The Effect of War on Small Businesses in Ukraine: Data Insights from 2022–2025

The Russia-Ukraine war in 2022 triggered one of the most disruptive economic shocks in modern European history, reverberating across every sector of the country’s business landscape. While the headlines have focused on massive infrastructure damage and shifting global supply chains, less visible—but no less critical—are the war’s effects on Ukraine’s small and medium-sized enterprises (SMEs). These businesses, long the backbone of the national economy, now face existential threats: dislocation, labor shortages, diminished demand, and unprecedented operational risk. This report draws on detailed business-for-sale listing data to quantify how the war has impacted business valuations, sale activity, owner confidence, and everyday economic life in Ukraine. By weaving together hard metrics and voices from business owners themselves, we provide a clear and candid portrait of the wartime business environment—and the uncertain, but resilient, path forward.

About the Data This report draws on data from more than 80 businesses for sale in Ukraine listings in top locations across Ukraine, including Kiev, Lviv, Ukrainka, Kharkiv, Odessa, Dnipro, and others on SMERGERS, covering:

- Pre-war period : early 2014 to early 2022 (~8 years)

- Post-war period : March 2022 to April 2025 (~3.1 years)

- Sample : Over 80 qualified listings across key sectors (IT/SaaS, retail, manufacturing, hospitality, agriculture)

- Data points : Asking prices, sales multiples, EBITDA multiples, business headcount, and explicit owner rationales behind sales

The dataset is representative of domestic small-business exits, capital-

seeking, and operational pivots. The stats below reference real figures quoted

by small businesses in Ukraine.

Key Insights

1. Listings Have More Than Doubled Since the War

| Period | Years Covered | Total Listings | Avg Listings/Year |

|---|---|---|---|

Pre-war |

2014–2022 |

46 |

5.8 |

Post-war |

2022–2025 |

37 |

11.9 |

Findings:

- Listings per year have more than doubled post-war (from ~6 to ~12).

- This reflects a surge in forced/strategic exits, owner relocations, and new digital ventures, all accelerated by war-driven disruption and risk.

2. Valuations and EBITDA Multiples Have Dropped Significantly

| Period | Median Asking Price | EBITDA Multiple (Median) | Avg No of Employees |

|---|---|---|---|

Pre-war |

$500–700k |

4.5–5x |

53 |

Post-war |

$200–500k |

2-4x |

34 |

- Valuation multiples have shrunk: Pre-war, EBITDA multiples commonly ranged 4.5–5x (or higher for certain assets); post-war, the "new normal" is 2–4x, with the median near 3x.

- Distress is evident: Many profitable businesses now sell at just 2–2.5x EBITDA, especially when owners face urgency to exit or liquidity crunches.

- Outlier/high multiples are rare: post-war, except for a few asset-heavy or “special” cases higher multiples are rare—reflecting buyers’ growing risk aversion.

