made by 48 international companies from 23 countries.

Consumer Spending and E-Commerce Impact

Consumer spending on food via e-commerce platforms reached AED 4 billion ($1.1 billion) in 2023 and is expected to increase at a Compounded Annual Growth Rate (CAGR) of 9.5% between 2023 and 2027. The UAE’s food and beverage sector generated AED 60.2 billion ($16.4 billion) in retail sales, including fresh food and packaged food³.

Investment in Restaurant Tech

The UAE accounted for the largest share of venture capital investments in the Middle East’s restaurant tech sector from 2018 to 2023. It attracted investments exceeding $1 billion in this area³.

Transaction Comparables (in AED million) 6

| Date | Target | Acquirer / Investor | Target Description | EV | EV/ Revenue |

Dec-21 |

Rebel Foods |

Qatar Investment Authority |

Rebel Foods is an Indian online restaurant company which operates 11 cloud kitchen brands including Faasos, Behrouz Biryani and Oven Story. It is the largest cloud kitchen restaurant chain in the world, operating more than 450 cloud kitchens in 10 countries, as of April 2022 |

5,026 |

13.0x |

Trading Comparables (In AED million, As on 26th July 2023) 7

| Company | Enterprise Value (EV) | Revenue (TTM) | EV / Revenue |

Just Kitchen |

21 |

51 |

0.4x |

Eating Habits and Trends

78% of UAE residents eat out up to twice a week, mainly for social and family gatherings5. The trend of eating out in Dubai is influenced by factors such as the high expat population, the rise in online food delivery, the demand for local and international cuisines, and the thriving tourism industry.

Porter’s Five Forces for the Restaurant Industry in UAE

Threat of New Entrants - Moderate.

Based on capital requirement, economies of scale, brand loyalty and

government regulations, the threat of new entrants in the restaurant industry

in Dubai can be considered moderate. While it’s not impossible for new

restaurants to enter the market and succeed, they must overcome significant

challenges such as high rental and labor costs to do so.

Bargaining Power of Customers - Moderate.

Customers have a moderate bargaining power in the restaurant

industry in Dubai as the customers are price-sensitive, well-informed, and

demand high-quality food variety of choices. Restaurants must offer

competitive prices, high-quality food, and a great dining experience to

attract and retain customers.

Existing Competitive Rivalry - High

The restaurant industry in Dubai faces high competitive rivalry from

many existing players. Restaurants have to compete for customers, locations,

suppliers, and employees, and differentiate their products and services. The

competitive rivalry is affected by the market growth, the exit barriers, and

the switching costs.

Threat of Substitutes - Moderate

This is influenced by factors such as home-cooked meals, online food

delivery, cloud kitchens, grocery stores, cuisine diversity, and customer

preferences. This threat can reduce the demand and profitability of

restaurants, as customers can switch to alternative products or services that

offer lower prices or higher value.

Bargaining Power of Suppliers - Low

Suppliers have low power of bargaining in the restaurant industry in

Dubai, as there are many suppliers and low switching costs for the

restaurants. Supplier power can increase if the products are unique, high-

quality, scarce, or expensive to substitute.

Sources

- https://www.mordorintelligence.com/industry-reports/uae-foodservice-market

- https://www.dubaitourism.gov.ae/en/research-and-insights/gastronomy-industry-report-september-2022

- https://www.arabianbusiness.com/industries/retail/dubai-attracts-577m-of-foreign-investment-to-boost-uaes-16-4bn-food-and-beverage-retail-sector

- https://www.mordorintelligence.com/industry-reports/uae-foodservice-market

- https://gulfnews.com/uae/78-per-cent-of-uae-residents-eat-out-up-to-twice-a-week-1.855016

- https://www.rebelfoods.com/press-release/qatar-investment-authority-invests-in-cloud-kitchen-indian-unicorn

- https://in.investing.com/equities/just-kitchen-holdings