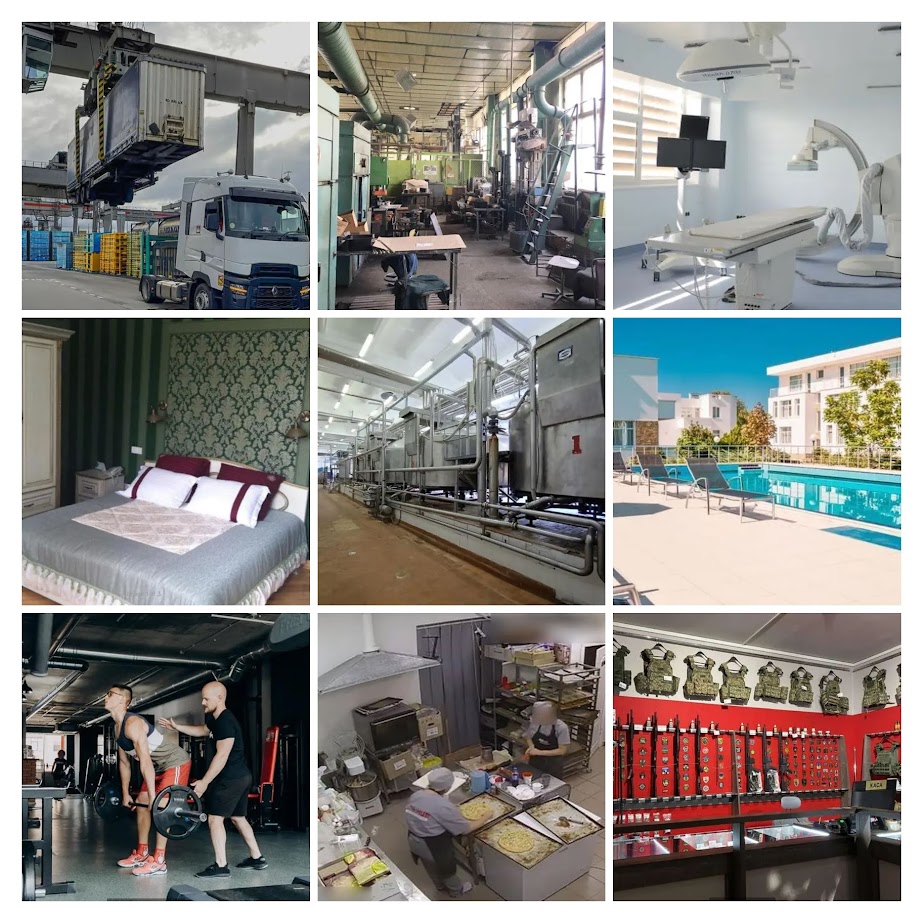

3. Sectoral and Operational Stress

Sectors represented (and typical impact):

- Tech/IT/SaaS: More resilient—though affected by talent emigration, they’re actively seeking partners abroad.

- Manufacturing & Agriculture: Most exposed to war; frequent listings cite urgent relocation or capital shortfalls.

- Hospitality: Deeply impacted; major hotels/cafés for sale at steep discounts due to slumping tourism.

- Retail/Services: Many try to adapt, but war-related uncertainty drives higher-than-usual exit rates.

4. Common Triggers for Listing Businesses for Sale

The ongoing conflict in Ukraine has fundamentally reshaped the environment for small and medium-sized enterprises (SMEs). The reasons cited by business owners for selling are heavily influenced by these challenging circumstances:

- Relocation/Internationalization: At least 25% of listings mention the intention or necessity to move operations abroad. Many owners state matter-of-factly, "the owner wants to move to another country," reflecting the growing need for personal and business safety.

- Operational Challenges Due to Conflict: Maintaining business activities amidst active conflict has become nearly impossible for some. As one owner headquartered in Kyiv noted, “We are headquartered in Kyiv and we are at war, we can neither develop the business nor invest in it now. Selling is the only option.”

- Necessity to Transfer Production: Some owners see no alternative but to move production out of Ukraine entirely in order to survive.

- Liquidity Crunch: Many sellers are seeking fast transactions, cash deals, or new partner buy-ins, highlighting the ongoing liquidity crunch, low local investment appetite, and a fragile banking sector.

- Employee Reductions: Downsizing has become common, especially among asset-heavy businesses, as owners are forced to cut workforce in light of declining revenues and persistent risk.

- Shift in Business Focus: Some entrepreneurs are shifting attention toward less risky, more digital, or international sectors, often citing a strategic pivot as their reason for sale.

- Cautious optimism: A few owners remain cautiously optimistic—anticipating opportunities in Ukraine’s eventual postwar reconstruction—but many emphasize the immediate need for capital and new partnerships to weather the current crisis.

The aggregate message from sellers is clear: the war has triggered forced relocations, market contraction, halted investments, and pervasive uncertainty, making it difficult to sustain even the most promising ventures. Nevertheless, a minority of business owners remain resilient and hopeful about rebuilding and participating in Ukraine’s recovery, underscoring both the extraordinary adversity and determination within Ukraine’s entrepreneurial sector.

5. Table: Sectoral Breakdown of Sale Listings

| Sector | % of Total Listings | Predominant Sale Rationale |

|---|---|---|

Retail/Food |

High |

Owner relocation, uncertainty |

IT/SaaS |

Moderate |

Expansion/internationalization |

Manufacturing |

High |

Relocation, capital shortage |

Hospitality |

High |

Retirement, unsustainable risk |

Agriculture |

Moderate |

Asset diversification abroad |

6. Outlook for Ukraine Small Businesses

- Double the Exits, Halved the Multiples: The war has abruptly more than doubled small business sale activity, while dramatically shrinking the prices and multiples at which businesses sell, especially those with physical assets tied to the Ukrainian market.

- Distress and Urgency Dominate: Most businesses are selling below "normal" emerging market multiples, signaling distress. Owners increasingly seek international buyers, capital, or fast exits.

- Winners and Losers: IT and digital businesses remain somewhat more resilient, but face talent and funding drains. Manufacturing, hospitality, and retail—especially those with reliance on local demand or large physical assets—are far more stressed.

- Internationalization as Survival: The path forward for many Ukrainian entrepreneurs appears to be either going digital, moving operations abroad, or seeking foreign capital.

The war has flipped the script for Ukrainian small businesses. What was once a market bustling with growth and ambition is now dominated by owners looking for an exit—even successful businesses aren’t immune, with their value taking a hit simply because of the uncertainty. The environment has pushed many entrepreneurs to rethink how they operate, favoring digital-first, international, or asset-light business models just to keep afloat. For foreign investors and buyers, the door is wide open—but make no mistake, what most sellers want right now isn’t bigger profits; it’s stability, safety, and a path out of the crossfire.

If you’re considering business opportunities in Ukraine and want deeper data or specific insights, don’t hesitate to get in touch with us at help@inbox.smergers.com.